In the rapidly evolving landscape of digital asset trading, smart contracts have emerged as a revolutionary tool. These self-executing contracts encoded on blockchain technology facilitate secure and automated transactions without the need for intermediaries.

Mastering smart contract development for derivatives trading is essential for those seeking to navigate this dynamic space effectively. In this blog, we delve into the fundamentals of smart contracts, their development process, and their pivotal role in automating transactions securely.

Understanding Smart Contracts in Digital Asset Trading

Smart contracts are self-executing contracts and they operate on blockchain platforms like Ethereum, utilizing the decentralized nature of blockchain technology to execute transactions automatically. In digital asset trading, smart contracts enable the creation and execution of various financial instruments, including derivatives, with excellent efficiency.

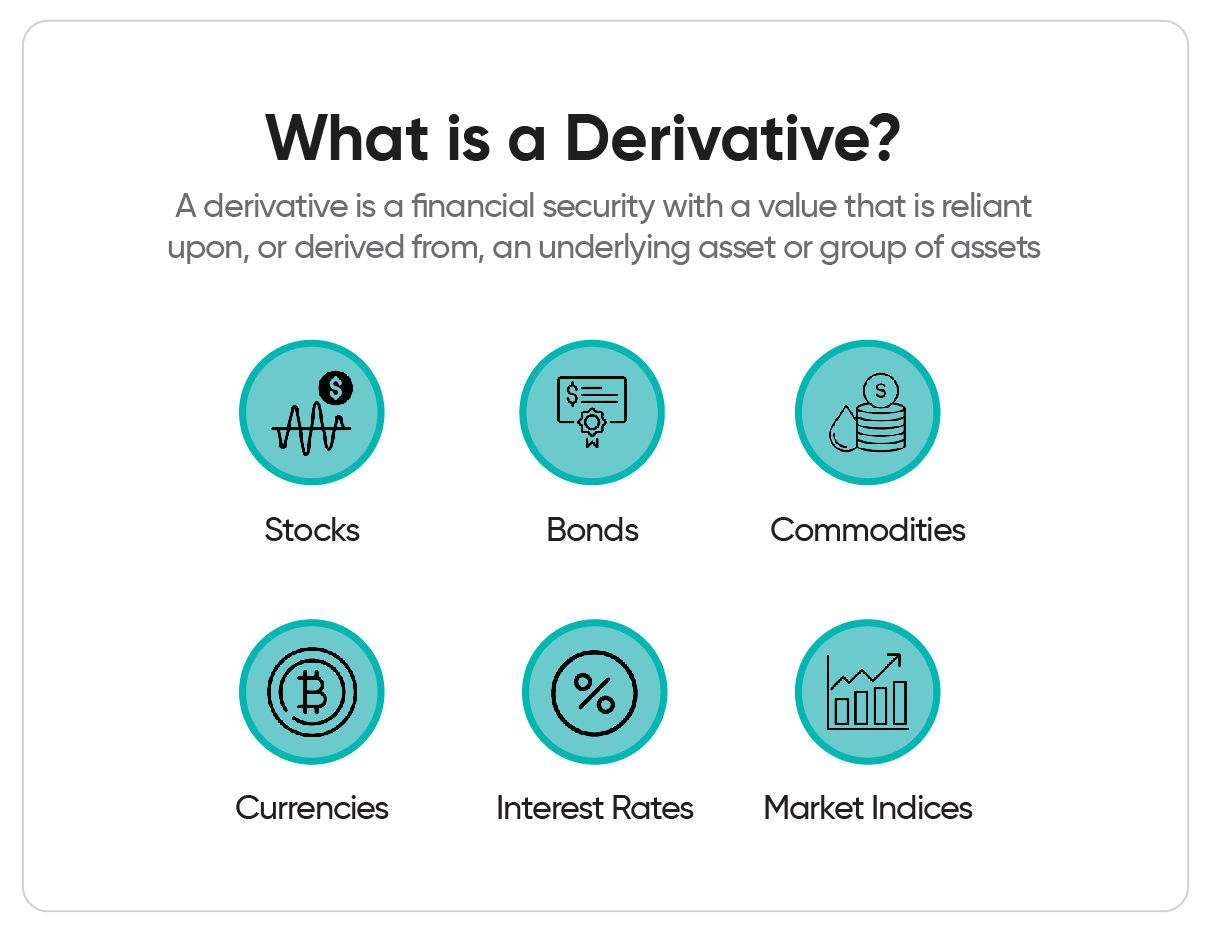

Derivatives trading involves contracts whose value derives from the performance of an underlying asset like cryptocurrencies. Traditional derivatives markets often suffer from inefficiencies and lack of transparency. Fortunately, smart contracts address these challenges by automating trade settlement, eliminating the need for intermediaries, and providing transparent record-keeping.

The Development Process of Smart Contracts

Developing smart contracts for derivatives trading requires a solid understanding of blockchain technology and the specific requirements of the derivatives market. Below are the key steps involved in the development process:

- Identifying requirements: Begin by clearly defining the requirements of the derivative contract, including the underlying asset, contract terms, and any other relevant parameters. Thoroughly understanding the needs of market participants is crucial for designing effective smart contracts.

- Selecting the blockchain platform: Select a suitable blockchain platform for deploying the smart contract. Ethereum remains the dominant choice for smart contract development because of its robust ecosystem and large developer community.

- Writing smart contract code: Build the code for the smart contract using a programming language supported by the chosen blockchain platform. Ensure that the code is well-tested and audited to mitigate potential vulnerabilities.

- Testing and deployment: Thoroughly test the smart contract under various conditions to ensure its functionality and compliance with the specified requirements. Once testing is complete, deploy the contract to the chosen blockchain network.

- Integration with trading platforms: Integrate the smart contract with trading platforms or decentralized exchanges (DEXs) where derivatives trading will take place. This integration facilitates the seamless execution of trades and ensures interoperability with other financial products.

Role of Smart Contracts in Automating Transactions Securely

Smart contracts play a crucial role in automating transactions securely in derivatives trading. Here are some key aspects of their functionality:

- Automated trade execution: Smart contracts enable automated execution of trades based on predefined conditions like price triggers. This eliminates the need for manual intervention and decreases the risk of errors in trade execution.

- Transparent record-keeping: Transactions executed through smart contracts are recorded on the blockchain, providing a transparent audit trail of all trades. This enhances trust in the derivatives market by ensuring that transaction history is verifiable by all parties.

- Elimination of counterparty risk: By operating as self-executing contracts, smart contracts eliminate counterparty risk associated with traditional derivatives trading. Once the conditions of the contract are met, the execution of the trade is irreversible, reducing the chances of disputes.

- Cost Savings: Smart contracts streamline the derivatives trading process by removing intermediaries. This improves operational efficiency and reduces costs associated with manual processes.

Overcoming Challenges and Considerations in Smart Contract Development

While smart contracts offer numerous benefits for derivatives trading, developers must also be mindful of potential challenges:

- Security vulnerabilities: Smart contracts are susceptible to security vulnerabilities, including coding errors, design flaws, and external exploits. Developers must conduct thorough code audits, employ best practices in secure coding, and stay updated on emerging cyber threatsto mitigate these risks effectively.

- Scalability and performance: Scalability remains a significant challenge for blockchain networks. As the volume of transactions increases, congestion on the blockchain can lead to delays and higher transaction fees. Developers must consider alternative blockchain platforms with better output to ensure optimal performance for derivatives trading.

- Regulatory compliance: The regulatory landscape surrounding derivatives trading and blockchain technology is continually evolving. Developers must navigate complex regulatory requirements, including licensing and investor protection, to ensure compliance with applicable laws.

Future Trends and Innovations in Smart Contract Development In Derivatives Trading

Looking ahead, several trends and innovations are shaping the future of smart contract development for derivatives trading:

- Interoperability and standards: Interoperability between different blockchain platforms and standards for smart contract development are crucial for promoting seamless integration and interoperability across decentralized finance (DeFi) ecosystems.

- Decentralized networks: Decentralized oracle networks play a crucial role in providing external data to smart contracts, enabling them to execute based on real-world events. Integrating decentralized oracle networks into derivatives trading smart contracts enhances their reliability and accuracy, reducing the reliance on centralized data sources and mitigating the risk of market manipulation.

Connect With Our Investment Experts To Understand Smart Contracts In Derivatives Trading

At Kenson Investments, we offer excellent digital asset consulting services for our investors. As a leading digital asset strategy consulting firm, we specialize in providing customized solutions to improve your investment portfolio. Our team of experts excels in blockchain and digital asset consulting, assisting you in navigating the complexities of the digital asset market.

You can contact us for more details.

Disclaimer: The content provided on this blog is for informational purposes only and should not be construed as financial advice. The information presented herein is based on personal opinions and experiences, and it may not be suitable for your individual financial situation. We strongly recommend consulting with a qualified financial advisor or professional before making any financial decisions. Any actions you take based on the information from this blog are at your own risk.