Layer 1 blockchains are the bedrock of the decentralized digital world, serving as the fundamental infrastructures where transactions are validated and recorded directly on the blockchain’s main ledger. They are crucial because they uphold the principles of decentralization, security, and scalability—core to the function and value of blockchain technology.

Introduction to Layer 1 Blockchain Protocols

Foundational Role of Layer 1 Protocols

Layer 1 protocols such as Bitcoin, Ethereum, and newer entrants like Solana and Cardano form the foundation on which all blockchain-based applications are built. These networks set the rules and protocols that govern their ecosystems, ensuring the secure and efficient processing of transactions. Each of these networks uses a consensus mechanism, like Proof of Work (PoW) or Proof of Stake (PoS), to agree on the state of the ledger in a decentralized manner.

Decentralization and Security

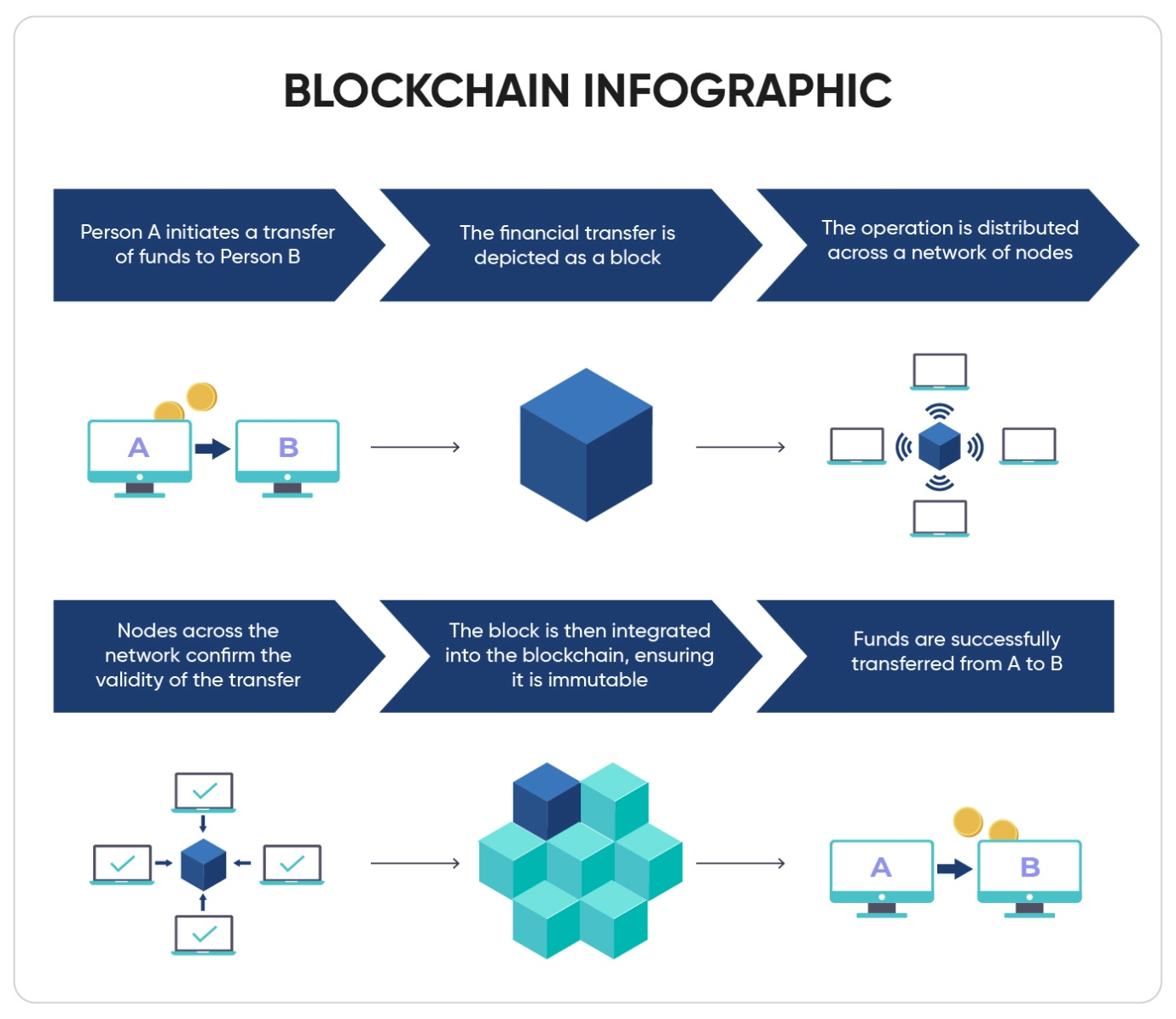

A defining feature of layer 1 blockchains is their decentralized nature, which means no single entity has control over the entire network. This is critical for the security and integrity of the data recorded on the blockchain, as it prevents any single point of failure that could be exploited by malicious actors. Bitcoin, for example, utilizes PoW to secure its network and ensure the immutability of its transactions.

Challenges of Scalability

Despite their strengths, layer 1 protocols often struggle with scalability. As the number of users and transactions grows, these networks can become victims of their own success, leading to slower transaction times and higher fees. This is evident in networks like Ethereum, which, despite its capability to support smart contracts and decentralized applications, can process only about 15 transactions per second—far less than needed for global scale applications.

Innovative Solutions to Scalability

To address these limitations, several layer 1 blockchains are innovating with new scalability solutions. Sharding and layer-2 solutions like rollups are prominent examples where the transaction processing load is distributed or handled off the main chain to improve transaction speeds and reduce costs. For instance, Ethereum’s future upgrades include sharding, which will divide the database into smaller, easier-to-manage parts, each capable of processing transactions in parallel.

Emerging Projects and Future Directions

The ongoing evolution in the layer 1 space is also characterized by the emergence of new projects like Solana, which employs a hybrid PoS mechanism to enhance throughput and efficiency, thereby offering a high-speed and low-cost alternative to its predecessors. Similarly, projects like Polkadot and Avalanche are introducing novel consensus mechanisms and cross-chain interoperability features to address the trilemma of scalability, security, and decentralization more effectively.

Layer 1 blockchains continue to be pivotal in the blockchain ecosystem. Their role extends beyond just transaction processing; they are platforms for innovation, offering developers the tools to build decentralized applications that could transform numerous industries. As the technology matures, the focus will likely continue to be on enhancing scalability and user experience, ensuring that these platforms can support the next generation of digital services on a global scale.

Key Layer 1 Projects and Their Roles

Layer 1 blockchain projects are fundamental to the development and expansion of the digital asset ecosystem. Each of these projects offers unique solutions to the blockchain trilemma—decentralization, security, and scalability—while supporting a variety of applications from simple transactions to complex decentralized applications (dApps).

Bitcoin and Ethereum

Bitcoin (BTC) and Ethereum (ETH) are the archetypes of Layer 1 blockchains, each playing a crucial role in shaping the blockchain landscape.

Bitcoin, introduced in 2009, operates on a Proof of Work (PoW) mechanism. This protocol was revolutionary in enabling a decentralized network where transactions are securely validated by miners who solve complex cryptographic puzzles. The design focuses heavily on security and decentralization but has faced criticism for its scalability limitations and environmental impact due to the high energy consumption of mining processes.

Ethereum was launched in 2015 to complement the functionalities of Bitcoin by supporting decentralized applications (dApps) and smart contracts. Unlike Bitcoin, Ethereum’s Layer 1 has evolved from PoW to a Proof of Stake (PoS) mechanism with its ‘Merge’ update, aiming to address energy concerns while attempting to improve scalability and transaction speed. Despite these advancements, Ethereum still struggles with high transaction costs and network congestion during peak times, driving the development of Layer 2 solutions like rollups and sidechains to enhance its performance.

Both Bitcoin and Ethereum have developed rich ecosystems and remain at the forefront of the cryptocurrency market due to their robust security features, widespread adoption, and active community support. However, they continue to face challenges in balancing the blockchain trilemma—decentralization, security, and scalability—which influences ongoing innovations within each network.

As Layer 1 protocols, both Bitcoin and Ethereum serve as foundational platforms for a myriad of financial and non-financial applications, continually adapting to the growing demands of the blockchain community and maintaining their dominance in the digital asset space.

Solana

Known for its high throughput and low transaction costs, Solana uses a unique Proof of History (PoH) consensus combined with PoS, enabling it to process up to 65,000 transactions per second. This makes it an attractive platform for developers looking for speed and scalability.

Cardano

Launched by one of Ethereum’s co-founders, Cardano is distinguished by its research-driven approach and use of a Proof of Stake (PoS) consensus mechanism. It focuses on sustainability and interoperability, which are crucial for long-term development and cross-chain functionality.

Algorand

Algorand addresses scalability through its Pure Proof of Stake (PPoS) mechanism, offering fast transaction speeds and finality without compromising on security. It is designed to support a wide range of applications, including financial tools and services.

Avalanche

Avalanche offers a unique approach with its subnets and multiple chains, which allows for customizable blockchains tailored to specific use cases. Its consensus mechanism provides rapid transaction finality, making it suitable for decentralized finance (DeFi) applications.

Elrond

Elrond is notable for its use of Adaptive State Sharding and a Secure Proof of Stake (SPoS) consensus mechanism, which drastically enhances its scalability and throughput capabilities. This makes Elrond a strong contender for hosting a variety of enterprise-level applications.

Harmony

Harmony utilizes sharding technology to scale the network while maintaining a focus on creating a decentralized and secure blockchain. Its Effective Proof of Stake (EPoS) consensus allows it to offer low fees and fast transaction speeds, which are beneficial for developers and end-users alike.

Celo

Celo is tailored for mobile use, with a lightweight blockchain structure that allows mobile phones to be used as nodes. It uses a PoS mechanism and aims to increase cryptocurrency adoption through user-friendly features such as using phone numbers as public keys.

THORChain

THORChain is unique in enabling cross-chain liquidity without the need to wrap or peg assets, using its native token RUNE for transaction fees, governance, and security. It supports a decentralized exchange (DEX) model that facilitates seamless asset exchange across different blockchains.

Each of these Layer 1 projects plays a pivotal role in the blockchain ecosystem, providing diverse capabilities and innovations that address specific challenges within the industry. Their continuous development and adaptation are crucial as the blockchain space evolves to accommodate more users and increasingly complex applications.

Scalability Solutions Within Layer 1 Protocols

Scalability is a pivotal challenge for Layer 1 blockchain protocols, and addressing it requires innovative solutions that can enhance the network’s capacity to handle a larger volume of transactions efficiently. The primary methods include modifying the block size, consensus mechanisms, and implementing sharding.

Increasing Block Size

One straightforward method to improve scalability in Layer 1 blockchains is by increasing the block size, which allows more transactions to be processed within a single block. This approach was notably adopted by Bitcoin Cash, which increased its block size first to 8 MB and later to 32 MB, significantly boosting its transaction processing capacity compared to Bitcoin’s.

Updated Consensus Mechanisms

Switching from Proof of Work (PoW) to Proof of Stake (PoS) is another strategy that several blockchains have employed to address scalability. PoS is less energy-intensive and can handle transactions faster than PoW. Ethereum’s transition to PoS through the ‘Merge’ is a prominent example of this approach, aiming to increase transactions per second while reducing energy usage and transaction costs.

Sharding

Sharding involves dividing the blockchain into several smaller, manageable segments, known as shards, each capable of processing transactions independently. This means that transactions can be processed in parallel, significantly increasing the throughput of the network. Ethereum’s upcoming upgrades include sharding to enhance its scalability.

Layer 2 Solutions

While technically not modifications to the Layer 1 protocol itself, Layer 2 solutions are crucial for scalability. They handle transactions off the main chain, reducing the load and speeding up processing times. Examples include state channels, sidechains, and rollups. State channels, like the Lightning Network for Bitcoin, allow multiple transactions to be conducted off-chain before settling on the main blockchain. Sidechains are independent blockchains that run parallel to the main blockchain, allowing for more rapid processing of transactions.

Novel Consensus Models

Alternative consensus mechanisms like Delegated Proof of Stake (DPoS) and Byzantine Fault Tolerance (BFT) variants are also being explored for their potential to offer faster and more energy-efficient transaction validations. These models differ in how they select validators and manage the consensus process, potentially offering improvements in speed and scalability without compromising security.

These scalability solutions are vital for the evolution of Layer 1 blockchains, enabling them to support higher volumes of transactions and a broader array of applications. As the blockchain technology landscape continues to evolve, these innovations will play a critical role in shaping its future.

Impact of Layer 1 Innovations on Digital Asset Markets

Layer 1 blockchain innovations have profoundly influenced digital asset markets, driving both technological advancements and financial developments across the ecosystem. These innovations not only enhance the functionality and efficiency of blockchain networks but also greatly expand the scope and scalability of applications built on them, leading to significant shifts in market dynamics.

Enhanced Market Efficiency and Accessibility

Layer 1 innovations have led to more efficient and accessible markets. For instance, advancements in blockchain technology have streamlined processes like tokenization, which improves liquidity and lowers transaction costs. This has opened up markets to a broader range of investors globally, making it easier for institutional and individual investors to participate in digital asset markets that were previously less accessible.

Increased Scalability and New Financial Products

Innovations such as sharding and consensus mechanism upgrades (e.g., from Proof of Work to Proof of Stake) have directly addressed scalability issues that once hindered blockchain networks like Ethereum and Bitcoin. These improvements have not only supported existing applications but have also facilitated the development of new financial products, including complex DeFi (Decentralized Finance) applications and various tokenization projects that cover real estate, art, and other collectibles.

Growth of Decentralized Applications (dApps)

The expansion of Layer 1 capabilities has spurred the growth of decentralized applications by providing a more robust and scalable infrastructure. Projects like Ethereum have seen a surge in dApps, ranging from financial services to gaming and social media platforms. This has been pivotal in driving the adoption of blockchain technology beyond mere currency transactions to a wide array of digital interactions and financial innovations.

Impact on Token Economics

Layer 1 innovations have also reshaped token economics, influencing both the value and utility of native blockchain tokens. Enhancements in network efficiency and scalability often lead to increased demand for native tokens, which are used for transaction fees, governance, and staking. This demand can lead to price appreciation and greater investor interest in the market. Furthermore, the ability to support a larger number of transactions can attract more developers and users to the ecosystem, creating a positive feedback loop that further enhances the value and utility of the digital assets.

Cross-chain Interoperability

Advancements in Layer 1 technology have also facilitated better cross-chain interoperability, allowing for seamless asset and data transfer across different blockchain networks. This interoperability is crucial for the broader adoption of blockchain technology as it enables diverse applications to communicate and transact across ecosystems without the need for intermediaries, thereby enhancing efficiency and reducing costs.

Layer 1 innovations have been instrumental in shaping the digital asset markets, driving innovation, improving market efficiencies, and expanding the use cases of blockchain technology. As these technologies continue to evolve, they are likely to introduce further transformative changes to the digital asset landscape, potentially ushering in a new era of financial technology.

Examples of Emerging Layer 1 Projects

Sui

Sui is distinguished by its high transaction throughput and low latency, making it a robust platform for developers creating complex and high-frequency applications. Its design emphasizes scalability and performance, providing a conducive environment for deploying decentralized applications (dApps). Despite its strengths, Sui faces stiff competition from established Layer 1 projects and may encounter adoption challenges due to its newness in a competitive market.

Sei Network

Sei Network focuses on optimizing performance for trading and decentralized finance (DeFi), offering rapid transaction finality and high throughput. This makes it well-suited for financial transactions where speed and reliability are critical. The network’s architecture aims to minimize latency, which is particularly important for real-time trading and DeFi operations.

Quai Network

Quai Network introduces an innovative hierarchical chain structure aimed at enhancing scalability and transaction throughput. This structure allows Quai Network to process a high volume of transactions efficiently, making it suitable for applications that demand robust and scalable blockchain solutions. The hierarchical design also helps in maintaining decentralization by distributing validation and consensus processes across multiple nodes.

Kaspa

Kaspa is a Layer 1 blockchain that uses a Proof-of-Work (PoW) consensus model and is notable for its single-second confirmation times. Despite the typically slow nature of PoW, Kaspa achieves exceptionally fast transaction speeds, which could make it a compelling option for users looking for quick transaction finality.

Celestia

Celestia offers a unique modular approach to blockchain architecture, separating consensus and data availability from execution layers. This modularity allows developers to create customized blockchains with enhanced flexibility and efficiency, making it easier to scale operations and tailor solutions to specific needs.

NEON

NEON is an Ethereum-compatible blockchain built on Solana, providing the benefits of Ethereum’s smart contracts combined with Solana’s high-speed transaction capabilities. This dual benefit makes NEON an attractive platform for developers who require both robust smart contract functionality and efficient transaction processing.

These emerging Layer 1 projects represent the forefront of blockchain innovation, each bringing unique solutions to scalability, speed, and flexibility challenges. They highlight the ongoing evolution in the blockchain sector aimed at broader adoption and more complex applications.

Conclusion: The Future Driven by Layer 1 Protocols

The advancements increasingly influence the trajectory of blockchain development in Layer 1 protocols. These foundational networks not only support a myriad of applications but are pivotal in defining the future landscape of digital and decentralized solutions across various sectors.

Decentralization and Efficiency Trade-Offs

Layer 1 protocols continue to navigate the delicate balance between decentralization and efficiency. While fully decentralized networks like Bitcoin and Ethereum offer enhanced security and resilience, they often face scalability challenges. On the other end of the spectrum, slightly more centralized solutions can provide increased transaction speeds and reduced costs but may compromise on decentralization to some extent.

Adoption Across Industries

The broadening adoption of Layer 1 technologies spans diverse industries, from finance to supply chain management, indicating their potential for widespread use. This adoption is driven by the ability of these protocols to offer real-world solutions that address industry-specific needs.

Technological Innovations and Scalability

Technological innovations within Layer 1 protocols, such as the transition from Proof of Work to Proof of Stake, as seen with Ethereum, are making these networks more sustainable and efficient. Such advancements are crucial in addressing the pressing issue of scalability, allowing these networks to support greater transaction volumes and more complex applications.

Regulatory Landscape and Challenges

Layer 1 protocols must also navigate an evolving regulatory landscape, which varies significantly across jurisdictions. This poses a considerable challenge as compliance with diverse regulatory frameworks becomes increasingly complex. Protocols need to implement robust compliance measures, including AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures, to adapt to these regulatory demands.

Future Outlook

Looking ahead, the future of Layer 1 protocols appears intertwined with the development of Layer 2 solutions, which are designed to enhance scalability and transaction capacity without compromising the security and decentralization of the underlying Layer 1 network. The synergy between these layers is likely to play a critical role in the next phase of blockchain evolution, promoting more efficient, scalable, and user-friendly blockchain ecosystems.

As blockchain technology continues to evolve, the ongoing innovation and strategic implementation of Layer 1 protocols will undoubtedly shape the future of digital transactions and decentralized applications, forging a path toward a more interconnected and efficient global digital economy.

Craft A Digital Asset Portfolio Like No Other

Whether it’s established currencies like BTC and ETH to form the foundation of your digital portfolio or a mix of NFTs and altcoin investment options for a diversified approach, Kenson Investments is here to educate you and support your journey. Our blockchain asset consulting and blockchain and digital asset consulting services are tailored to meet your needs. As bitcoin investment consultants, we provide expert guidance and digital asset investment solutions. Connect with our digital asset management consultant and digital assets consulting team today to begin! Our cryptocurrency investment consultant and real world asset consultants are ready to help you navigate your investment options for a secure financial future.