The financial sector is experiencing a major shift due to the rise of blockchain technology. One interesting development is the introduction of Real-World Asset (RWA) tokens, which are also referred to as security tokens. These tokens symbolize ownership or entitlements to physical assets like property, artwork, goods, or intellectual property on a blockchain network.

Kenson Investments, recognizing the immense potential of RWA tokens to revolutionize traditional finance, is positioned as your trusted partner in navigating this innovative landscape. By leveraging our skills, you can explore the exciting opportunities RWA tokens offer, including increased liquidity through fractionalized ownership, enhanced transparency with blockchain technology, lower barriers to entry for investing in high-value assets, and the facilitation of global investment through borderless trading.

The idea of RWA tokenization is fairly recent and has been gaining considerable popularity in recent years. Recognizing the vast potential of digital asset technology, Kenson Investments is one of the top players in the sector. We believe that RWA tokens have the potential to transform conventional finance by:

Unlocking New Investment Opportunities: RWA tokens open doors to a wider range of digital asset classes for businesses. Previously illiquid assets like real estate, art, and even private equity can be accessed through fractionalized ownership via RWA tokens. This diversification potential allows potential investors to build more robust and strategic portfolios.

Democratizing Investments: Fractionalization through tokenization significantly lowers the barrier to entry for many investments. With smaller investment amounts required, a broader range of individuals can participate in ownership of traditionally high-value assets. This fosters greater financial inclusion and empowers a wider audience to grow.

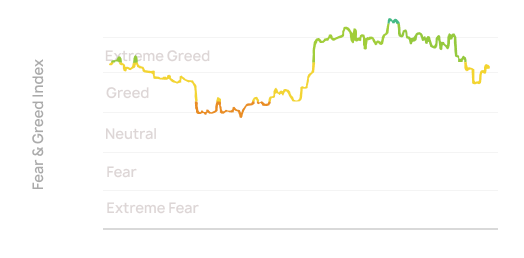

Enhancing Liquidity: RWA tokens can significantly improve the liquidity of traditionally illiquid assets. By creating a secondary market for these fractionalized tokens, people can easily buy and sell their holdings, increasing overall market activity and reducing the time it takes to convert assets to cash.

Boosting Transparency and Efficiency: Blockchain technology underpins RWA tokens, providing a secure and transparent record of ownership and transaction history. This reduces the risk of fraud and errors, streamlines administrative processes, and fosters greater trust in the investment ecosystem.

Facilitating Global Investment: Cryptocurrency markets operate 24/7, eliminating geographical limitations for RWA token trading. Potential investors worldwide can participate in these markets, fostering a more global and interconnected investment landscape.

Introducing Programmability: Smart contracts can be attached to RWA tokens, automating tasks like dividend distribution, voting rights management, and even pre-defined transfer restrictions. This programmable nature introduces greater efficiency and flexibility in managing asset ownership.

Kenson Investments is committed to staying at the forefront of RWA tokenization. We offer our clients with market insights and educating them to explore this exciting investment opportunity.

RWA tokens play a crucial role in bridging the gap between traditional and digital finance. They integrate real-world assets into the crypto ecosystem, offering several advantages:

Blockchain technology streamlines processes associated with asset ownership and trading, reducing costs and transaction times.

Blockchain provides a tamper-proof record of ownership and transaction history, minimizing the risk of fraud and errors.

Crypto markets operate 24/7, allowing for global participation in RWA token trading.

RWA tokens unlock new avenues for investors seeking exposure to diverse asset classes.

A real-world asset is identified for tokenization.

The asset is linked to a digital token on a blockchain platform.

Legal and regulatory requirements are met to ensure compliance with securities laws.

Tokens are distributed to investors and traded on secondary markets.

| Feature | Traditional Securities | RWA Tokens |

|---|---|---|

| Form | Physical certificates or digital records | Digital tokens on a blockchain |

| Underlying Asset | Tangible or intangible assets | Real-world assets |

| Trading Platform | Stock exchanges | Crypto exchanges |

| Settlement Time | T+2 or longer | Near-instantaneous |

| Transparency | Limited transparency | High transparency |

| Fractional Ownership | Limited | Possible through tokenization |

RWA tokens occupy a fascinating space, blurring the lines between traditional securities and the burgeoning world of crypto. While they share some core principles with stocks and bonds, their digital nature unlocks a whole new set of possibilities. Here’s a breakdown of these intriguing characteristics:

Similar to stocks, RWA tokens represent ownership rights or interests in a real-world asset. However, RWA tokens can offer more granular ownership compared to traditional shares. For instance, a single share of a company represents a fraction of its overall ownership, but an RWA token for a piece of real estate could represent a specific portion of the property (e.g., a studio apartment within a building).

Existing on a secure blockchain ledger offers several advantages over traditional paper certificates.

-Enhanced Security: Blockchain technology provides a tamper-proof record of ownership, significantly reducing the risk of fraud or loss compared to physical certificates.

-Improved Efficiency: Transactions involving RWA tokens can be settled almost instantaneously compared tothe T+2 (trade plus 2 business days)

settlement time for traditional securities. -Global Accessibility: Cryptocurrency markets operate 24/7, allowing for global participation in RWA tokentrading, unlike traditional stock exchanges with defined trading hours.

Smart contracts, self-executing programs on the blockchain, can be attached to RWA tokens. These smart contracts can automate various processes associated with the asset, such as:

-Dividend Distribution: Automatically distribute profits or rental income generated by the underlying asset to token holders based on their ownership percentage.

-Voting Rights: Allow token holders to vote on decisions related to the underlying asset, such as property management for real estate tokens.

-Transfer Restrictions: Program specific conditions for transferring tokens, ensuring compliance with regulations or investment strategies.

One of the most transformative aspects of RWA tokens is the ability to fractionalize ownership of an asset. A single, high-value asset like a building or artwork can be divided into numerous tokens, enabling:

-Lower Barriers to Entry: Investors with smaller budgets can participate in ownership of traditionally inaccessible assets.

-Increased Liquidity: Fractionalization creates a larger pool of potential buyers and sellers, increasing the tradability of the asset compared to whole ownership.

-Portfolio Diversification: Investors can use RWA tokens to diversify their portfolios with smaller investments across various asset classes.

The regulatory landscape surrounding RWA tokens is still evolving. Kenson Investments stays up-to-date on these regulations and ensures our clients remain compliant when exploring RWA token opportunities.

While blockchain technology offers enhanced security, the overall ecosystem is relatively new, and vulnerabilities can exist. Kenson Investments prioritizes partnering with reputable platforms and projects to mitigate security risks.

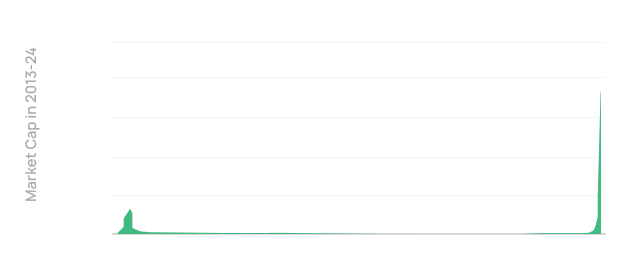

While the RWA token landscape is still evolving, several prominent players are shaping the future of this innovative market. Here’s a quick introduction to some of the frontrunners you’ll encounter:

Ondo:Focuses on tokenizing real-world assets like real estate and providing investors with rental income streams through token ownership.

Mantra (OM):Provides a platform for creating and managing synthetic assets, including RWA-backed tokens, allowing for various investment strategies and risk management tools.

Pendle:Specializes in creating optionable tokens, enabling investors to hedge their RWA token holdings and potentially profit from price fluctuations.

Propy (PRO):Targets the real estate market, offering a platform for tokenizing and fractionalizing ownership of properties, streamlining the buying and selling process.

TokenFi: Provides a comprehensive solution for security token issuance and lifecycle management, catering to businesses looking to tokenize their real-world assets.

Kenson Investments stays informed about the latest developments from these and other key players. We leverage this knowledge to provide our clients with the most up-to-date insights and opportunities in the RWA token market. As your trusted partner, we can help you choose the ones that best align with your investment goals.

Seamlessly connect with Kenson Investments for specialized assistance on your digital asset journey.

Kenson Investments excels in digital asset management, serving high-net-worth individuals and businesses. We prioritize security and transparency, offering tailored solutions for asset management, diversification, and innovative investment opportunities in the expanding digital asset sector.

Disclaimer: The crypto currency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered as financial investment advice. Please consultant your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC including, equities, registered securities, ETFs, stocks, bonds, or equivalents.

Copyright © 2024 Kenson Investments. All Rights Reserved.