Utility tokens are a core component of blockchain technology, providing access to services or features within a particular ecosystem. These tokens are distinct from cryptocurrencies like Bitcoin or Ethereum, which are often used primarily as a medium of exchange or for investment. Utility tokens are designed for specific functionalities within their respective platforms, such as accessing decentralized applications (dApps), participating in network governance, or using platform-specific services like discounted trading fees or voting rights.

Introduction to Utility Tokens

Genesis and Functionality

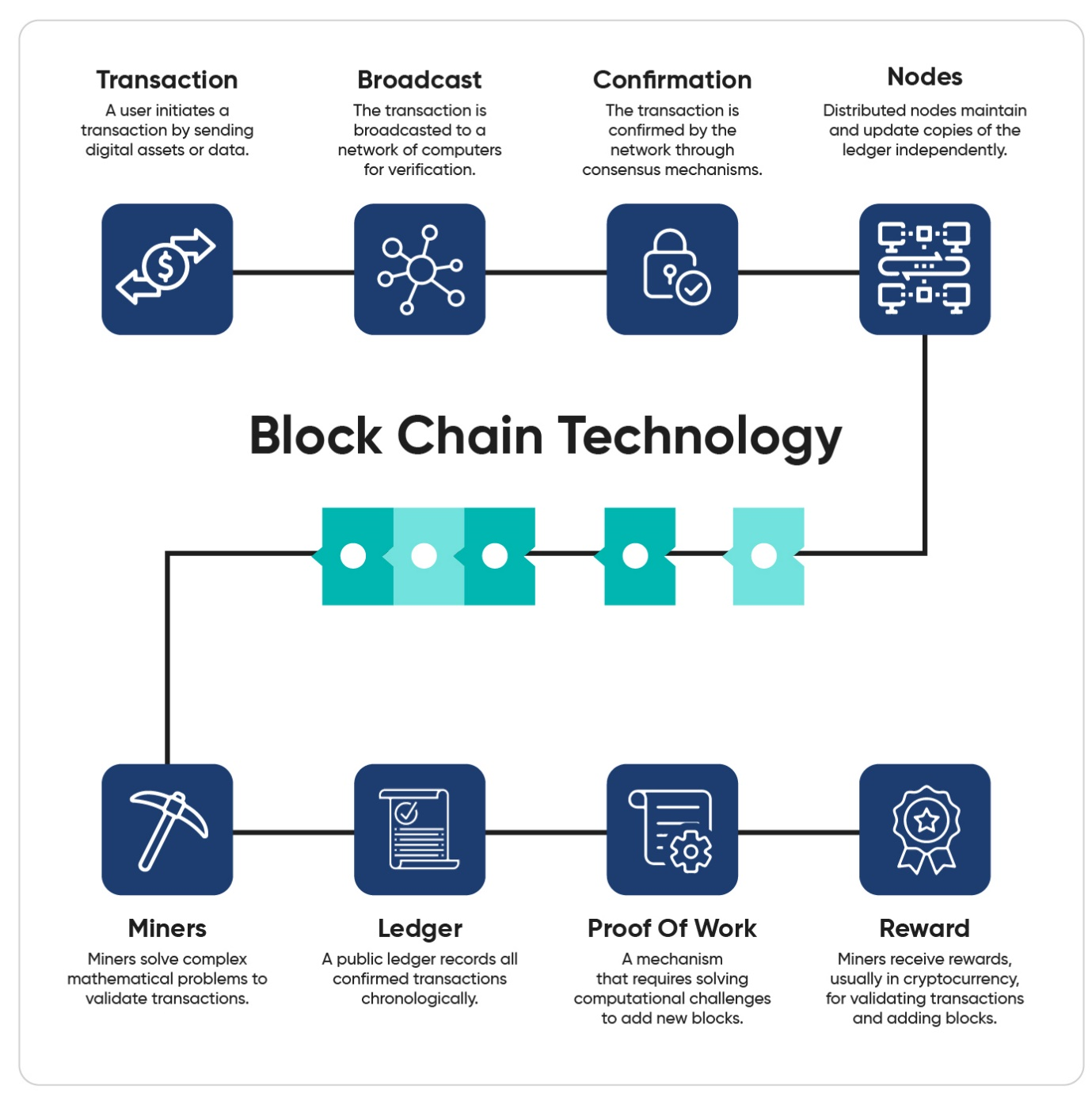

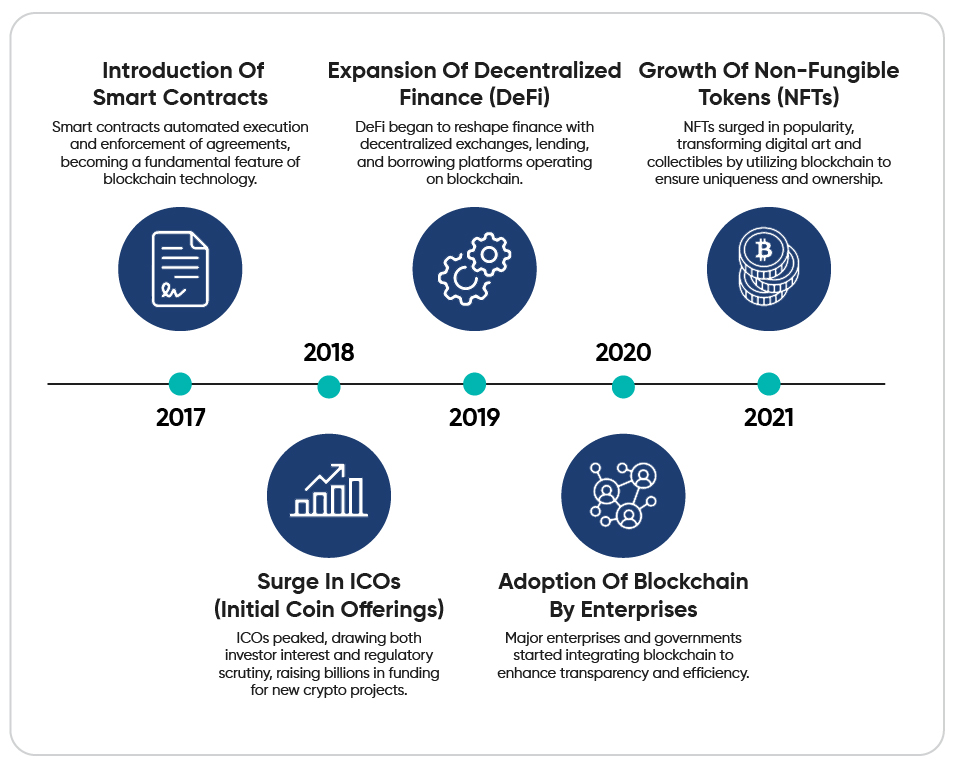

Utility tokens originated as a means to fund project development through mechanisms like Initial Coin Offerings (ICOs). During an ICO, tokens are sold to raise capital for new projects, and these tokens can later be used within the project’s ecosystem. For instance, Binance Coin (BNB) was initially issued through an ICO to support the development of the Binance exchange, offering benefits like reduced trading fees to its holders.

The functionalities of utility tokens are vast and vary depending on the platform’s needs. For example, in the gaming sector, tokens can be used as in-game currency or to purchase special items. In decentralized finance (DeFi), utility tokens might be used to participate in protocol governance or to stake and secure lending transactions.

Technological Underpinnings

Utility tokens are primarily built using existing blockchain platforms, with Ethereum being the most prevalent due to its robust smart contract capabilities. The use of smart contracts allows developers to embed the token’s utility directly into the blockchain, automating and securing interactions without the need for intermediaries. This automation ranges from executing transactions to managing the distribution of tokens during ICOs, thereby enhancing transparency and efficiency.

Economic Impact

The value of utility tokens is intrinsically linked to the demand for the service they provide within their respective ecosystems. This demand is not only driven by the current utility of the token but also by speculative interests related to the future potential of the platform. As the platform grows and becomes more integrated into its target markets, the utility—and potentially the value—of its tokens may increase.

Regulatory Landscape

One of the major challenges facing utility tokens is navigating the complex and often unclear regulatory environment. Unlike security tokens, which are regulated similarly to traditional securities, utility tokens often fall into a grey area in many jurisdictions. This ambiguity can pose risks for both issuers and holders, as the lack of clear guidelines may lead to unforeseen legal challenges.

Regulators in different countries are still grappling with how to classify and manage these tokens, balancing the need to protect investors with the desire to encourage technological innovation. In the United States, for example, whether a token is classified as a utility or security can affect its issuance, trading, and broader handling under the law.

Utility tokens are a dynamic and integral part of the blockchain ecosystem. They facilitate new forms of interaction and transaction within digital platforms, contributing to the ongoing evolution of decentralized networks. As the market for these tokens matures, both the technology underlying them and the regulatory frameworks governing them will continue to develop, shaping the future landscape in which they operate.

Tokenomics and Economic Implications

The concept of tokenomics encompasses the economic policies and mechanisms that govern the functionality and distribution of utility tokens within a blockchain ecosystem. These mechanisms are crucial for managing supply, demand, and the overall economic stability of tokens.

Token Supply Management

One of the primary strategies used in tokenomics is managing the token supply to enhance value and stability. This includes practices such as token burning and buybacks. Token burning involves removing tokens from circulation permanently, thus reducing the total supply and potentially increasing the scarcity and value of the remaining tokens if demand remains stable or increases.

Token Distribution and Sale Models

Token sales are a critical aspect of tokenomics, providing the initial distribution and often funding for blockchain projects. Various models govern how tokens are sold, including fixed price, Dutch auction, and dynamic pricing models, each with implications for how tokens are priced and distributed among investors. The choice of model can significantly impact investor interest and market dynamics post-launch.

Staking and Incentivization

To ensure the active participation of token holders in the network, tokenomics often includes staking mechanisms. Token holders can lock up their tokens for a period, contributing to network security or liquidity, and in return, they receive rewards. This not only secures the network but also encourages holding rather than selling the token, which can stabilize or increase its price.

Economic Activities Enabled by Tokens

Tokens enable various economic activities within blockchain ecosystems, such as micropayments for services, decentralized finance (DeFi) operations, and access to specific functionalities within dApps. They can also facilitate innovative investment opportunities like fractional ownership of assets through tokenization, which can democratize access to assets that were previously inaccessible due to high costs or regulatory barriers.

Regulatory and Market Challenges

The regulatory environment remains a significant challenge and a vital aspect of tokenomics. Since the legal framework for utility tokens is still evolving, projects must navigate a complex landscape of international regulations which can affect token design, sale, and long-term viability. Compliance with these regulations is crucial for the success and legitimacy of tokens.

Future Prospects

Looking ahead, the landscape of tokenomics is likely to evolve with the broader adoption of blockchain technology. Innovations in token design, improved regulatory clarity, and greater public understanding of blockchain technologies may lead to more robust and economically significant token ecosystems.

These elements of tokenomics not only define the current capabilities and limitations of blockchain projects but also shape the future trajectory of digital assets in the global economy. As this field matures, the interplay between technological innovation and regulatory frameworks will be crucial in determining the success and stability of token-based economies.

Utility Tokens Across Various Sectors

Gaming and Virtual Real Estate

Utility tokens have transformed the gaming industry by enabling a decentralized economy within games. Players can earn, buy, and trade in-game assets using tokens, enhancing engagement and monetization for developers. For instance, Decentraland uses the MANA token to facilitate transactions within its virtual reality platform, allowing users to buy virtual land and other digital goods, making gaming experiences more immersive and economically viable.

Digital Content and Entertainment

In the realm of digital content, utility tokens empower creators by allowing them to monetize their work directly. Platforms like Audius use tokens to enable artists to receive payments directly from listeners, bypassing traditional media distribution channels and intermediaries. This not only ensures fair compensation but also fosters a direct relationship between creators and consumers.

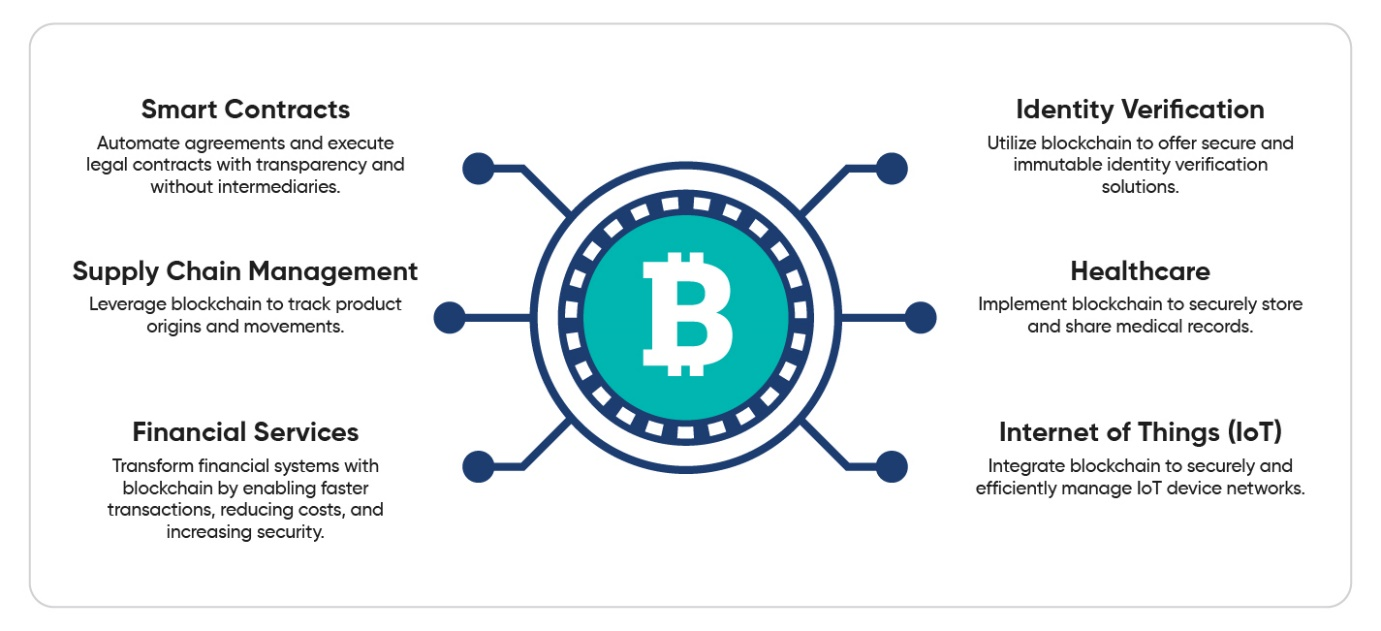

Supply Chain Transparency

Tokens enhance supply chain management by providing transparency and traceability of products from production to consumption. VeChain, for example, uses tokens to track the lifecycle of products, ensuring authenticity and ethical sourcing. This application is particularly valuable in industries where provenance and authenticity are crucial, such as luxury goods, pharmaceuticals, and agriculture.

Decentralized Finance (DeFi)

In the financial sector, utility tokens are foundational to the emerging DeFi landscape, facilitating services such as peer-to-peer lending, decentralized exchanges, and automated asset management. These tokens enable more inclusive financial services, reducing barriers and costs associated with traditional financial institutions.

Real Estate and Asset Tokenization

Tokenization of physical assets, particularly real estate, is another significant use case. It allows fractional ownership of properties, making real estate investment more accessible and liquid. By using blockchain technology, the process reduces the need for intermediaries, lowers transaction costs, and increases market efficiency.

Identity Verification and Data Security

Blockchain technology enhances identity verification processes by enabling secure and immutable storage of personal data. Utility tokens facilitate access to digital identities, allowing individuals to control and share their information securely and conveniently. This application is increasingly relevant in a world where digital interaction and security are paramount.

Charitable Donations

In the charitable sector, tokens can improve the transparency and efficiency of donations. Blockchain technology ensures that contributions are traceable, reducing fraud and ensuring funds are used as intended. This fosters greater trust and accountability between donors, charities, and beneficiaries.

These diverse applications of utility tokens illustrate their potential to revolutionize multiple sectors by enhancing transparency, efficiency, and user engagement. As blockchain technology continues to evolve, the scope for utility tokens is likely to expand further, introducing new functionalities and transforming traditional business models.

Regulatory Landscape and Challenges

Navigating the Regulatory Maze

Utility tokens operate within a complex and rapidly evolving regulatory environment. As they do not typically confer ownership or financial returns directly, they often avoid the stringent regulations that govern security tokens. However, the lack of clear and consistent regulations across jurisdictions presents significant challenges. Regulatory bodies worldwide are striving to create frameworks that balance investor protection with the promotion of innovation and market integrity.

Compliance and Legal Hurdles

One of the principal challenges in issuing utility tokens is ensuring that they do not inadvertently fall under securities laws. This requires careful crafting of the token’s functionalities and the methods of their sale to clearly differentiate them from investment vehicles. Missteps in this area can attract legal scrutiny and potentially severe penalties.

Global Variance in Regulatory Approaches

Different countries have taken various stances on utility tokens, ranging from strict to more accommodating frameworks. For instance, while the U.S. is actively working towards clearer guidelines for digital assets, Switzerland already has more defined frameworks in place. This disparity necessitates that issuers have a deep understanding of and compliance strategy for each market in which they operate.

Ongoing Developments and Future Outlook

The regulatory landscape for utility tokens is far from static. Authorities in several regions are continuously working to refine their approaches to better accommodate the unique aspects of blockchain technologies and digital tokens. This ongoing development promises a future where regulations might be more harmonized and predictable, potentially leading to broader adoption and integration of utility tokens across various sectors.

While utility tokens present a novel means of user engagement and transaction within digital ecosystems, navigating their regulatory landscape requires careful planning and ongoing vigilance. As the market matures, clearer guidelines are expected to emerge, which will help stabilize the development environment for utility tokens.

Focus on Ethereum and Binance Coin

Ethereum’s Role in Blockchain and Tokenization

Ethereum has established itself as a cornerstone of the blockchain sector, particularly through its implementation of ERC-20 and ERC-721 standards. These standards have facilitated the widespread creation and management of digital tokens, each serving diverse purposes from stablecoins to unique digital collectibles. Ethereum’s ability to support these standards stems from its flexible, programmable architecture, which allows developers to create sophisticated decentralized applications (dApps) and automated smart contracts. This versatility has been instrumental in the proliferation of decentralized finance (DeFi) applications, which leverage tokens for everything from lending and borrowing platforms to automated trading systems.

Binance Coin’s Evolution and Utility

Binance Coin (BNB), initially launched to facilitate efficient operations within the Binance exchange ecosystem, has expanded its utility far beyond just reducing trading fees. BNB is now integral to a range of applications, from in-game purchases to funding new projects through the Binance Launchpad. Its integration into Binance’s decentralized exchange (DEX) and other platforms has enabled it not only to streamline transaction processes but also to expand into areas like loan collateralization and NFT markets. This broad utility helps maintain Binance Coin’s position as a key player in the cryptocurrency landscape.

Technological and Economic Impact

Both Ethereum and Binance Coin have contributed significantly to blockchain’s technological advancement and economic expansion. Ethereum’s smart contracts have become the backbone of numerous DeFi projects, while Binance Coin’s flexibility has made it a favorite for a variety of blockchain-based applications. The ongoing development and refinement of these platforms reflect their commitment to maintaining robust, scalable, and efficient ecosystems. This continuous innovation is crucial as both face growing demands from an expanding user base and increasingly complex applications.

In conclusion, Ethereum and Binance Coin exemplify the transformative potential of blockchain technology. Through their respective contributions to token standards and platform-specific utilities, they have each played pivotal roles in shaping the current and future landscape of digital transactions and decentralized applications. As they evolve, their ongoing adaptations and enhancements will likely continue to influence new sectors and drive further adoption of blockchain technology.

Strategies for Token Holders

1. Dollar-Cost Averaging (DCA)

One effective strategy for managing investment in volatile markets like cryptocurrency is dollar-cost averaging. This approach involves investing a fixed amount of money at regular intervals, regardless of the token’s price, to reduce the impact of volatility on the overall purchase. The method spreads the investment over time, providing a smoother entry into the market.

2. HODLing

“HODL,” a term derived from a misspelling of “hold,” is a popular strategy among cryptocurrency enthusiasts. It refers to holding onto your tokens regardless of market fluctuations, based on a long-term belief in blockchain technology’s potential. This strategy is particularly favored by those who prefer to avoid the risks associated with frequent trading.

3. Utilizing Liquidity Pools and Yield Farming

Engaging in yield farming and adding your tokens to liquidity pools can be a lucrative strategy. This involves lending your cryptocurrency to others through the DeFi (Decentralized Finance) ecosystem, earning interest or tokens in exchange for providing liquidity. This strategy can offer higher returns compared to traditional savings, although it also involves higher risks.

4. Active Trading Strategies

For those who prefer a more hands-on approach, strategies like scalping and swing trading can be considered. Scalping involves making frequent, small trades to capitalize on minor market inefficiencies, while swing trading focuses on capturing gains from market swings, holding positions for a longer period than a scalper but shorter than a typical HODLer.

5. Participation in Governance and Staking

If the tokens you hold have governance capabilities, participating in decision-making processes can be a powerful way to influence the project’s direction. Additionally, staking tokens can provide you with a return while contributing to the network’s security and efficiency.

6. Market Making and Liquidity Provision

Engaging as a market maker can be a strategy for those with substantial capital. Market makers provide liquidity to exchanges by filling buy and sell orders. This can be profitable but requires an understanding of both market conditions and specific exchange rules.

7. Token Metrics and Research

Staying informed about the token’s metrics, such as transaction volumes, active wallets, and development activity, is crucial. Tools like Dune Analytics and Nansen can provide insights into various blockchain activities, helping you make informed decisions.

8. Managing Risk and Diversification

Diversifying your investment across different tokens and blockchain projects can reduce risk. Not all investments will perform well simultaneously, so diversification can help stabilize your returns over time.

Each of these strategies carries its own set of risks and benefits, and the best choice depends on individual financial goals, risk tolerance, and involvement in the cryptocurrency community. Staying educated and vigilant about new developments in the blockchain space is essential for all token holders.

The Future of Utility Tokens: Pioneering Digital Innovation and Economic Growth

Utility tokens have carved a niche within the blockchain ecosystem, showcasing their potential to revolutionize both digital interactions and traditional economic models. As the blockchain landscape evolves, utility tokens are set to play a pivotal role in the broad adoption of this technology across various sectors.

Expanding Role in Digital Platforms and Decentralized Applications

Utility tokens are integral to enhancing user engagement and functionality within decentralized platforms. They facilitate a wide array of interactions, from governance participation to accessing specific platform features. As digital platforms continue to grow, the demand for utility tokens that provide these operational capabilities is expected to rise, further embedding them into the digital economy.

Driving Innovation in Decentralized Finance (DeFi)

In the realm of DeFi, utility tokens are crucial. They enable users to participate in governance, contribute to liquidity pools, and engage in staking, among other financial activities. This not only supports the financial structure of DeFi applications but also incentivizes user participation and investment in the ecosystem. The continued development of DeFi is likely to increase the utility and value of these tokens as they become more intertwined with financial operations on the blockchain.

Enhancing Transparency, Decentralization, and Inclusivity

Utility tokens are at the forefront of promoting transparency and decentralization. By leveraging blockchain technology, these tokens ensure that all transactions and governance actions are recorded transparently, mitigating the risk of fraud and enhancing trust among users. Moreover, the decentralized nature of blockchain allows for more inclusive participation, enabling anyone with internet access to engage with global platforms and contribute to governance processes.

Potential Challenges and Considerations

Despite their benefits, utility tokens face regulatory and market challenges. The regulatory landscape for utility tokens is still evolving, with varying requirements across jurisdictions that can complicate the issuance and trading of these tokens. Additionally, the market for utility tokens can be highly volatile, with prices influenced by market trends, technological advancements, and regulatory news.

Future Prospects: Integration with Traditional Markets and Beyond

Looking ahead, utility tokens are poised to bridge the gap between traditional financial markets and the burgeoning digital economy. Their integration into everyday business practices, from supply chain management to corporate governance, could redefine traditional economic operations. As blockchain technology continues to mature, utility tokens may offer a viable alternative to conventional financial systems, potentially leading to broader economic changes.

In conclusion, utility tokens represent a dynamic and evolving asset class within the blockchain landscape. Their ability to foster new economic interactions, coupled with their role in enhancing platform functionalities, positions them as a key component of the future digital economy. As the technology and regulatory frameworks develop, the potential for utility tokens to transform various industries remains vast and largely untapped.

Discover Kenson Investments: Your Gateway to Digital Asset Portfolios

Kenson Investments excels in crafting digital asset portfolios, offering a comprehensive approach tailored to your needs. Our blockchain asset consulting and blockchain and digital asset consulting services ensure that you receive expert guidance in managing your investments. With a rich history of successfully enriching client experiences, our bitcoin investment consultants and digital asset management consultant focus on the longevity and transparency of your digital assets. Embrace a future with Kenson Investments, where we provide digital asset investment solutions and altcoin investment options, prioritizing enduring value and client satisfaction in the digital sphere. Our digital assets consulting team, along with real world asset consultants and cryptocurrency investment consultant, are dedicated to supporting your investment journey.

Contact us today!