Introduction

The Evolution of Finance

The financial sector has undergone a fascinating metamorphosis over the centuries, shedding its rudimentary beginnings in barter systems for the intricate web of financial markets that underpins the global economy today. In the earliest days of commerce, people exchanged goods and services directly – a farmer might trade a sack of wheat for a blacksmith’s crafted tools. This simple system, however, proved increasingly restrictive as societies grew more complex.

Traditional finance (TradFi), as it came to be known, emerged to address these limitations. Brick-and-mortar institutions like banks and brokerage houses became the central nervous system of financial activity. These intermediaries played a crucial role in facilitating transactions – a bank, for instance, could connect a business seeking capital for expansion with an investor looking to grow their wealth. They also took on the responsibility of managing risk by assessing the creditworthiness of borrowers and mitigating potential losses. Additionally, TradFi institutions provided liquidity, ensuring there was always enough money readily available in the system to keep transactions flowing smoothly.

Despite its undeniable contributions, TradFi has faced growing criticism in recent years. Concerns have been raised about inherent inefficiencies within the system. Layers of intermediaries can lead to cumbersome processes and slow transaction times. Furthermore, these traditional institutions often charge hefty fees for their services, making financial products and services less accessible to certain segments of the population. Perhaps the most significant criticism centers around a perceived lack of transparency. The complex nature of TradFi products and the opacity surrounding certain financial instruments can leave both borrowers and lenders feeling vulnerable to hidden risks and unfair practices. These shortcomings have paved the way for the emergence of innovative financial technologies, collectively known as Fintech, which promise to revolutionize the way we interact with money.

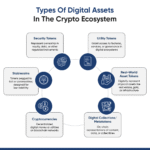

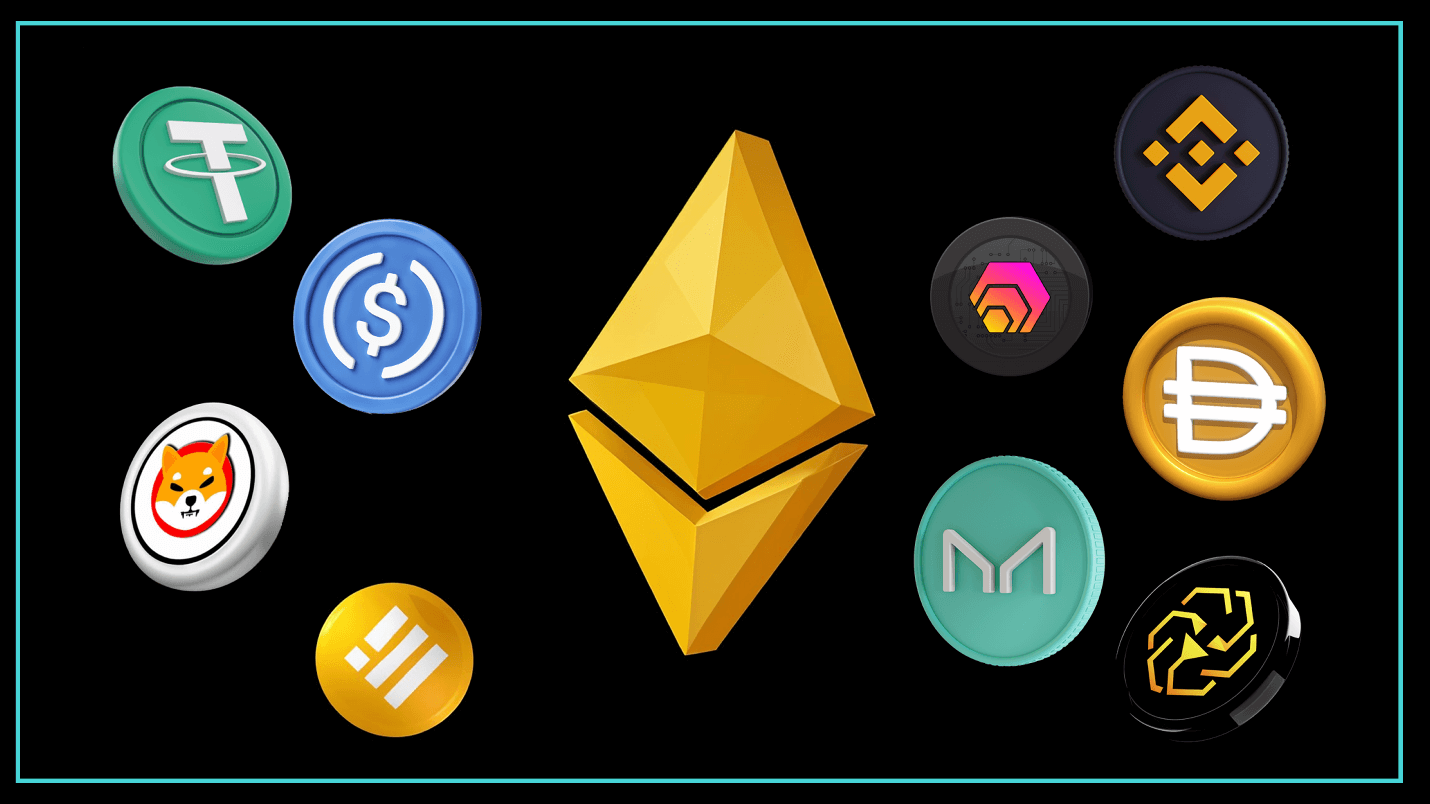

Enter the realm of digital assets and decentralized finance (DeFi). This new frontier presents a world of exciting possibilities for interested individuals and businesses alike. However, navigating this complex landscape can be daunting, especially for those unfamiliar with the intricacies of blockchain technology, stablecoins, and altcoin investment options. This is where global digital asset consulting firms and blockchain asset investment consultants come in. These specialized firms offer a comprehensive suite of services, including defi finance consulting services, digital asset strategy consulting, and digital asset consulting for startups. Their expert teams can guide clients through the entire process, from developing a digital asset investment strategy to cryptocurrency investment consultation and digital asset portfolio management.

Digital asset consulting for compliance is another crucial area of expertise. As regulatory frameworks around digital assets continue to evolve, partnering with a firm that can navigate the complexities of compliance can help ensure your investments are on solid ground. Whether you’re a seasoned investor seeking real world asset tokenization investment consultants or a startup exploring the potential of defi real world assets investment, these firms offer the knowledge and experience to help you achieve your financial goals.

The digital asset landscape also encompasses a burgeoning world of Security token investments and non-fungible tokens (NFTs). Consulting firms with expertise in NFT portfolio management and digital asset management services can empower you to make informed decisions about these innovative asset classes.

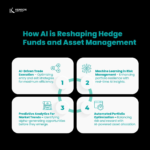

For those seeking a more traditional approach, some firms offer services akin to hedge funds, providing crypto investment company solutions and investment analysis and portfolio management tailored to the digital asset space. The spectrum of options extends to crypto asset management, with dedicated firms specializing in managing crypto portfolios on behalf of their clients.

Ultimately, the digital asset revolution presents a wealth of opportunities for those seeking alternative investment avenues. By partnering with a reputable digital asset management consultant or a global digital asset consulting firm, you can gain the knowledge and guidance necessary to navigate this dynamic and rapidly evolving market.

The Emergence of Blockchain Technology

The financial sector, once a slow-moving giant reliant on brick-and-mortar institutions, has been jolted awake by the emergence of blockchain technology. Introduced in 2009 with the birth of Bitcoin, blockchain wasn’t just a new cryptocurrency – it was a revolutionary concept poised to reshape how we interact with value. Unlike traditional financial systems riddled with intermediaries and opaque processes, blockchain offered a compelling alternative: a decentralized, transparent, and immutable ledger. This distributed database technology promised to streamline transactions, eliminate the need for trusted third parties, and significantly reduce friction within various industries.

One of the core strengths of blockchain lies in its very structure. Imagine a giant, constantly updated record book, not housed in a single bank vault but replicated and distributed across a vast network of computers around the world. Every new transaction – a payment made, a contract signed – is added as a new block to this ever-growing chain, creating an immutable record that cannot be tampered with. This transparency fosters trust, eliminates the risk of fraud, and empowers all participants to verify the legitimacy of transactions in real-time.

Further amplifying this revolution was the introduction of smart contracts by the Ethereum blockchain in 2015. These self-executing agreements, essentially lines of code stored on the blockchain, eliminate the need for intermediaries like lawyers or brokers. When pre-defined conditions are met, the smart contract automatically executes the terms of the agreement, removing human error and streamlining complex processes.

The implications for traditional finance were vast. Suddenly, the possibility of secure, automated transactions without the involvement of banks or other financial institutions became a reality. This paved the way for innovative financial instruments and a new wave of financial inclusion.

However, the true potential of blockchain extends far beyond just cryptocurrencies. Let’s delve deeper into a specific application that’s transforming the way we view and interact with assets:

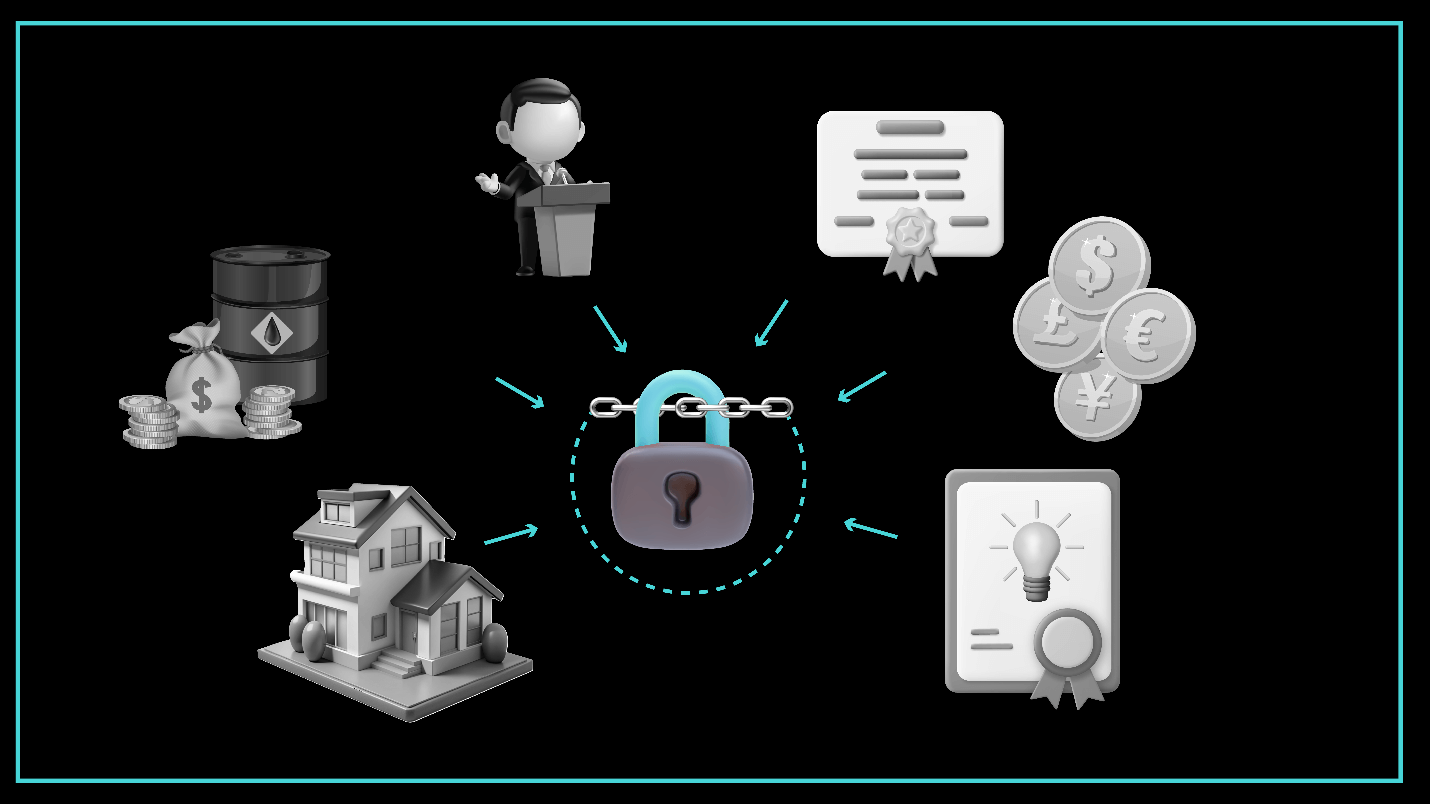

Real-world asset tokenization (RWAT) represents a fascinating marriage between traditional assets and the innovative world of blockchain. Imagine converting a piece of real estate, a fraction of a valuable painting, or even a share in a company into a digital token. This is precisely what RWAT allows us to do. By creating digital tokens representing ownership or a stake in a real-world asset, RWAT unlocks a treasure trove of possibilities:

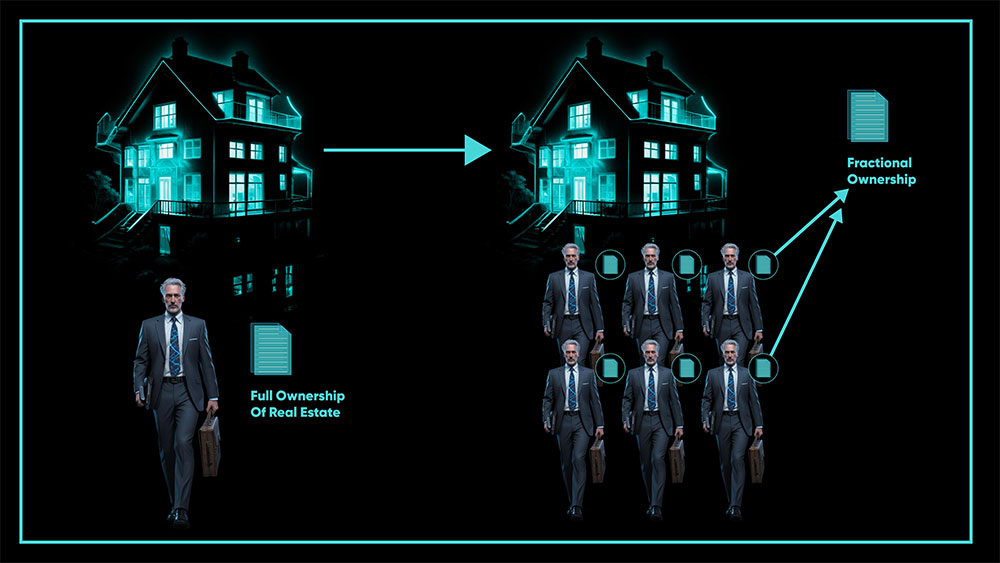

Fractional Ownership: Traditionally, owning a high-value asset like real estate or a rare piece of art has been restricted to those with substantial wealth. RWAT breaks down these barriers by enabling fractional ownership. An expensive property can be divided into smaller digital tokens, allowing multiple interested individuals to own a piece of the asset. This opens doors for a wider range of interested individuals to participate in previously inaccessible asset classes.

Increased Liquidity: Traditional assets like real estate can be notoriously illiquid. Selling a property often involves a lengthy and complex process. RWAT tokens, however, can be easily traded on digital marketplaces, significantly increasing the liquidity of the underlying asset. This allows interested individuals to enter and exit positions more readily, fostering a more dynamic market.

Enhanced Transparency and Efficiency: Blockchain technology’s inherent transparency extends to RWAT. All ownership records and transaction history are immutably stored on the blockchain, providing a clear audit trail and reducing the risk of fraud. Additionally, smart contracts can automate various aspects of asset management, streamlining processes and reducing administrative costs.

Global Investment Opportunities: RWAT transcends geographical boundaries. Digital tokens representing real-world assets can be traded on global platforms, opening doors for interested individuals from around the world. This allows for a more diversified investment portfolio and the potential for higher returns.

The impact of RWAT is not limited to interested individuals. Businesses can leverage this technology to raise capital more efficiently by issuing asset-backed tokens. This can be particularly beneficial for startups and small businesses seeking alternative financing options. Additionally, RWAT can enhance operational efficiency in various industries, such as supply chain management and trade finance.

However, RWAT is still in its nascent stages, and there are challenges to address. Regulatory frameworks around digital assets are still evolving, and investor protection needs to be carefully considered. Additionally, ensuring the proper valuation and underlying asset custody remains crucial.

Despite these challenges, the potential of RWAT to revolutionize traditional finance is undeniable. By leveraging the power of blockchain technology, RWAT offers a glimpse into a future where ownership is democratized, markets are more efficient, and global investment opportunities are readily accessible.

The Role of Digital Asset Consulting Firms in the RWAT Landscape

As the RWAT ecosystem continues to evolve, the need for expert guidance becomes increasingly important. This is where digital asset consulting firms with expertise in real world asset tokenization investment come into play. These firms offer a range of services, including:

RWAT feasibility studies: Helping businesses assess the suitability of their assets for tokenization and developing a strategic roadmap for implementation.

Regulatory compliance guidance: Navigating the complex legal landscape surrounding RWAT and ensuring compliance with evolving regulations.

Smart contract development: Creating secure and efficient smart contracts to automate various aspects of asset management and tokenized transactions.

Marketing and investor outreach: Developing strategies to attract interested individuals and ensure successful token offerings.

By partnering with a reputable digital asset consulting firm, businesses and interested individuals can navigate the intricacies of RWAT with confidence, unlocking the full potential of this transformative technology.

2. Understanding Real-World Asset Tokenization

Definition and Key Concepts

The financial landscape is undergoing a seismic shift fueled by innovation. At the forefront of this transformation lies asset tokenization, a revolutionary concept poised to redefine how we interact with and own assets. In essence, asset tokenization involves the creation of digital tokens on a blockchain that represent real-world assets. These tokens, akin to digital certificates of ownership, unlock a new realm of possibilities for both interested individuals and asset owners.

Let’s delve deeper into the core concepts that underpin this transformative technology:

Digital Tokens: Imagine a secure, tamper-proof digital representation of an asset – a piece of real estate, a share in a company, or even a rare work of art. This is precisely what a digital token is. These tokens, residing on a blockchain, function as units of ownership or value. They can be easily divided, traded on digital marketplaces, and offer a level of granularity that traditional asset ownership often lacks. For instance, a multi-million-dollar property can be fragmented into smaller, more manageable digital tokens, enabling fractional ownership.

Smart Contracts: Think of a self-executing agreement, a set of pre-defined rules encoded directly on the blockchain. These are smart contracts, the invisible workhorses that automate various aspects of asset management and tokenized transactions. When predetermined conditions are met (e.g., a specific payment is received), the smart contract automatically executes the terms of the agreement, eliminating the need for manual intervention or intermediaries. This not only streamlines processes but also reduces the risk of errors and fraud associated with traditional methods.

Fractional Ownership: Traditionally, owning high-value assets has been the exclusive domain of the wealthy. A luxurious beachfront property or a coveted piece of contemporary art might be out of reach for most interested individuals. Asset tokenization disrupts this paradigm by enabling fractional ownership. By dividing the asset into smaller digital tokens, multiple interested individuals can collectively own a portion of the underlying asset. This opens doors for a broader investor base to participate in previously inaccessible asset classes, fostering a more inclusive and dynamic financial ecosystem.

Types of Real-World Assets That Can Be Tokenized

A Tokenized World: Unveiling the Potential of Real-World Asset Tokenization

The financial world is on the cusp of a paradigm shift. Asset tokenization, a revolutionary concept empowered by blockchain technology, is poised to reshape how we interact with and own the things that hold value. By creating digital tokens on a blockchain that represent real-world assets, asset tokenization unlocks a universe of possibilities for both traditional asset owners and aspiring interested individuals.

This transformative technology transcends geographical borders and transcends traditional asset classes. Let’s explore the vast array of real-world assets that can be tokenized, venturing beyond the typical and into the realm of exciting possibilities:

Real Estate

From towering skyscrapers in bustling metropolises to cozy cabins nestled amidst serene landscapes, real estate has traditionally been a cornerstone of asset portfolios. Asset tokenization opens a new chapter for this asset class. Residential properties, be it single-family homes, sprawling apartment complexes, or student housing units, can be divided into tradable digital tokens, enabling fractional ownership. This democratizes access to real estate investment, allowing individuals with smaller investment capital to participate in a market previously reserved for high-net-worth individuals. Similarly, commercial properties like office buildings, shopping malls, and industrial warehouses can be tokenized, facilitating more efficient investment in these assets.

Consultancy for defi finance investments and blockchain asset investments consultant services can provide valuable insights into navigating this evolving landscape.

Commodities

The backbone of global trade, commodities like gold, oil, and agricultural products have long held a place of importance in the financial ecosystem. Traditionally, investing in commodities has often involved complex contracts and high barriers to entry. Asset tokenization offers a more accessible alternative. By creating digital tokens representing ownership or a stake in a particular commodity, interested individuals can gain exposure to these markets with greater ease. Imagine easily buying a token representing a fraction of a barrel of oil or owning a piece of a virtual gold bar – all through a secure digital platform.

Digital asset strategy consulting firms and global digital asset consulting firms are at the forefront of helping interested individuals understand and capitalize on these opportunities. Blockchain and digital asset consulting can guide interested individuals through the complexities of tokenizing commodities.

Art and Collectibles

The world of art and collectibles, encompassing everything from priceless masterpieces by renowned artists to rare baseball cards and vintage automobiles, has always held a certain allure. However, investing in these passion assets has traditionally been limited to a select group of high-value collectors. Asset tokenization is poised to change this narrative. By tokenizing paintings, sculptures, or even entire art collections, ownership can be fragmented into smaller digital tokens. This opens doors for a broader audience to participate in this asset class, allowing them to invest in a piece of coveted artwork or own a fraction of a valuable vintage car.

Digital asset consulting for startups and compliance ensures that interested individuals can navigate regulatory landscapes while participating in these unique investment opportunities. Bitcoin investment consultants and digital asset investment solutions offer tailored advice for incorporating these tokenized assets into diversified portfolios.

Financial Instruments

The traditional financial landscape thrives on a complex web of financial instruments like crypto stocks, bonds, and crypto derivatives. Asset tokenization can revolutionize this domain as well. Imagine a world where shares of a company or ownership units in a private equity fund are represented by digital tokens. This could streamline investment processes, reduce settlement times, and potentially increase access to a wider pool of interested individuals for these financial instruments. Additionally, tokenized derivatives could introduce greater transparency and efficiency to the complex world of financial contracts.

Digital asset management consultants and firms specializing in digital assets consulting can provide expertise in managing and investing in these tokenized financial instruments. Digital asset portfolio management and altcoin investment options offer diversified strategies for modern interested individuals. Cryptocurrency investment solutions and stablecoins for investment further enhance the flexibility and security of tokenized financial assets.

Real World Assets

Real asset tokenization investment consultants and real-world assets on-chain investment consultants are crucial in bridging the gap between traditional assets and blockchain technology. Defi real-world assets investment consultants and security tokens investment consultants are leading the charge in leveraging decentralized finance for real-world asset investments.

As we step into this tokenized world, digital asset management companies and crypto investment firms provide the necessary guidance and infrastructure to navigate this complex yet promising landscape. With the support of portfolio management consultants and digital asset consulting services, interested individuals can harness the full potential of real-world asset tokenization.

The Tokenization Process

The transformative potential of asset tokenization hinges on a carefully orchestrated process. While the specifics may vary depending on the chosen asset class and regulatory environment, the core stages typically involve:

- Asset Identification and Selection: The journey begins with a meticulous evaluation of the asset. Not all assets are well-suited for tokenization. Factors like divisibility, liquidity, and regulatory considerations play a crucial role in this initial phase. Digital asset consulting firms with expertise in real world asset tokenization investment can provide invaluable guidance during this stage. They can help assess the asset’s suitability for tokenization, considering factors such as the underlying value, potential investor interest, and the legal and regulatory landscape surrounding the specific asset class.

- Legal Structuring and Regulatory Compliance: The world of finance is a complex web of regulations. Before embarking on the tokenization journey, ensuring compliance with relevant regulations is paramount. This may involve establishing a legal framework for the token issuance, defining the rights and obligations associated with the tokens, and navigating tax implications. Reputable digital asset consulting firms can provide regulatory compliance guidance, helping businesses navigate the evolving legal landscape and ensure their tokenization strategy adheres to all applicable regulations.

- Token Creation and Smart Contract Development: Once the legal groundwork is laid, it’s time to translate the real-world asset into its digital equivalent. This involves choosing a suitable blockchain platform and creating the digital tokens themselves. These tokens reside on the blockchain, a secure and distributed ledger system, ensuring the immutability and transparency of ownership records. Additionally, smart contracts are often programmed to automate various aspects of the tokenized asset’s lifecycle. These self-executing contracts can manage tasks such as dividend distribution, voting rights, and token redemption, streamlining processes and reducing reliance on manual intervention. Digital asset consulting firms with expertise in smart contract development can play a crucial role in this stage, ensuring the creation of secure and efficient smart contracts that govern the tokenized asset’s behavior.

- Token Distribution and Investor Outreach: With the digital tokens minted and the smart contracts in place, the next step is getting them into the hands of interested individuals. This may involve conducting an initial token offering (ITO) or listing the tokens on secondary market exchanges. Developing a marketing and investor outreach strategy is crucial to attract potential interested individuals and ensure a successful token offering. Digital asset consulting firms can assist with this aspect as well, helping businesses craft a compelling narrative for their tokenized asset and develop effective strategies to reach their target audience.

- Secondary Market Trading and Liquidity Management: A key advantage of asset tokenization lies in its ability to enhance liquidity. Unlike traditional assets that can be cumbersome to trade, tokenized assets can be easily bought and sold on secondary market exchanges. This fosters a more dynamic and efficient market environment. Digital asset consulting firms can also provide guidance on liquidity management strategies, helping businesses ensure there are enough buyers and sellers in the market to facilitate smooth trading of their tokenized assets.

3. Technical Aspects of Asset Tokenization

Asset tokenization isn’t magic; it’s a carefully orchestrated interplay of innovative technologies. At the heart of this transformation lies blockchain technology, a revolutionary distributed ledger system that provides the secure and transparent foundation upon which tokenization thrives. Imagine a giant, constantly updated record book, not housed in a single bank vault but replicated and distributed across a vast network of computers around the world. Every new transaction – a token created, transferred, or redeemed – is added as a new block to this ever-growing chain, creating an immutable record. This transparency fosters trust and eliminates the risk of fraud or manipulation, making it ideal for recording ownership and managing tokenized assets.

Consultancy for defi finance investments and blockchain asset investments consultant services can play a crucial role in helping interested individuals navigate this intricate ecosystem.

Smart contracts add another layer of efficiency and automation to the tokenization process. These self-executing agreements, essentially lines of code stored on the blockchain, eliminate the need for intermediaries like lawyers or brokers. When pre-defined conditions are met (e.g., a specific token payment is received), the smart contract automatically executes the terms of the agreement, streamlining processes and reducing the risk of errors associated with manual intervention. Imagine a piece of real estate being fractionalized into tokens – a smart contract can be programmed to automatically distribute rental income proportionally to all token holders, eliminating the need for manual calculations and disbursements.

For effective deployment of smart contracts and tokenization processes, defi finance consulting services and stablecoin investment consultants can provide valuable insights.

However, for this intricate ecosystem to function seamlessly, standardized protocols are essential. Enter token standards, a set of guidelines that define how tokens interact with each other and with blockchain platforms. These standards ensure compatibility and interoperability, allowing tokens issued on one platform to potentially be traded on another. Here are some of the most common token standards:

ERC-20

This widely adopted standard, native to the Ethereum blockchain, defines the rules for fungible tokens. Fungible tokens, like shares of a company stock or units of a cryptocurrency, are essentially interchangeable – one token is equal to any other token of the same type. The ERC-20 standard streamlines the creation and trading of these fungible tokens on the Ethereum network.

Digital asset strategy consulting firms and global digital asset consulting firms can offer strategic advice on leveraging ERC-20 tokens for diverse investment portfolios.

ERC-721

Unlike fungible tokens, non-fungible tokens (NFTs) are unique and irreplaceable. Each NFT represents a one-of-a-kind digital asset, like a piece of digital art or a rare collectible. The ERC-721 standard, another Ethereum-based innovation, defines the properties and functionalities of NFTs, enabling secure ownership and trading of these unique digital assets.

For businesses and startups exploring NFT opportunities, digital asset consulting for startups and blockchain asset consulting services are invaluable resources.

ERC-1155

This versatile standard takes things a step further by allowing for the creation of multi-token contracts. Imagine a single contract containing both fungible and non-fungible tokens – a scenario well-suited for representing ownership in a video game, where players might own fungible tokens representing in-game currency and non-fungible tokens representing unique characters or items. The ERC-1155 standard facilitates the creation and management of these hybrid token contracts.

For compliance and regulatory guidance in managing multi-token contracts, digital asset consulting for compliance and blockchain and digital asset consulting firms provide essential support.

Security and privacy are paramount considerations in the world of asset tokenization. After all, we’re dealing with the representation of valuable assets on a digital platform. Here are some key security measures employed:

Cryptographic Security

Advanced cryptographic algorithms are used to ensure the integrity and confidentiality of transactions on the blockchain. These algorithms make it virtually impossible to tamper with transaction data or forge tokens, safeguarding the security of the entire system.

Bitcoin investment consultants and digital asset investment solutions can provide expert advice on implementing robust cryptographic security measures.

Multi-Signature Wallets

An extra layer of security can be achieved through the use of multi-signature wallets. These wallets require multiple approvals before a transaction can be executed, minimizing the risk of unauthorized access or fraudulent activity. Imagine a company holding digital tokens representing a property – a multi-signature wallet might require approval from multiple authorized personnel before any tokens can be transferred or redeemed.

Digital asset management consultants and firms specializing in digital assets consulting can help implement and manage multi-signature wallets for enhanced security.

Privacy Solutions

While blockchain technology offers transparency in terms of transaction records, it doesn’t necessarily reveal the identities of the parties involved. Techniques like zero-knowledge proofs allow for the verification of information without actually revealing the underlying data. This can be beneficial for certain types of asset tokenization where investor privacy might be a concern.

Digital asset portfolio management and altcoin investment options offer diversified strategies for modern interested individuals, ensuring privacy and security.

Interoperability and scalability are two additional challenges that need to be addressed for the widespread adoption of asset tokenization. Imagine a world where tokens representing real estate can only be traded on one specific platform – this would limit liquidity and hinder market growth. Here’s how the industry is tackling these challenges:

Cross-Chain Protocols

These innovative solutions allow assets to move seamlessly across different blockchain networks. This fosters interoperability, enabling tokens issued on one platform to be traded on another, ultimately creating a more dynamic and interconnected tokenized asset ecosystem.

Cryptocurrency investment solutions and stablecoins for investment provide flexible and secure options for cross-chain asset management.

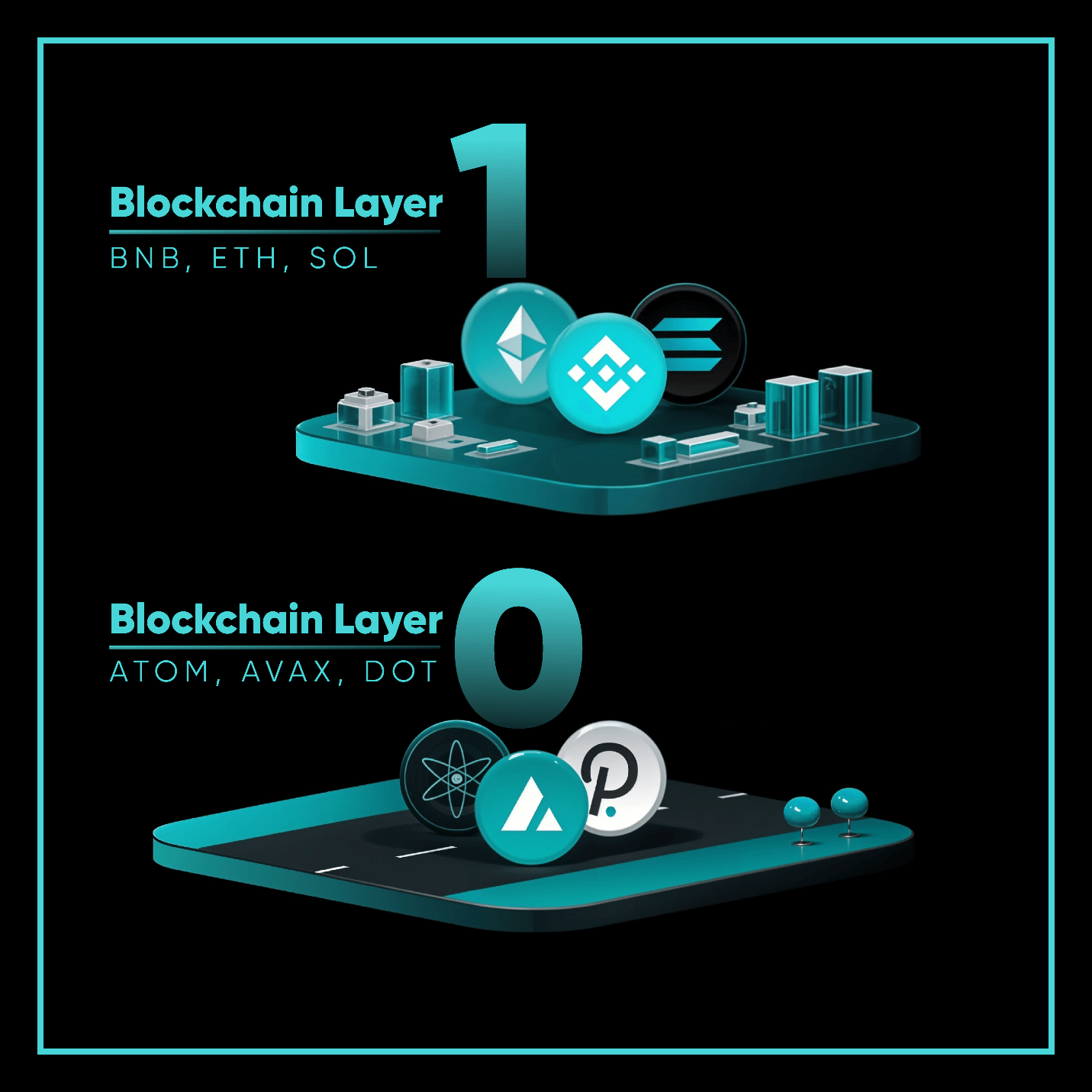

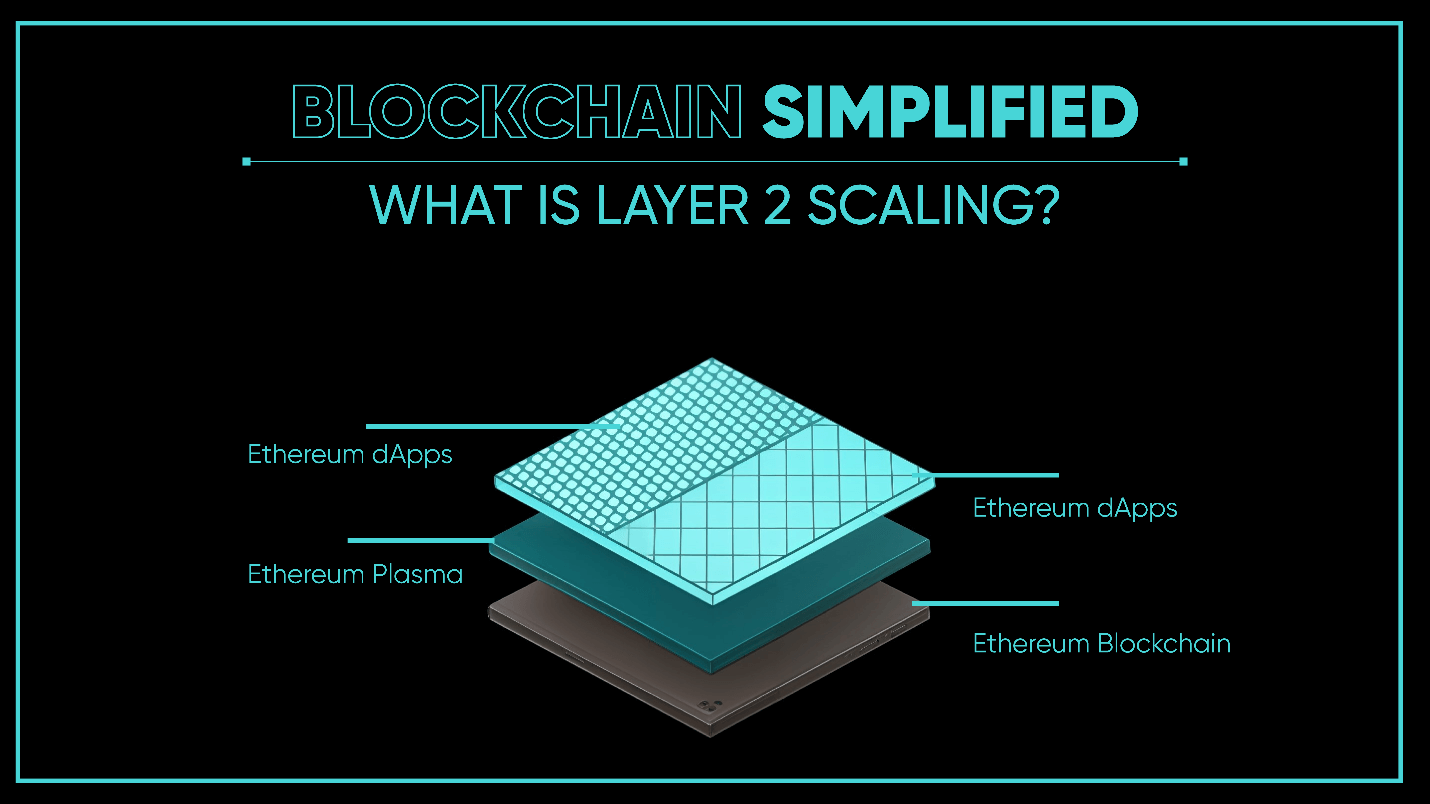

Layer 2 Solutions

As the popularity of blockchain technology grows, so does the volume of transactions. This can lead to scalability issues, where the main blockchain network becomes congested, and transaction processing slows down. Layer 2 solutions address this challenge by offloading transactions from the main blockchain onto secondary networks. Imagine a highway becoming overloaded with traffic – layer 2 solutions function like bypass roads, alleviating congestion on the main network and ensuring smooth and efficient transaction processing for tokenized assets.

Crypto asset management and crypto investment companies are at the forefront of developing and implementing Layer 2 solutions for enhanced scalability.

4. Regulatory Landscape

Global Regulatory Frameworks

Regulation varies significantly across jurisdictions. Key regulatory frameworks include:

The United States: SEC guidelines on digital assets and securities.

The European Union: MiFID II and upcoming MiCA regulations.

Asia: Regulatory approaches in countries like Singapore, Japan, and Hong Kong.

Compliance and Legal Considerations

Compliance involves:

KYC/AML: Ensuring know-your-customer (KYC) and anti-money laundering (AML) compliance.

Securities Laws: Adhering to laws governing the issuance and trading of securities.

Taxation: Understanding the tax implications of tokenized assets.

Challenges and Opportunities in Regulation

Challenges include regulatory uncertainty and the need for global harmonization. Opportunities lie in creating frameworks that balance innovation with protection.

5. Strategic Implications for Businesses

Benefits of Asset Tokenization

Asset tokenization isn’t just a technological innovation; it’s a catalyst for profound change within the financial landscape. By bridging the gap between traditional assets and the digital world, it unlocks a treasure trove of benefits for asset owners. Let’s delve deeper into these advantages and explore how asset tokenization is poised to reshape the way we interact with and own valuable assets.

1. Unleashing Liquidity: Transforming Illiquid Assets into Tradable Treasures

Traditionally, certain asset classes like real estate or fine art have been notorious for their lack of liquidity. Owning a multi-million-dollar property or a coveted piece of contemporary art might be a dream for many, but selling such assets quickly and efficiently can be a challenge. Asset tokenization disrupts this paradigm by introducing a revolutionary concept: fractional ownership. By dividing the asset into smaller digital tokens, it becomes possible for multiple people to collectively own a portion of the underlying asset. This fragmentation unlocks a new level of liquidity.

Imagine a luxurious beachfront property being tokenized – people can now purchase smaller, more manageable tokens representing ownership in the property. This opens doors for a broader base to participate in this asset class, fostering a more dynamic and liquid market. Similarly, a rare masterpiece by a renowned artist can be tokenized, allowing a wider audience to own a piece of this valuable artwork.

The benefits extend beyond just real estate and art. Private equity funds, venture capital investments, and even intellectual property can be tokenized, enabling easier entry and exit for users. This increased liquidity not only benefits people seeking diversification but also empowers asset owners to unlock the value tied up in their holdings.

2. Democratizing Investment: Lowering the Entry Barrier

Traditionally, investing in certain asset classes has been a privilege reserved for high-net-worth individuals. The high entry barrier associated with these assets often excludes a significant portion of the population from participating in potentially lucrative investment opportunities. Asset tokenization dismantles this barrier by facilitating fractional ownership. By dividing the asset into smaller, more affordable tokens, interested individuals with less capital can now participate in markets that were previously out of reach. Imagine investing in a piece of prime commercial real estate for a fraction of the cost of purchasing the entire property. Asset tokenization makes this a reality, fostering a more inclusive and accessible investment landscape.

This democratization extends beyond just cost. Traditionally, complex investment structures and opaque processes can deter potential interested individuals. Asset tokenization, with its inherent transparency and reliance on smart contracts, streamlines the investment process, making it more accessible to a wider audience.

3. Transparency Triumphs: Building Trust Through Immutable Records

Trust is the cornerstone of any healthy financial system. However, traditional financial processes can often be opaque, shrouded in layers of intermediaries and complex documentation. Asset tokenization shines a light on these processes by leveraging the power of blockchain technology. All ownership records and transaction history are immutably stored on the blockchain, creating a transparent and tamper-proof audit trail. This enhanced transparency fosters trust between asset owners and other stakeholders involved in the tokenized asset ecosystem.

Imagine a world where every transaction related to a piece of real estate – from purchase to ownership changes – is permanently recorded on a secure and transparent ledger. This eliminates the potential for fraud or manipulation, fostering confidence and security within the tokenized asset market.

4. Efficiency Reigns Supreme: Streamlining Processes and Reducing Costs

The traditional financial system can be riddled with inefficiencies. Manual processes, complex paperwork, and multiple intermediaries all contribute to delays and unnecessary costs. Asset tokenization offers a more efficient alternative. By leveraging smart contracts and self-executing agreements coded directly on the blockchain, many manual tasks associated with asset management and transactions can be automated. Imagine a rental property being tokenized – a smart contract can be programmed to automatically distribute rental income proportionally to all token holders, eliminating the need for manual calculations and disbursements. This automation translates to reduced costs and a more streamlined experience for all parties involved.

Additionally, asset tokenization can potentially reduce transaction fees associated with traditional financial intermediaries. By eliminating the need for these intermediaries and automating processes through smart contracts, the overall cost of transactions can be significantly lowered. This efficiency makes tokenized assets a more attractive proposition for both asset owners.

The benefits of asset tokenization extend far beyond these core advantages. As the technology matures and regulatory frameworks evolve, we can expect to see even more innovative applications emerge, transforming the way we interact with and own valuable assets in the years to come.

Risks and Mitigation Strategies

Risks include:

Regulatory Risks: Navigating complex regulatory landscapes.

Technical Risks: Ensuring the security and scalability of blockchain solutions.

Market Risks: Managing volatility and market acceptance.

Mitigation strategies involve robust compliance, thorough technical vetting, and market education.

Business Models and Use Cases

Business models include:

Real Estate Investment Platforms: Offering tokenized property investments.

Commodity Trading Platforms: Enabling fractional ownership of commodities.

Art and Collectibles Marketplaces: Facilitating the trading of tokenized art.

Implementation Strategies

Successful implementation involves:

Feasibility Studies: Assessing the viability of tokenization.

Partnering with Experts: Collaborating with legal, technical, and financial experts.

Pilot Projects: Testing tokenization with smaller assets before scaling.

6.User Perspective

Investment Opportunities and Strategies

People can explore opportunities in various asset classes, from real estate to commodities. Strategies include:

Diversification: Spreading investments across different tokenized assets.

Yield Farming: Earning returns through staking and liquidity provision.

Speculative Trading: Capitalizing on price movements of tokens.

Risk Management and Due Diligence

Key risk management practices include:

Thorough Research: Understanding the underlying asset and tokenization process.

Regulatory Compliance: Ensuring investments comply with relevant laws.

Security Measures: Safeguarding digital assets through secure wallets and platforms.

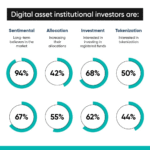

Market Trends and Future Outlook

Trends include:

Increased Institutional Adoption: Growing interest from institutions.

Innovation in Token Standards: Development of new token standards for different asset classes.

Expansion of Secondary Markets: Growth of platforms facilitating the trading of tokenized assets.

7. Case Studies and Real-World Applications

Real Estate Tokenization

Asset tokenization isn’t a one-size-fits-all solution; its transformative potential extends across various asset classes, each offering unique advantages and considerations. Let’s embark on a journey through some of the most promising applications of asset tokenization, exploring how it’s reshaping the way we interact with valuable assets.

1. Real Estate Tokenization: Democratizing Ownership of Brick and Mortar

Real estate has long been a cornerstone of asset portfolios, offering stability and potential for long-term appreciation. However, traditional real estate investment has its limitations. High entry barriers, complex transactions, and limited liquidity can often deter potential interested individuals. Asset tokenization disrupts this paradigm by introducing real estate tokenization. Imagine a world where property ownership is fragmented into digital tokens accessible to a wider audience.

This isn’t just a hypothetical scenario. Real-world examples are already paving the way for a tokenized real estate future:

St. Regis Aspen Resort: In a landmark deal, a portion of the ownership of the luxurious St. Regis Aspen Resort was tokenized through a security token offering (STO). This innovative approach allowed interested individuals to purchase digital tokens representing ownership in the resort, potentially reaping benefits from its ongoing operations.

Manhattan Real Estate: The bustling real estate market of Manhattan is also exploring the possibilities of tokenization. Several projects are underway, aiming to leverage digital tokens to attract a global pool of interested individuals previously restricted by geographical barriers. These endeavors hold the potential to unlock new avenues for capital raising and investment in the competitive Manhattan market.

2. Commodities and Natural Resources: Transforming Traditional Trading

Commodities like gold, oil, and agricultural products play a vital role in the global economy. Traditionally, investing in commodities has often involved complex contracts and high minimum investment requirements. Asset tokenization offers a more accessible and transparent alternative: commodity tokenization. Imagine owning a digital token backed by a fraction of a barrel of oil or a gram of gold – all through a secure and user-friendly platform.

Here are some compelling examples of commodity tokenization in action:

Gold Tokens: Several companies now offer gold tokens, digital assets backed by physical gold reserves. These tokens provide interested individuals with a convenient and potentially more affordable way to gain exposure to the gold market compared to traditional methods like purchasing physical gold bars.

Oil and Gas Projects: The energy sector is also embracing tokenization. Projects are being explored where ownership in oil and gas projects can be tokenized, allowing interested individuals to participate in the potential returns generated by these ventures. This could open doors for a broader investor base to participate in the energy sector and potentially democratize access to these investment opportunities.

3. Art and Collectibles: Unlocking Value and Fostering Participation

The world of art and collectibles, encompassing everything from priceless masterpieces to rare historical artifacts, has always held a certain allure. However, investing in these passion assets has traditionally been limited to a select group of high-value collectors. Asset tokenization offers a solution: art and collectible tokenization. Imagine owning a fraction of a Van Gogh masterpiece or a rare baseball card – all represented by a secure digital token.

The art world is actively exploring the potential of tokenization:

NFT Marketplaces: Platforms like OpenSea and Rarible are leading the charge in facilitating the trading of non-fungible tokens (NFTs), unique digital tokens representing ownership in art and collectibles. These marketplaces provide a secure and transparent environment for artists, collectors, and interested individuals to connect and participate in the tokenized art market.

Fractional Ownership Models: Companies like Masterworks are leveraging tokenization to create innovative fractional ownership models. These models allow individuals to invest in high-value art pieces by purchasing a fraction of the ownership represented by a digital token. This opens doors for a wider audience to participate in the art market, previously reserved for the ultra-wealthy.

4. Financial Instruments and Securities: Streamlining Issuance and Trading

The traditional financial landscape thrives on a complex web of financial instruments like stocks, bonds, and derivatives. Asset tokenization can revolutionize this domain as well. Tokenized financial instruments streamline issuance and trading processes, potentially increasing efficiency and accessibility. Imagine companies raising capital by issuing digital tokens representing ownership shares or a portion of future profits.

Here’s a glimpse into the future of tokenized financial instruments:

Tokenized Bonds: Governments and corporations are exploring the issuance of tokenized bonds. These bonds would be represented by digital tokens, potentially facilitating a more efficient and transparent primary and secondary market for bond issuance and trading.

Equity Tokens: Companies can leverage equity token offerings to raise capital. These offerings involve issuing digital tokens representing ownership equity in the company. This could provide an alternative fundraising avenue for startups and small and medium-sized enterprises (SMEs), potentially attracting a broader pool of globally interested individuals.

8. Challenges and Future Directions

Technical and Operational Challenges

Challenges include:

Scalability: Ensuring blockchain networks can handle high transaction volumes.

Interoperability: Facilitating seamless asset transfer across different blockchains.

Security: Protecting against cyber threats and ensuring the integrity of tokenized assets.

Regulatory and Legal Hurdles

Navigating the regulatory landscape remains a significant challenge. Key issues include:

Global Harmonization: Achieving consistent regulatory standards across jurisdictions.

Investor Protection: Balancing innovation with robust investor safeguards.

Taxation: Clarifying tax treatment for tokenized assets.

Future Trends and Innovations

Future directions include:

Enhanced Token Standards: Developing standards tailored to different asset classes.

Decentralized Finance (DeFi) Integration: Leveraging DeFi protocols for asset tokenization.

Institutional Adoption: Growing acceptance and participation from traditional financial institutions.

9. Conclusion

The Path Forward for Asset Tokenization

Asset tokenization represents a significant opportunity to bridge traditional and digital finance. By leveraging blockchain technology, businesses and interested individuals can unlock new levels of efficiency, transparency, and liquidity.

Final Thoughts

While challenges remain, the potential benefits of asset tokenization are immense. As technology and regulatory frameworks evolve, the integration of traditional and digital finance will continue to transform the financial landscape, offering new opportunities for innovation and growth. Kenson Investments’ digital asset specialists can help you stay updated on all the latest developments in the field of RWAs.