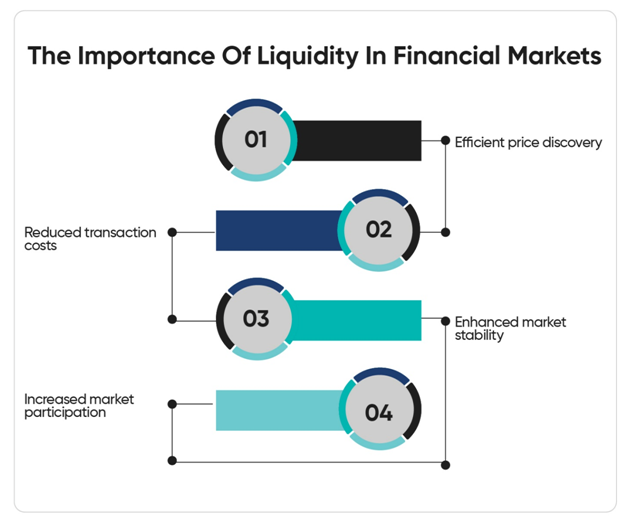

In the rapidly evolving landscape of digital assets, liquidity remains a critical concern for traders, investors, and businesses alike. The ability to quickly trade assets without significantly impacting their price is essential for market efficiency and investor confidence.

However, achieving high liquidity in digital asset markets can be challenging because of factors like fragmented trading platforms, regulatory uncertainty, and market volatility. In this blog, we’ll explore strategies and insights for enhancing digital asset liquidity.

Market Infrastructure: Building the Foundations for Liquidity

The foundation of liquidity in digital asset markets lies in robust market infrastructure. This includes the trading platforms and liquidity providers that facilitate the buying and selling of assets. To enhance liquidity, market participants must focus on several key areas:

- Exchange connectivity: Traders benefit from access to multiple trading venues through exchange connectivity. These platforms allow traders to execute orders across various exchanges simultaneously, improving liquidity by accessing a larger pool of liquidity providers. They enable traders to arbitrage price discrepancies between exchanges, further enhancing market efficiency.

- Market making: Market makers play a crucial role in enhancing liquidity by continuously quoting bid and ask prices and absorbing excess buy or sell orders. By providing liquidity to the market, these entities facilitate smoother price discovery and reduce transaction costs for traders. Market makers often use sophisticated algorithms and risk management techniques to optimize their trading strategies and mitigate market impact.

- Decentralized finance (DeFi) liquidity pools: In the realm of decentralized finance, liquidity pools have emerged as a popular mechanism for providing liquidity to digital asset markets. These pools allow users to contribute their assets to a common liquidity pool in exchange for trading fees and incentives.

Trading Strategies: Maximizing Efficiency and Minimizing Impact

Effective trading strategies play a crucial role in enhancing liquidity by optimizing order execution and minimizing market impact. Traders can employ various strategies to navigate digital asset markets efficiently:

- Algorithmic trading: Algorithmic trading strategies use automated systems to execute pre-defined trading instructions at high speeds and volumes. These strategies use quantitative analysis, machine learning, and statistical models to identify trading opportunities and manage risk. By executing trades swiftly and efficiently, algorithmic trading contributes to market liquidity while minimizing price impact.

- Smart order routing:These routing systems optimize order execution by dynamically routing orders to the most favorable trading venues based on factors like price and liquidity. These systems help traders access liquidity across multiple exchanges and achieve better execution outcomes.

- Liquidity mining: Some digital asset projects implement liquidity mining and incentive programs to encourage trading activity. These programs reward users for providing liquidity to decentralized exchanges or lending platforms. By offering incentives like yield farming rewards or token distributions, projects incentivize users to contribute their assets to liquidity pools, which enhances market liquidity.

Regulatory Considerations: Navigating Compliance and Market Integrity

Regulatory considerations play a crucial role in shaping the liquidity landscape of digital asset markets. Regulatory clarity, investor protection, and market integrity are essential for building trust and confidence among market participants. Key regulatory considerations include:

- Regulatory compliance: Market participants must adhere to applicable regulations governing digital asset trading. Compliance with regulatory standards not only safeguards against illicit activities but also enhances investor trust in the market.

- Market surveillance: Regulatory authorities employ market surveillance and oversight mechanisms to detect and prevent market manipulation and fraud. Enhanced market surveillance capabilities, including the monitoring of trading activities and order book dynamics, are essential for maintaining market integrity and promoting fair and orderly markets.

- Regulatory innovation: Regulatory innovation and collaboration are critical for fostering a conducive regulatory environment for digital asset liquidity. Regulators must adapt existing frameworks to accommodate the unique characteristics of digital assets while collaborating with industry stakeholders to develop best practices and standards.

Connect With Investment Consultants To Enhance Digital Asset Liquidity

Investment consultants offer a holistic approach to enhancing digital asset liquidity, drawing on their extensive experience and industry networks to provide strategic guidance tailored to the unique needs of their clients.

Through in-depth market analysis and due diligence, investment consultants help clients identify optimal entry and exit points, minimize risks, and capitalize on emerging opportunities. They assist in evaluating the liquidity profiles of different assets, assessing market depth, and identifying potential liquidity providers.

Investment consultants play a crucial role in developing customized trading strategies, leveraging advanced analytics and algorithmic tools to optimize order execution and mitigate market impact. By understanding regulatory developments and compliance requirements, they ensure that clients operate within the bounds of applicable laws, safeguarding against legal risks.

Join Hands With A Reputable Investment Consultancy Firm

Discover the power of strategic guidance with Kenson Investments, a renowned digital asset strategy consulting company. Our team of digital asset consulting experts offers comprehensive solutions tailored to your financial needs. From evaluating cryptocurrency options to navigating futures trading, we provide innovative strategies for success.

We can help you explore opportunities in blockchain, NFTs, cryptocurrency investments, and decentralized finance with our secure and transparent solutions. Join forces with Kenson Investments and unlock the potential of digital asset management for excellent growth and long-term success.

Schedule a consultation today to elevate your investment strategy and achieve your financial goals.

Disclaimer: The content provided on this blog is for informational purposes only and should not be construed as financial advice. The information presented herein is based on personal opinions and experiences, and it may not be suitable for your individual financial situation. We strongly recommend consulting with a qualified financial advisor or professional before making any financial decisions. Any actions you take based on the information from this blog are at your own risk.