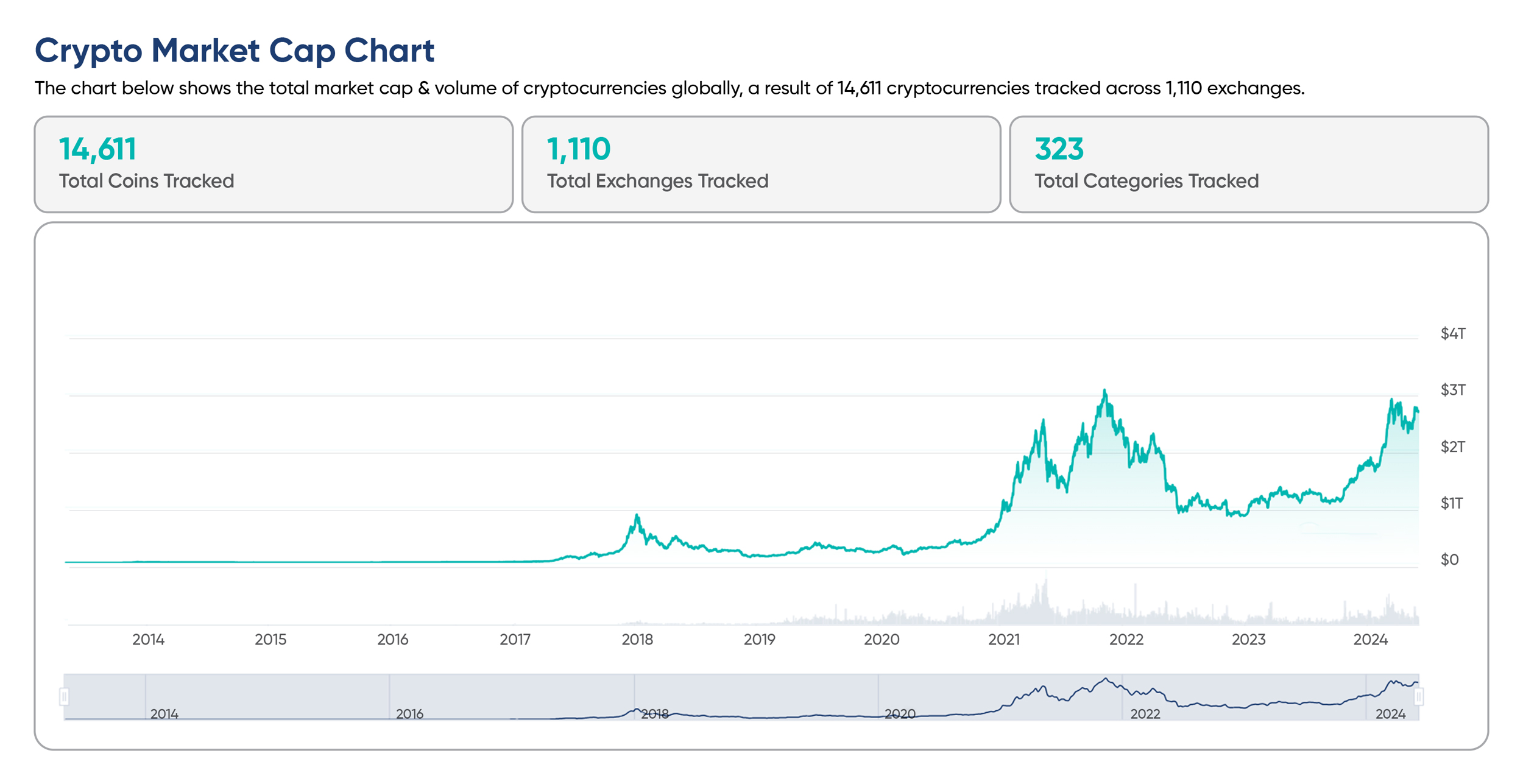

Shaken but not shattered, the cryptocurrency market has roared back to life in 2024, leaving behind a period of volatility and fraud. With a total market capitalization now at a robust $2.66 trillion, nearing its record highs from 2021, this resurgence underscores the enduring potential of digital assets. It also paves the way for a revolutionary shift in finance—real-world asset tokenization.

Imagine a world where owning a piece of the Eiffel Tower or a rare Picasso is as easy as buying a stock. This isn’t science fiction; it’s the future of finance powered by a revolutionary concept called real-world asset tokenization. This technology is set to disrupt traditional ownership models and usher in a new era of financial inclusion and accessibility.

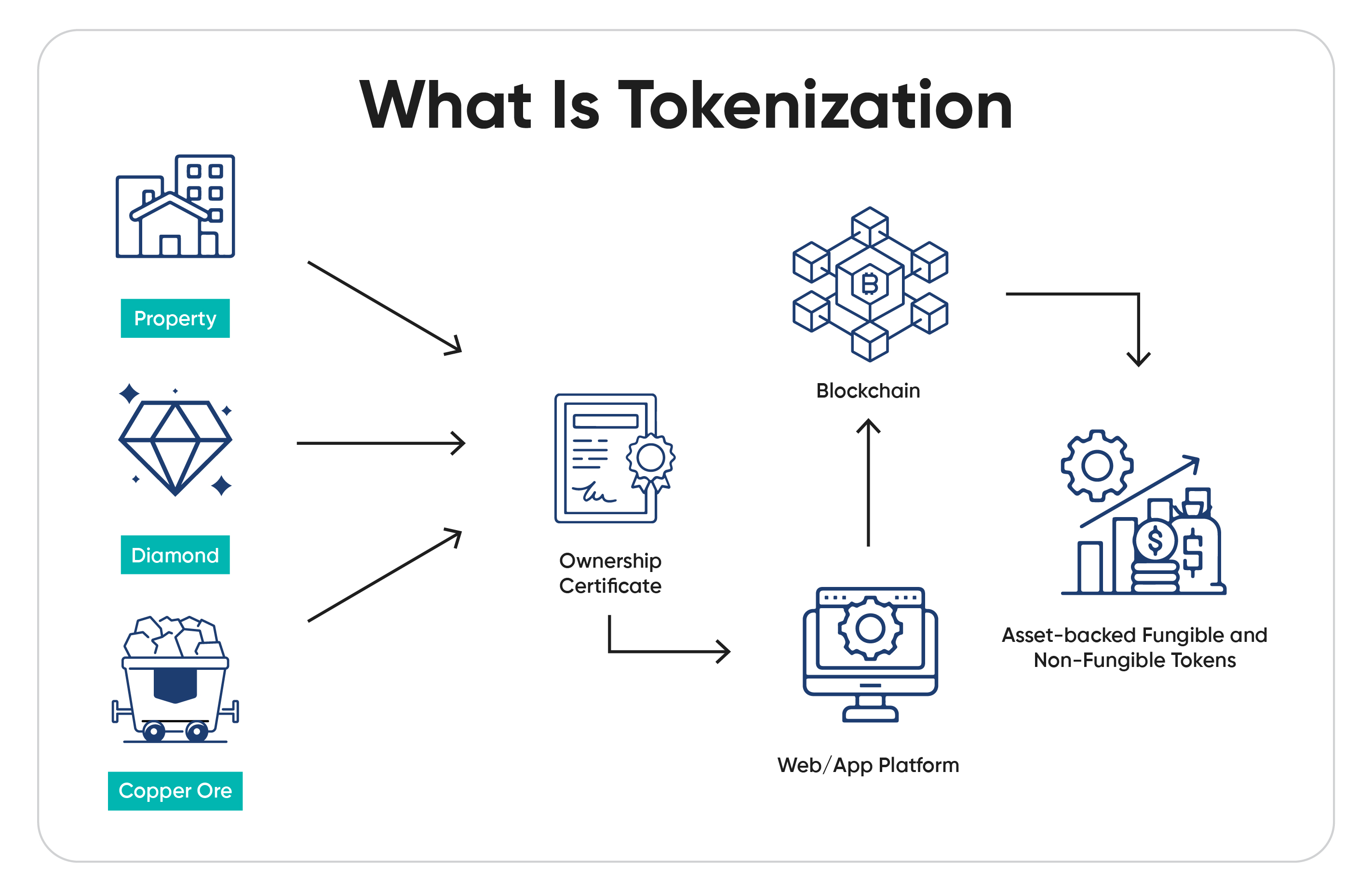

Real-world asset tokenization involves creating digital tokens representing ownership of tangible assets like real estate, art, or intellectual property. These tokens are tradable on secure digital platforms, much like stocks on stock exchanges. Fractional ownership allows investors to purchase portions of an asset, democratizing access to markets that were once out of reach.

The cryptocurrency market, the bedrock of digital assets, has witnessed explosive growth. The first and most well-known cryptocurrency, Bitcoin, has surged in value, capturing headlines and igniting public interest. However, the market’s inherent volatility underscores the need for a deeper understanding of the underlying technologies and trends shaping the future of digital assets.

Navigating the digital asset market requires knowledge and insight. In this blog, we’ll dive into real-world asset tokenization and its potential impact on the financial landscape. We’ll explore the increasing global adoption of digital assets, analyze upcoming regulatory changes, and examine how emerging technologies shape this innovative space.

By understanding these key trends, you can make informed investment decisions and position yourself for the exciting opportunities ahead.

The Rise of Real-World Asset Tokenization

Democratizing Ownership: What is Real-World Asset Tokenization?

Real-world asset tokenization is a revolutionary process that leverages blockchain technology to create digital tokens representing ownership of physical assets. These tokens can be anything from a fraction of a Picasso painting to a share of a commercial building.

Imagine a digital certificate on a secure platform verifying your ownership of a portion of a valuable vineyard in Napa Valley. This is the power of tokenization—it fragments ownership into smaller, more manageable units.

This innovative approach unlocks a multitude of benefits for both asset owners and investors:

- Fractional Ownership:Traditionally, investing in high-value assets like real estate or art requires significant capital. Tokenization breaks down these barriers by dividing ownership into smaller, tradable tokens. This makes these investments accessible to a wider range of individuals, fostering greater financial inclusion.

- Increased Liquidity:Real-world assets are often illiquid, making them difficult to buy and sell quickly. Tokenization transforms these assets into digital representations that can be easily traded on global marketplaces 24/7. This increased liquidity benefits both asset owners, who can offload their holdings more readily, and investors seeking new opportunities.

- Enhanced Transparency:Blockchain technology provides a secure and transparent record of ownership. Every transaction involving a tokenized asset is immutably recorded on the blockchain, creating a clear audit trail and reducing the risk of fraud or manipulation.

- Streamlined Processes:Tokenization automates many traditional investment processes, such as asset management and recordkeeping. This reduces administrative costs and complexities for both issuers and investors.

Beyond the Obvious: Reimagining Industries with Tokenization

The impact of real-world asset tokenization extends far beyond just making investments more accessible. It has the potential to revolutionize various industries:

- Real Estate:Tokenization can unlock new avenues for real estate investment. Fractional ownership of properties allows individuals to participate in the market with smaller investments, while developers can raise capital more efficiently. Tokenization can also streamline property management and facilitate easier secondary market transactions.

- Art & Collectibles:The art world, notorious for its opacity and limited access, can benefit greatly from tokenization. Fractional ownership of valuable artworks allows for wider participation and potentially higher liquidity. Additionally, tokenized art can be more easily authenticated and tracked, reducing the risk of forgery.

- Intellectual Property:Authors, musicians, and other creators can leverage tokenization to monetize their intellectual property in innovative ways. Fractional ownership of patents, copyrights, or trademarks can generate passive income for creators and attract investment for future projects.

These are just a few examples, and the potential applications of real-world asset tokenization are vast. As the technology evolves, we can expect to see its influence extend to sectors like private equity, supply chain management, and even voting systems.

Challenges and Considerations: The Road Ahead

While the potential of real-world asset tokenization is undeniable, it’s important to acknowledge the challenges that need to be addressed:

- Regulation:The regulatory landscape surrounding digital assets is still evolving. Governments worldwide are grappling with how to best regulate tokenized assets and ensure investor protection. Uncertain regulations can create a barrier to widespread adoption.

- Security:The security of blockchain platforms is paramount. While blockchain technology boasts robust security features, vulnerabilities can still exist. Strong security protocols and ongoing vigilance are crucial to mitigating risks.

- Valuation:Determining the fair market value of tokenized assets, especially for unique or illiquid assets, can be challenging. Traditional valuation methods might need to be adapted to the digital asset space.

Despite these challenges, the innovation and potential benefits of real-world asset tokenization are driving ongoing development and adoption.

Real-World Success Stories: Tokenization in Action

Several successful real-world asset tokenization projects demonstrate the potential of this technology:

- Regis Aspen Resort:In 2018, a luxury resort in Aspen offered tokenized ownership stakes, allowing investors to participate in the real estate market with a lower investment.

- Masterworks:This online platform allows individuals to invest in fractions of high-value artworks by renowned artists like Basquiat and Monet.

- Global Tokenization Standard (GTS):This consortium is developing standardized protocols for tokenizing real-world assets to increase transparency and streamline the process.

These examples showcase the diverse applications of real-world asset tokenization and its potential to reshape how we invest, own, and manage valuable assets.

Global Digital Asset Adoption: A Wave of Change

The digital asset landscape is witnessing a surge in global adoption, fueled by both individual and institutional participation. Retail investors increasingly recognize the potential of digital assets like cryptocurrencies, while established financial institutions are exploring ways to integrate them into their portfolios.

This widespread adoption can be attributed to several key factors:

- Financial Inclusion:Digital assets offer a path towards financial inclusion for the underbanked population. In regions with limited access to traditional banking systems, cryptocurrencies can provide a secure and accessible means of storing value and conducting transactions.

- Technological Advancements:The underlying technology of digital assets, blockchain, offers a secure and transparent platform for transactions. This, coupled with the development of user-friendly wallets and trading platforms, is making digital assets more accessible to a wider audience.

- Diversification and Potential Returns:Digital assets offer an alternative asset class with the potential for high returns. Investors seeking diversification beyond traditional stocks and bonds are increasingly turning to cryptocurrencies and other digital assets.

- Growing Awareness and Acceptance:Increased media coverage and public interest have led to a growing awareness of digital assets. This, along with the growing adoption by institutional players, is fostering greater acceptance and legitimacy for the asset class.

Adding further fuel to the fire, the total cryptocurrency trading volume has surged significantly in the past day. According to data from CoinMarketCap (as of June 3rd, 2024), the total trading volume across all cryptocurrencies has increased by over 54% in the last 24 hours, reaching $72.54 billion.

Notably, stablecoins and cryptocurrencies pegged to the value of traditional assets like the US dollar and continue to dominate trading activity. They account for a whopping 92.38% of the total daily volume, with a combined value traded of $67.01 billion.

This dominance highlights their appeal to investors seeking a familiar value proposition within the digital asset space.

Geographical Landscape: A Tale of Two Worlds

The adoption of digital assets isn’t uniform across the globe. Developed economies tend to have a higher digital asset penetration than developing economies. This can be attributed to several factors:

- Regulatory Environment:Developed countries are often at the forefront of developing regulations for digital assets, providing a clearer framework for investors and institutions. This fosters greater trust and willingness to participate.

- Financial Infrastructure:Developed economies generally have a more robust financial infrastructure with higher internet penetration. This facilitates easier access to digital asset platforms and trading services.

- Economic Stability:Individuals in developing economies with high inflation or currency volatility may find digital assets to be a more stable store of value compared to their local fiat currencies. This can drive adoption in these regions.

However, the gap is narrowing. Developing economies are rapidly catching up, with a staggering rise in digital asset adoption observed in countries like Vietnam, Nigeria, and Argentina. These countries are experiencing explosive growth, with projections indicating their digital asset markets could surge by double digits in the coming years.

Vietnam’s market is expected to climb over 8.6%, while Nigeria’s and Argentina’s are forecasted to reach impressive growth rates exceeding 11.5% and 12.9%, respectively. This trend will likely continue as internet access improves and regulatory frameworks evolve across these regions.

The Role of Governments and Regulations

Governments play a crucial role in shaping the global adoption of digital assets. Clear and well-defined regulations are essential for fostering trust, protecting investors, and preventing illicit activity. However, overly restrictive regulations can stifle innovation and hinder the market growth.

Currently, the regulatory landscape for digital assets remains fragmented. Some countries are taking a proactive approach, while others are still exploring how to address this emerging asset class best. A coordinated global effort to establish a clear and consistent regulatory framework will be crucial for facilitating wider adoption.

Roadblocks on the Road to Mass Adoption

Despite the growth, several challenges remain on the path to widespread digital asset adoption:

- Volatility:The price volatility associated with cryptocurrencies can deter some investors. As the market matures and regulations are implemented, volatility is expected to decrease, but it remains a factor to consider.

- Security Concerns:Security breaches and hacks on cryptocurrency exchanges have raised concerns about the safety of digital assets. Improved security protocols and education for users are essential to mitigating these risks.

- Limited Use Cases:Currently, the use cases for digital assets are primarily focused on investment and speculation. For widespread adoption, the development of more practical applications for digital assets in everyday transactions is necessary.

These hurdles are not insurmountable. As the technology matures, regulations evolve, and awareness increases, we can expect to see these challenges addressed and global digital asset adoption continue to rise.

Regulatory Updates and Impact: Navigating the Evolving Landscape

The regulatory landscape surrounding digital assets is currently a work in progress. Governments worldwide are grappling with how to best regulate this innovative asset class, balancing the need for investor protection and fostering innovation.

Here’s a glimpse into the current state:

- Fragmented Framework:Currently, there’s no single, globally accepted regulatory framework for digital assets. Regulations vary significantly by country, creating uncertainty for businesses and investors operating across borders.

- Focus on KYC/AML:Many regulations focus on Anti-Money Laundering (AML) and Know-Your-Customer (KYC) protocols. This helps mitigate risks associated with money laundering and terrorist financing but can also add complexity to the digital asset ecosystem.

- Evolving Classification:Governments are still determining how to classify digital assets. Are they securities, commodities, or something entirely new? This classification will determine which regulations apply and how the market is overseen.

The impact of regulations on the digital asset market is multifaceted:

- Increased Legitimacy:Clear regulations can provide greater legitimacy to the digital asset space, attracting institutional investors and fostering wider adoption.

- Market Stability:Regulations can help stabilize the market by reducing risks associated with fraud and manipulation.

- Innovation Hurdles:Overly restrictive regulations can stifle innovation by limiting the development and application of new technologies.

Looking ahead, several regulatory changes could significantly influence real-world asset tokenization:

- Tokenization-Specific Regulations:Governments may develop specific regulations tailored to address the unique aspects of tokenized assets. This could provide clarity and guidance for issuers and investors in this emerging space.

- Global Harmonization:There’s a growing push for international cooperation to establish a harmonized approach to digital asset regulations. This would create a more level playing field for businesses operating globally and boost investor confidence.

Staying informed about regulatory updates is crucial for anyone involved in the digital asset space. Kenson Investments, a leader in digital asset management consulting, closely monitors regulatory developments and can help you navigate the evolving landscape.

Technological Innovations and Price Impact: The Engine of Change

The digital asset space thrives on continuous innovation. Emerging technologies are constantly pushing the boundaries, shaping the future of real-world asset tokenization and impacting the overall market.

Let’s explore some key areas of innovation:

- Blockchain Scaling Solutions:

Current blockchain technology can face scalability limitations, hindering mass adoption. New solutions like layer-2 scaling and sharding are being developed to increase transaction throughput and reduce fees. Layer-2 scaling solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, operate on top of the existing blockchain to facilitate faster transactions.

Sharding, on the other hand, involves breaking the blockchain into smaller, more manageable pieces, or “shards,” each capable of processing its transactions and smart contracts. These advancements will not only make real-world asset tokenization more efficient and accessible but also support the growth of decentralized applications and services.

- Decentralized Finance (DeFi):

DeFi protocols offer a suite of financial services built on blockchain technology. This disrupts traditional financial intermediaries and can empower individuals to manage their assets in innovative ways. DeFi applications can facilitate the creation and trading of tokenized assets, streamlining real-world asset tokenization processes.

For example, some platforms provide decentralized exchanges and lending services that allow users to trade and leverage tokenized assets without relying on centralized entities. DeFi also introduces yield farming and staking, where users can earn rewards for providing liquidity or holding tokens, further incentivizing participation in the digital asset ecosystem.

- Custody Solutions:

Secure storage of digital assets remains a crucial concern. Emerging technologies like multi-signature wallets and hardware wallets are enhancing the security and user experience for custody solutions.

Multi-signature wallets require multiple private keys to authorize a transaction, adding an extra layer of security against unauthorized access. Hardware wallets store private keys offline, protecting them from online threats.

Additionally, institutional-grade custody solutions provide insurance and compliance features that appeal to large investors. This will be essential for building trust and attracting wider participation in real-world asset tokenization.

These innovations have the potential to significantly impact the digital asset market:

- Increased Scalability:

Improved scalability will enable processing a higher volume of transactions, making real-world asset tokenization more feasible for larger and more complex assets. For instance, real estate properties and luxury goods can be easily tokenized and traded, opening up new investment opportunities and liquidity channels.

Scalability solutions will also reduce congestion on blockchain networks, resulting in faster transaction times and lower fees, benefiting all participants.

- Enhanced Security:

Advancements in custody solutions will mitigate security risks associated with digital assets, fostering greater trust and participation. As security measures improve, more institutional investors are likely to enter the market, bringing substantial capital and legitimacy to the space. Enhanced security protocols also protect against hacking and fraud, ensuring that investors’ assets remain safe and secure.

- Improved Efficiency:

DeFi and other innovative protocols can streamline processes, making real-world asset tokenization more efficient and cost-effective. Automation through smart contracts can eliminate the need for intermediaries, reducing costs and increasing transparency.

For example, tokenized assets can be traded 24/7 on decentralized exchanges, providing greater liquidity and flexibility compared to traditional markets. Efficient processes also enable faster settlement times, reducing counterparty risk and enhancing the overall user experience.

The price of digital assets can be influenced by various factors, including technological advancements. Innovations that enhance scalability, security, and user experience can contribute to a more stable and potentially bullish market for digital assets, including tokenized assets.

The digital asset space is brimming with opportunity, but navigating this dynamic environment requires expertise and a keen understanding of evolving trends. Kenson Investments is your trusted partner in the digital asset revolution, offering Digital asset management consulting services to guide you through this complex landscape. Our team of experienced professionals provides Digital asset investment solutions tailored to your needs and possesses a deep understanding of real-world asset tokenization, regulatory nuances, and emerging technologies. We also offer Altcoin investment options for those looking to diversify their portfolio. Additionally, we focus on enhancing ROI with digital asset consulting, ensuring that you maximize your returns in this rapidly changing market.

As a leading digital asset management consulting firm, we offer comprehensive cryptocurrency investment solutions and blockchain asset consulting services tailored to meet your specific needs.

Contact us today to discuss your investment goals and explore how Kenson Investments can help you navigate the exciting opportunities that lie ahead in the future of digital assets.

Disclaimer: The content provided on this blog is for informational purposes only and should not be construed as financial advice. The information presented herein is based on personal opinions and experiences, and it may not be suitable for your individual financial situation. We strongly recommend consulting with a qualified financial advisor or professional before making any financial decisions. Any actions you take based on the information from this blog are at your own risk.