Decentralized Finance (DeFi) is a rapidly growing sector within the blockchain and cryptocurrency ecosystem, reshaping the traditional financial landscape by leveraging smart contracts and blockchain technology.

DeFi aims to create an open, permission-less, and decentralized financial system that operates without intermediaries like banks. This transformative approach is built on several key components, including lending, borrowing, and yield farming.

Keep reading as DeFi investment specialists at Kenson Investments explore these crucial aspects, offering insights into their functionality, benefits, and impact on the financial world.

Introduction to DeFi: The Future of Finance

Decentralized Lending

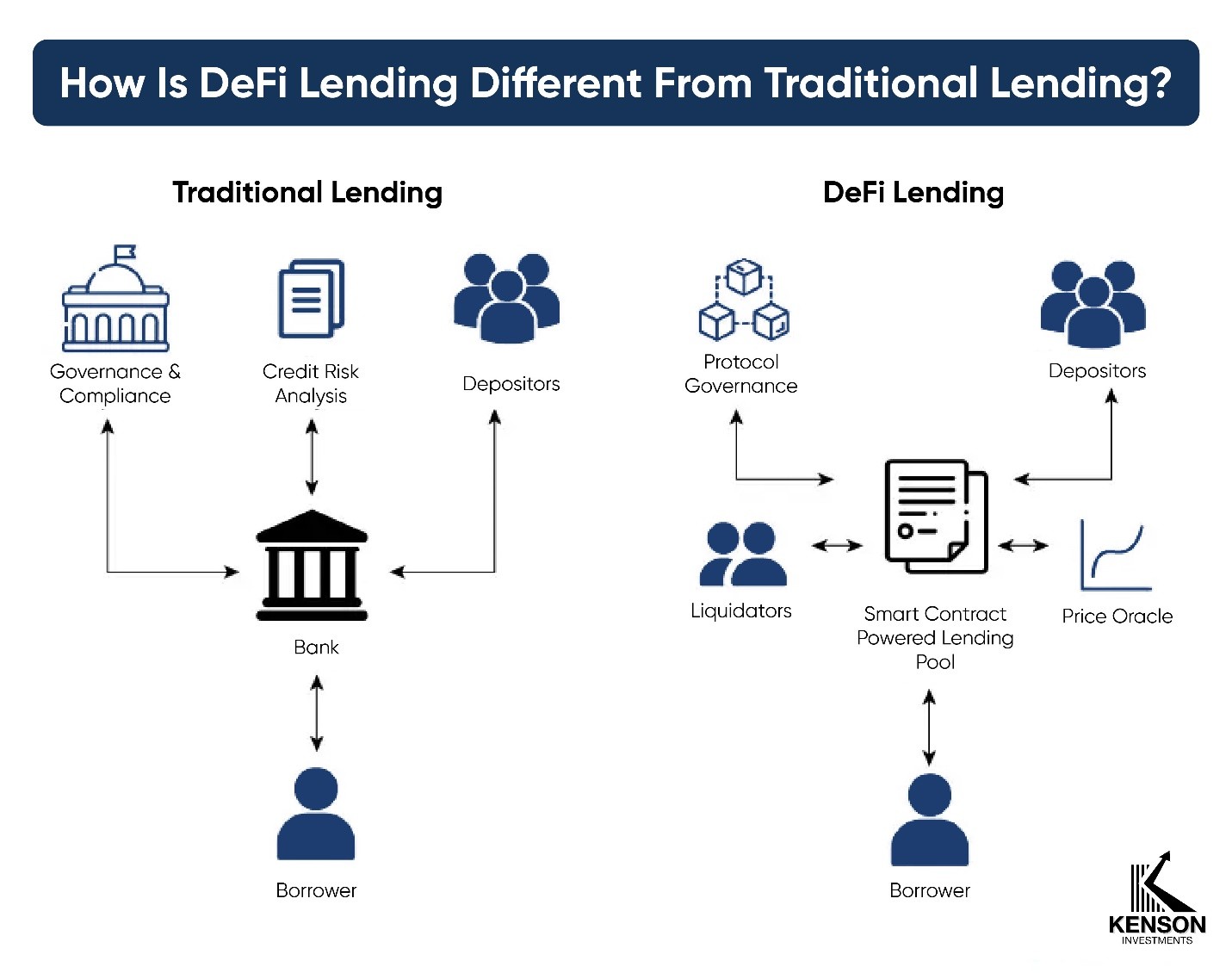

Decentralized lending allows individuals to lend their assets to others in a peer-to-peer manner without the need for traditional financial institutions. This process is facilitated by smart contracts—self-executing contracts with the terms of the agreement directly written into code.

Notably, some platforms offer features such as flash loans—short-term, uncollateralized loans that are repaid within the same transaction block. This innovation opens up new possibilities for arbitrage and other financial strategies.

Here’s an in-depth look at decentralized lending:

How It Works

Smart Contracts: In DeFi lending, smart contracts handle the lending process. Lenders deposit their assets into a liquidity pool, and borrowers can take out loans by providing collateral. The smart contract ensures that terms are met, and loans are repaid.

Collateralization: To mitigate the risk of default, borrowers must provide collateral that exceeds the value of the loan they wish to take. This collateral is held in a smart contract and can be liquidated if the borrower fails to repay the loan.

Interest Rates: Interest rates in decentralized lending platforms are determined algorithmically based on supply and demand. Interest rates rise when there is high demand for borrowing, and when supply exceeds demand, rates decrease.

Benefits

High Yields: DeFi lending platforms often offer higher interest rates than traditional savings accounts. According to a report by DeFi Pulse, annual interest rates can range from 3% to 15%, depending on the platform and asset.

Accessibility: DeFi lending is accessible to anyone with an internet connection and a cryptocurrency wallet. This democratizes access to financial services, especially in regions where traditional banking infrastructure is limited.

Transparency: The use of blockchain technology ensures transparency in all transactions. Users can verify the lending and borrowing activities through blockchain explorers.

Decentralization: DeFi components in lending platforms are decentralized, meaning they are not controlled by any single entity. This reduces the risk of censorship and enhances financial sovereignty.

Efficiency: Traditional lending processes can be slow and bureaucratic. DeFi lending platforms offer faster and more efficient loan processing due to their automated nature.

Risks and Challenges

Smart Contract Vulnerabilities: Bugs or vulnerabilities in smart contracts can lead to potential losses. For example, in 2020, the “bZx hack” exploited vulnerabilities in the protocol, resulting in significant losses.

Volatility: Cryptocurrency prices can be highly volatile, which can affect the value of collateral and the stability of lending rates.

| Platforms like Aave, Compound, and MakerDAO are among the leading DeFi lending platforms, each offering unique features and benefits to users.

|

Decentralized Borrowing

DeFi borrowing has seen significant growth, with the total amount borrowed across DeFi platforms reaching over $25 billion in 2024. Borrowing protocols within DeFi enable users to access funds by providing collateral, often in the form of cryptocurrencies or stablecoins. These protocols are designed to be trustless, meaning they operate without relying on a central authority.

They use automated mechanisms to manage collateral and enforce repayment, including liquidation procedures to handle defaults. This system provides greater accessibility to credit, particularly for those who might be excluded from traditional financial systems, and often offers more favorable terms compared to traditional banks.

Key Steps

Collateral Requirements: Borrowers must deposit assets as collateral into a smart contract. The amount of collateral required usually exceeds the loan amount, creating a buffer for lenders.

Loan Terms: The terms of the loan, including interest rates and repayment schedules, are defined by the smart contract. Borrowers need to adhere to these terms to avoid liquidation. Once the collateral is submitted, borrowers can take out a loan. The amount borrowed is typically a fraction of the collateral value.

Repayment: Borrowers must repay the loan along with interest. Failure to repay results in the liquidation of collateral to recover the loan amount.

Benefits

Liquidation: If the value of the collateral falls below a certain threshold, the smart contract automatically liquidates the collateral to cover the loan, protecting lenders from defaults.

No Credit Checks: DeFi borrowing does not require credit checks, making it accessible to individuals with poor or no credit history.

Global Reach: DeFi borrowing is available globally, allowing users from different countries to access funds without geographical restrictions.

Flexibility: Borrowers can choose the terms of their loans, including interest rates and repayment schedules, which are determined by the market dynamics of the lending platform.

Risks and Challenges

Liquidation Risk: If the value of the collateral falls below a certain threshold, the collateral may be liquidated to cover the loan, potentially resulting in loss of assets.

Over-Collateralization: Borrowers are required to provide more collateral than the loan amount, which can be a barrier for those who do not hold significant cryptocurrency assets.

Platform Risk: Different lending platforms have varying degrees of security and reliability. Choosing a reputable platform is crucial to avoid potential losses.

| Leading platforms for decentralized borrowing include Aave and Compound, which offer competitive borrowing rates and a range of supported assets.

|

Yield Farming

Yield farming, also known as liquidity mining, involves providing liquidity to DeFi protocols in exchange for rewards. This process incentivizes users to supply their assets to liquidity pools, which are used for various DeFi activities such as lending and trading.

How It Works

Liquidity Pools: Users deposit their assets into liquidity pools, which are used to facilitate trading or lending activities on DeFi platforms. In return, they receive liquidity provider (LP) tokens representing their share of the pool.

Yield Generation: Yield farmers earn rewards in the form of additional tokens. These rewards come from the fees generated by the liquidity pool or from the issuance of new tokens by the DeFi protocol.

Impermanent Loss: A risk associated with yield farming is impermanent loss, which occurs when the value of assets in the liquidity pool changes relative to the value of assets outside the pool.

Benefits

High Returns: Yield farming can offer high returns compared to traditional investment options. According to DeFi Rate, annual percentage yields (APYs) can range from 5% to over 100%, depending on the platform and asset.

Incentives for Participation: Yield farming incentivizes users to provide liquidity by offering attractive rewards. This helps improve the liquidity and efficiency of DeFi protocols.

Diversification: Yield farming allows users to diversify their investments across different assets and protocols, potentially reducing risk and increasing returns.

Smart Contract Risks: Yield farming relies on smart contracts, which can be vulnerable to bugs or exploits. For example, the “Yearn finance hack” in 2020 exploited a vulnerability in a yield farming strategy, resulting in significant losses.

Complexity: Yield farming strategies can be complex and require careful management of assets and rewards. Inexperienced users might struggle to navigate the various protocols and maximize returns.

| Popular yield farming platforms include Uniswap, SushiSwap, and Yearn. finance, each offering unique opportunities for yield generation. |

The Interconnectedness of DeFi Components

Lending, borrowing, and yield farming are deeply interconnected within the DeFi ecosystem. The availability of lending and borrowing services creates liquidity pools that are essential for yield farming. Borrowers access these funds by providing collateral and yield farmers contribute to the liquidity of these pools to earn rewards. As more users participate in these activities, the overall liquidity of the platform increases, leading to potentially higher returns for lenders and borrowers.

You May Also Like: Being the Change: The Future of DeFi Investments

Challenges and Considerations

While DeFi offers numerous advantages, it also presents challenges:

- Market Volatility: The cryptocurrency market is highly volatile, impacting the value of assets used as collateral.

- Smart Contract Risks: Bugs or vulnerabilities in smart contracts could lead to significant losses.

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving, creating legal and compliance risks.

Stay Ahead of DeFi Trends with Kenson Investments

Stay updated with the latest trends and developments in DeFi components by partnering with Kenson Investments. Our team provides timely updates and actionable insights on digital asset portfolio management, cryptocurrency investment solutions, stablecoins for investment, and altcoin investment to help you stay ahead of the curve. Register now for exclusive content and personalized strategies for navigating the evolving DeFi landscape.

Disclaimer: “The cryptocurrency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC including, equities, registered securities, ETFs, stocks, bonds, or equivalents”