Introduction

Cryptocurrencies have emerged as a disruptive force in the financial world, challenging traditional banking systems and introducing a new paradigm of decentralized digital assets. This white paper aims to provide an in-depth exploration of cryptocurrencies, elucidating their underlying technologies, practical applications, and potential impact on global finance.

Understanding Cryptocurrencies

Cryptocurrencies, a revolutionary innovation in the realm of finance and technology, are underpinned by three fundamental concepts: blockchain technology, cryptography, and decentralization.

Blockchain Technology

At the heart of cryptocurrencies lies blockchain technology, a decentralized ledger system that records transactions across a network of computers. Imagine a digital ledger distributed across thousands of computers worldwide, each maintaining an identical copy of the ledger. Every time a transaction occurs, it is recorded as a “block” on this ledger, which is then added to a chain of previous transactions, hence the term “blockchain.” This decentralized nature makes sure that a single entity doesn’t have control over the entire network, making it resistant to manipulation or fraud.

The growth and adoption of blockchain technology have been remarkable. According to Statista, the global blockchain technology market size is projected to reach 39 billion U.S. dollars by 2025, a testament to its increasing significance across various industries. Industries ranging from finance to healthcare, supply chain management to voting systems, are exploring and implementing blockchain solutions to enhance efficiency, transparency, and security.

Cryptography

Cryptography plays a crucial role in ensuring the security and integrity of cryptocurrency transactions. It employs advanced mathematical algorithms to encrypt and verify data, protecting it from unauthorized access or tampering. Public and private keys lie at the heart of cryptographic security. A public key, akin to a bank account number, serves as an address to receive funds, while a corresponding private key acts as a digital signature, granting access to those funds.

Through the clever use of cryptographic techniques such as hashing and digital signatures, cryptocurrencies ensure that transactions are secure, transparent, and irreversible.

Consider the example of Bitcoin, the first and most well-known cryptocurrency. Each Bitcoin transaction involves the sender’s private key signing off on the transaction, which is then verified by the recipient using the sender’s public key. This process ensures that only the rightful owner of the funds can initiate a transfer, maintaining the security and integrity of the Bitcoin network.

Decentralization

Cryptocurrencies operate on decentralized networks, eliminating the need for intermediaries such as banks or financial institutions. Traditional financial systems rely on centralized authorities to facilitate transactions and maintain records, making them susceptible to censorship, fraud, and single points of failure. In contrast, cryptocurrencies operate on peer-to-peer networks, where every participant (or “node”) in the network maintains a copy of the blockchain ledger.

This decentralized architecture not only enhances transparency and security but also promotes financial inclusivity by providing access to financial services for underserved populations. For example, in countries with unstable economies or limited banking infrastructure, cryptocurrencies offer a means of conducting transactions and storing value without reliance on traditional banking systems.

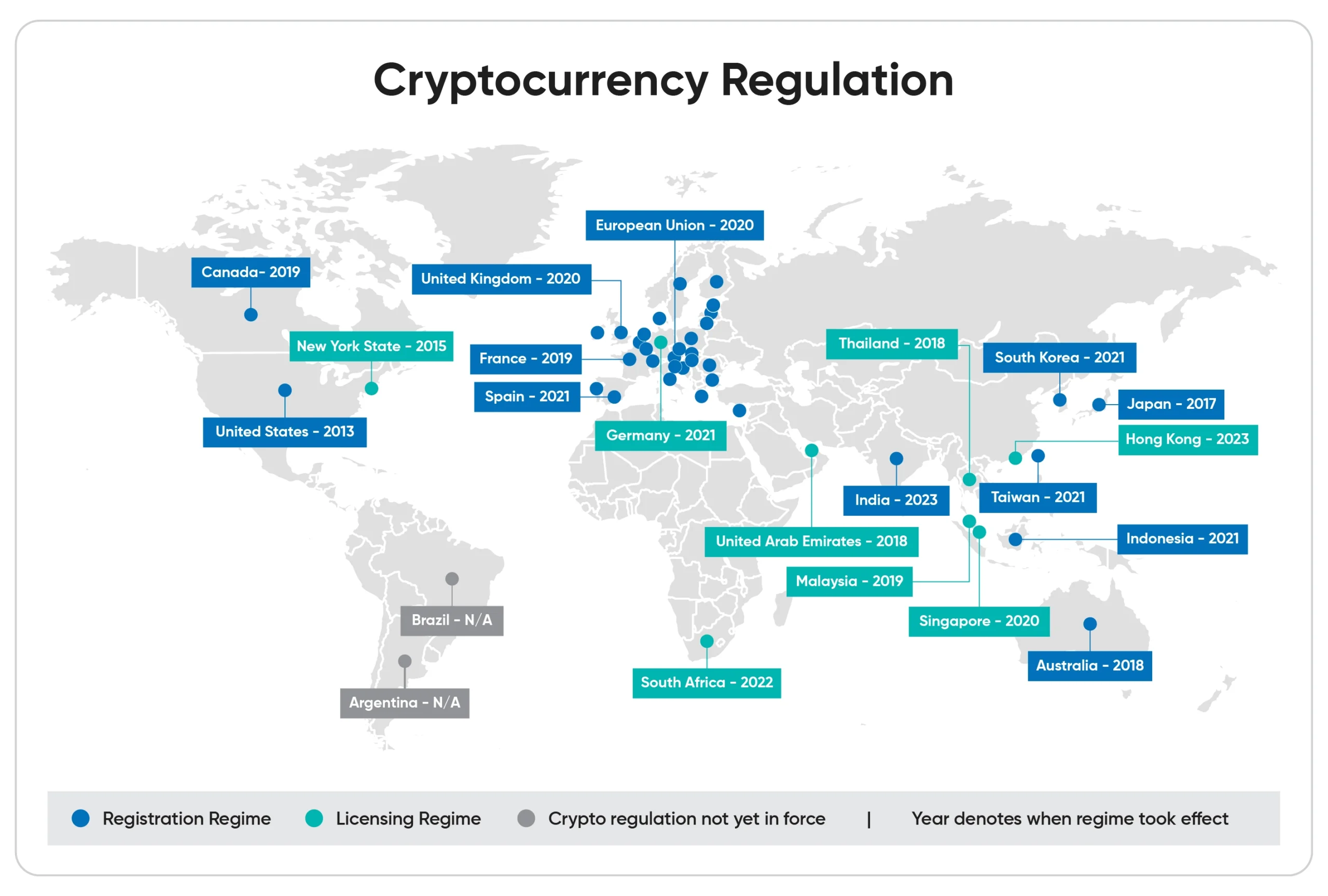

Regulation

The world of cryptocurrency regulation is a dynamic chess game, with governments and financial institutions maneuvering to establish control over this disruptive technology. Some countries, like El Salvador, have taken a bold leap by adopting Bitcoin as a legal tender, sending shockwaves through the traditional financial system. Others, like China, have cracked down heavily on crypto mining and trading, citing concerns about financial stability and energy consumption.

In the absence of a coordinated global approach, a patchwork of regulations is emerging. In the United States, the 2022 executive order from the Biden administration signaled a shift towards stricter oversight. This could involve increased scrutiny of cryptocurrency exchanges, with potential curbs on leverage trading and stricter Know Your Customer (KYC) requirements to combat money laundering and terrorist financing.

Meanwhile, the European Union is poised to implement the Markets in Crypto Assets (MiCA) framework in 2024. This ambitious legislation aims to create a standardized regulatory environment across the bloc, addressing concerns about consumer protection, market transparency, and the environmental impact of crypto mining.

Beyond national borders, international organizations like the Financial Stability Board (FSB) are playing a crucial role in fostering global cooperation. The FSB is working with central banks and financial regulators worldwide to develop a comprehensive framework for crypto regulation. Striking a balance remains the key challenge – fostering innovation in the crypto space while mitigating potential risks like financial instability and cybercrime.

While regulations might seem like a hurdle for the crypto industry, clear and well-defined frameworks can actually benefit the ecosystem in the long run. They can instill confidence in investors, attract institutional players, and ultimately pave the way for wider mainstream adoption of cryptocurrencies. However, navigating this complex regulatory landscape will require close collaboration between governments, financial institutions, and the crypto industry itself.

Types of Cryptocurrencies

The cryptocurrency landscape is a dynamic ecosystem that encompasses a diverse array of digital assets, each with its own unique features, use cases, and underlying technologies. Understanding the distinct characteristics of these cryptocurrencies is essential for navigating the complexities of the digital asset market.

Bitcoin

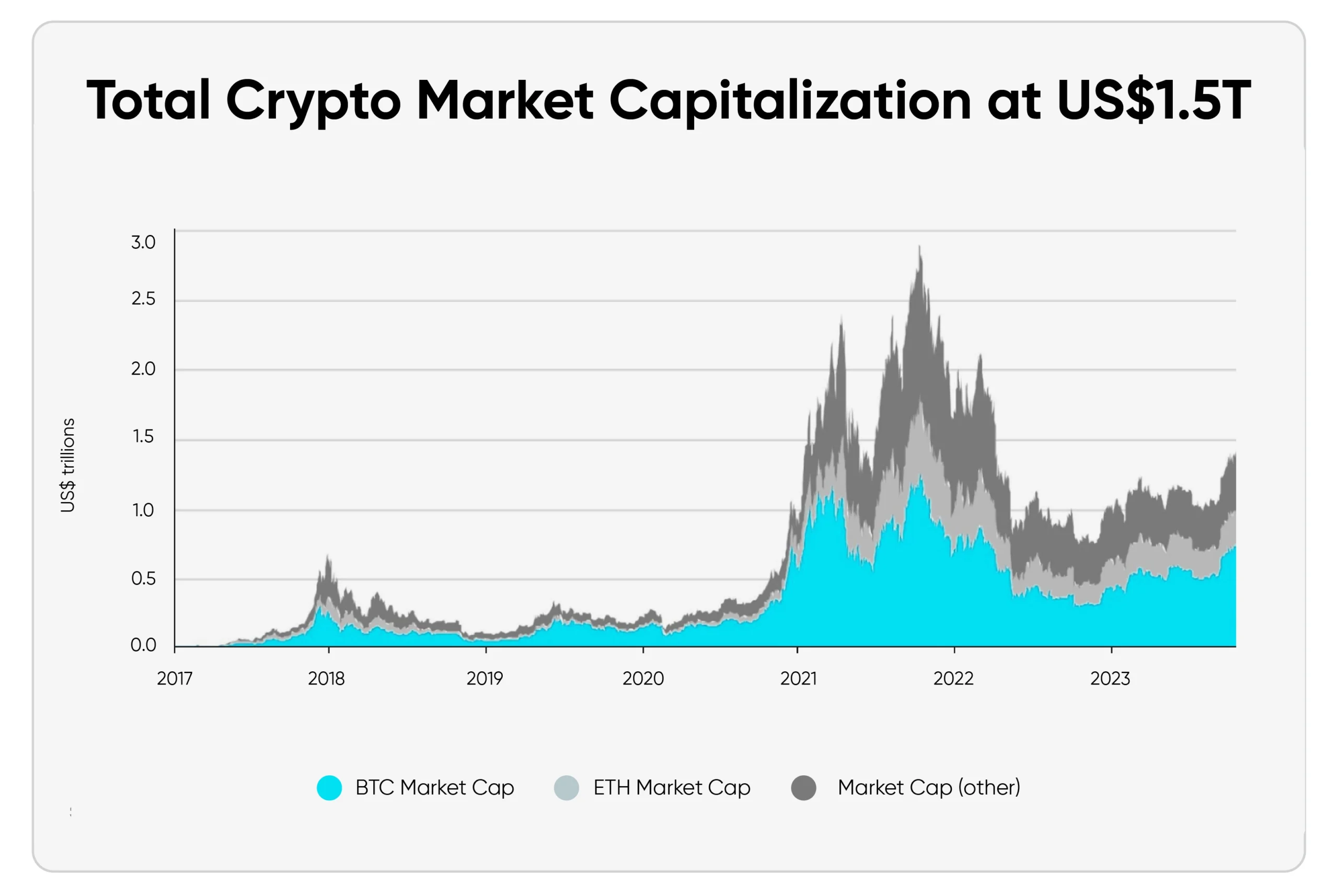

As the pioneering cryptocurrency, Bitcoin stands as the cornerstone of the digital currency revolution. Launched in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin introduced the world to the concept of decentralized digital currency. With a market dominance of over 40% as of January 2024, according to CoinMarketCap, Bitcoin remains the most widely recognized and valuable digital asset. Its scarcity, ensured by a capped supply of 21 million coins, along with its robust security and decentralization, has positioned it as a store of value and digital gold. Bitcoin’s immutable blockchain, powered by proof-of-work consensus, serves as the foundation for secure and censorship-resistant peer-to-peer transactions.

Ethereum

Ethereum, often hailed as the “world computer,” introduced a revolutionary concept beyond simple peer-to-peer transactions. Vitalik Buterin and his team launched Ethereum in 2015 with the vision of building a decentralized platform for smart contracts and decentralized applications (DApps). Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts enable developers to create a wide range of decentralized applications, spanning from decentralized finance (DeFi) protocols to non-fungible tokens (NFTs).

Ethereum’s native cryptocurrency, Ether (ETH), serves as the fuel for executing transactions and deploying smart contracts on the Ethereum network. Ethereum’s programmable nature and expansive ecosystem have propelled its prominence in the cryptocurrency landscape.

Ripple

Ripple, founded in 2012, aims to revolutionize cross-border payments by facilitating fast and low-cost transactions for financial institutions. At the core of Ripple’s technology stack lies the XRP Ledger, a distributed ledger protocol that enables real-time settlement of transactions. RippleNet, Ripple’s global payments network, leverages the XRP Ledger to provide financial institutions with a seamless infrastructure for cross-border payments.

Despite controversies surrounding its centralized governance model and regulatory challenges, Ripple has garnered partnerships with banks and payment providers worldwide. XRP, the native cryptocurrency of the Ripple network, plays a vital role in facilitating liquidity and enabling on-demand liquidity solutions for cross-border transactions.

Litecoin

Introduced in 2011 by Charlie Lee, a former Google engineer, Litecoin emerged as one of the earliest altcoins, offering a complementary approach to Bitcoin. Dubbed the “silver to Bitcoin’s gold,” Litecoin differentiates itself by offering faster transaction times and lower fees. This enhanced transaction throughput is achieved through Litecoin’s Scrypt hashing algorithm, which enables quicker block generation compared to Bitcoin’s SHA-256 algorithm. While Bitcoin serves primarily as a store of value, Litecoin positions itself as a medium of exchange, suitable for everyday transactions.

Cardano (ADA)

Launched in 2017, Cardano is a blockchain platform that aims to be a more scalable and secure alternative to Ethereum. It uses a unique proof-of-stake consensus mechanism, which is considered more energy-efficient than Bitcoin’s proof-of-work system. Cardano is also known for its focus on smart contracts, which are self-executing contracts that can automate a wide variety of tasks.

Key Features:

Scalability: Designed to handle a high volume of transactions per second.

Security: Uses a rigorously researched proof-of-stake system.

Smart Contracts: Focuses on enabling secure and reliable smart contracts.

Other Altcoins

Beyond the prominent cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin, the cryptocurrency market hosts thousands of alternative coins, collectively known as altcoins. These altcoins encompass a wide spectrum of projects, ranging from innovative blockchain platforms to niche market solutions. Examples include Polkadot, an interoperable blockchain protocol enabling cross-chain communication, and Solana, a high-performance blockchain platform designed for decentralized applications and crypto-native projects. Each of these altcoins explores unique technological innovations and addresses specific challenges within the cryptocurrency ecosystem.

Applications of Cryptocurrencies

Cryptocurrencies, with their versatile and innovative features, have broad-ranging applications across industries, driving transformation and efficiency in various sectors. Let’s delve deeper into each of these applications, exploring practical examples and the impact they have on their respective fields.

Peer-to-Peer Transactions

One of the foundational applications of cryptocurrencies is enabling direct, peer-to-peer transactions between individuals without the need for intermediaries like banks or payment processors. This not only reduces transaction fees but also accelerates the speed of transactions, especially in cross-border payments. For example, individuals in different countries can seamlessly transfer funds to each other using cryptocurrencies, bypassing the traditional banking system’s lengthy processing times and high fees. Platforms like Bitcoin and Litecoin serve as prime examples of facilitating borderless transactions, empowering users to send value across the globe with ease and speed.

Smart Contracts

Ethereum’s introduction of smart contract functionality revolutionized the way contractual agreements are executed, bringing automation and trustlessness to transactions. Smart contracts are self-executing contracts with predefined rules and conditions written in code, eliminating the need for intermediaries and ensuring tamper-proof execution. Practical applications of smart contracts range from automated rental agreements and decentralized crowdfunding campaigns to supply chain management and decentralized autonomous organizations (DAOs). For instance, in supply chain management, smart contracts can automate payment settlements between suppliers and manufacturers based on predefined delivery milestones, enhancing efficiency and transparency throughout the supply chain.

Supply Chain Management

Blockchain technology has emerged as a game-changer in supply chain management, offering enhanced transparency, traceability, and integrity to the entire process. By recording product provenance, certifications, and transactions on an immutable ledger, blockchain ensures that every step of the supply chain is verifiable and auditable. For example, companies like IBM and Walmart are leveraging blockchain to trace the journey of food products from farm to table, enabling swift identification and mitigation of foodborne illnesses. Similarly, luxury goods companies are using blockchain to authenticate the origins of high-value items, combating counterfeiting and preserving brand reputation.

Tokenization

Cryptocurrencies facilitate the tokenization of real-world assets, enabling fractional ownership, liquidity, and accessibility to traditionally illiquid assets. Real estate, art, stocks, and commodities can be represented as digital tokens on blockchain platforms, allowing investors to buy, sell, and trade fractions of these assets with ease. For instance, platforms like RealT and Propy tokenize real estate properties, allowing investors to purchase fractional ownership of properties and receive rental income proportional to their investment. This democratization of asset ownership opens up investment opportunities to a wider audience and increases market liquidity.

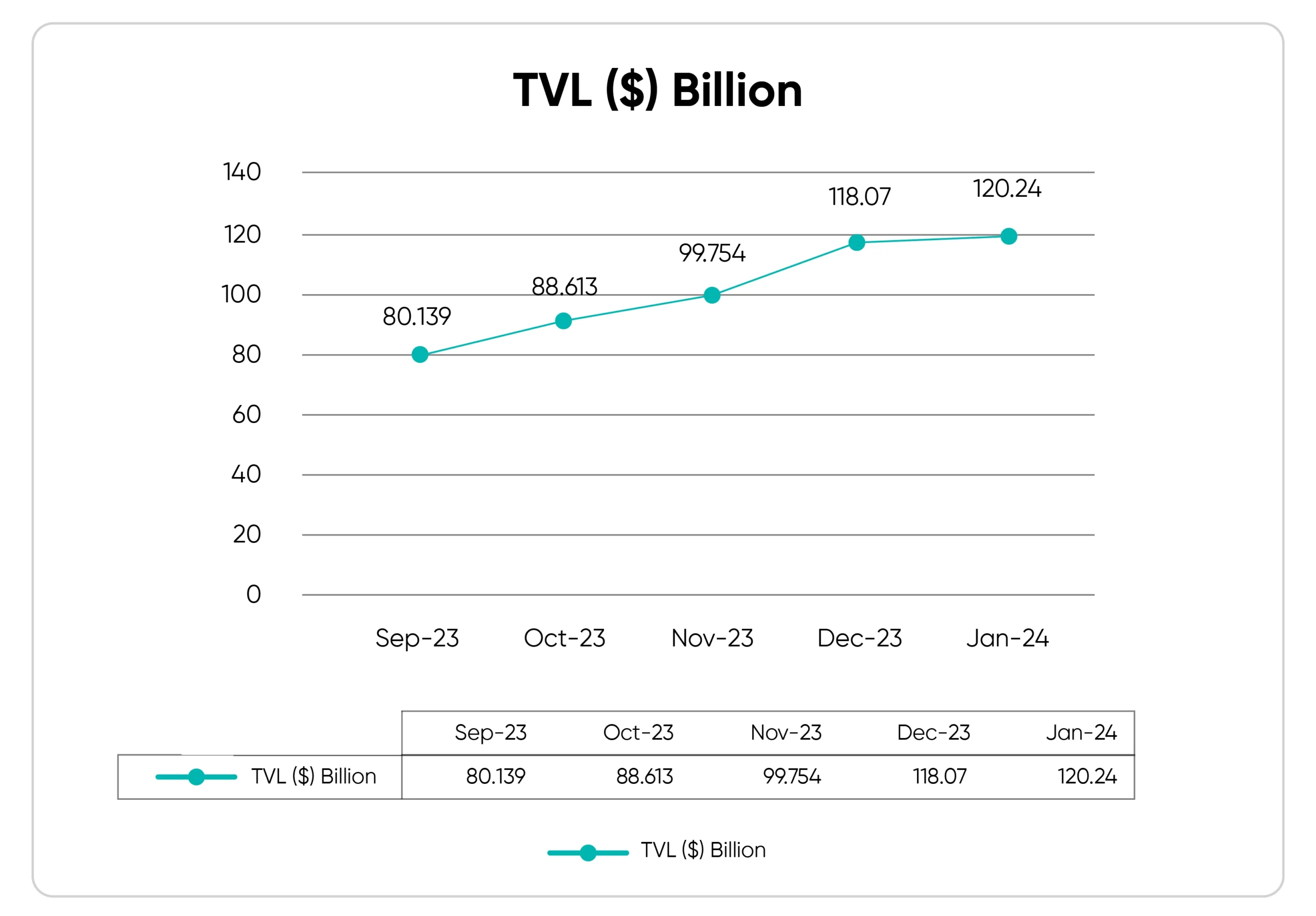

Decentralized Finance (DeFi)

DeFi represents a paradigm shift in traditional finance, leveraging blockchain technology to offer financial services without the need for intermediaries. DeFi platforms enable activities such as lending, borrowing, decentralized exchanges (DEXs), and yield farming in a permissionless and transparent manner. For example, platforms like Compound and Aave allow users to lend out their cryptocurrency assets and earn interest, while decentralized exchanges like Uniswap enable peer-to-peer trading without relying on centralized exchanges.

Yield farming protocols like Yearn Finance optimize returns by automatically moving funds between different DeFi platforms to maximize yields. DeFi not only offers financial inclusion to the unbanked but also provides traditional finance users with alternative avenues for wealth generation and investment diversification.

Impact on Global Finance

Cryptocurrencies are catalyzing a profound transformation in the global financial landscape, challenging the status quo of traditional banking systems and catalyzing unprecedented levels of financial inclusion and innovation.

Disruption of Traditional Banking Systems

The rise of cryptocurrencies poses a significant challenge to centralized banking systems, offering users an alternative financial ecosystem characterized by autonomy, accessibility, and censorship resistance. Traditional banking systems are bound by geographical constraints, regulatory requirements, and intermediary dependencies, which often result in inefficiencies and limitations for users.

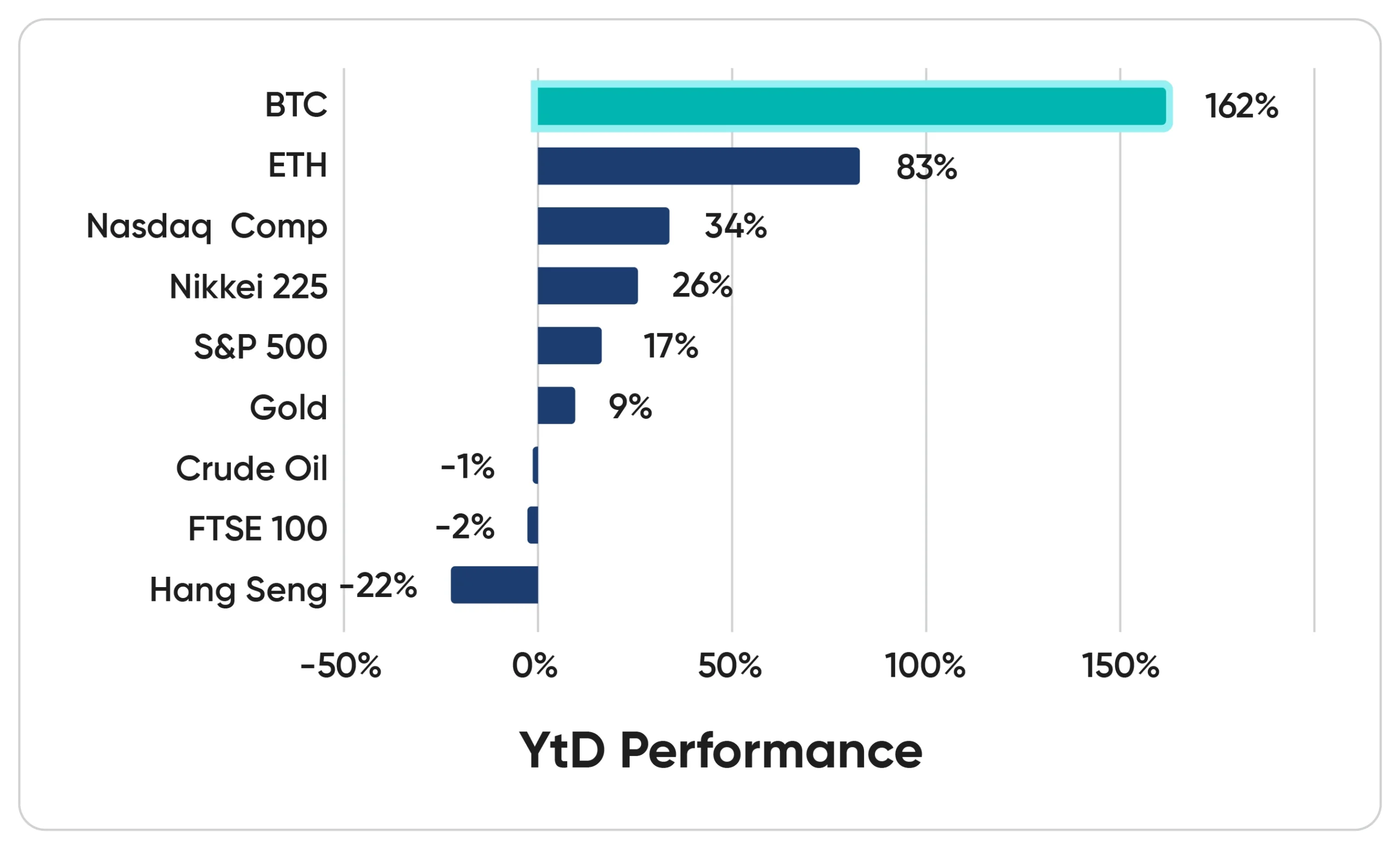

In contrast, cryptocurrencies empower individuals to take control of their finances, facilitating peer-to-peer transactions without reliance on intermediaries. This disruption has gained momentum over the years, with the total market capitalization of cryptocurrencies surpassing $2 trillion as of April 2024, according to CoinMarketCap.

Financial Inclusion

Despite advancements in financial infrastructure, approximately 1.7 billion adults globally remain unbanked, according to the World Bank. This exclusion from the traditional banking system restricts access to essential financial services and opportunities for economic growth. Cryptocurrencies offer a transformative solution to this challenge by providing individuals with access to banking services and digital assets through internet connectivity.

By leveraging blockchain technology, cryptocurrencies enable anyone with a smartphone or internet connection to participate in the global economy, regardless of geographical location or socioeconomic status. This democratization of finance has the potential to uplift underserved communities and unlock new avenues for economic empowerment.

Cross-Border Transactions

Traditional cross-border transactions are often plagued by high fees, lengthy processing times, and regulatory complexities. Financial institutions and remittance services act as intermediaries in these transactions, adding layers of friction and cost. Cryptocurrencies revolutionize cross-border transactions by facilitating near-instantaneous and low-cost transfers directly between parties, bypassing traditional intermediaries. This has significant implications for individuals and businesses engaged in international trade, remittances, and cross-border payments. For example, platforms like RippleNet leverage cryptocurrencies to streamline cross-border remittances for financial institutions, reducing transaction costs and settlement times while improving transparency and liquidity.

Central Bank Digital Currencies (CBDCs)

Recognizing the potential of blockchain technology to modernize payment systems, central banks worldwide are exploring the concept of Central Bank Digital Currencies (CBDCs). CBDCs represent digitized forms of fiat currencies issued and regulated by central authorities. These digital currencies leverage blockchain technology to enable efficient, transparent, and programmable money, offering benefits such as reduced transaction costs, enhanced financial inclusion, and improved monetary policy transmission.

Several countries, including China, Sweden, and the Bahamas, have already launched pilot programs or are in the advanced stages of researching and developing CBDCs. The emergence of CBDCs marks a significant milestone in the evolution of global finance, bridging the gap between traditional monetary systems and the innovative potential of blockchain technology.

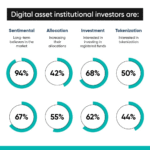

Investment Opportunities

Cryptocurrencies have emerged as a new asset class, offering investors alternative avenues for diversification and wealth accumulation. The volatility and potential for high returns in the cryptocurrency market have attracted both institutional and retail investors seeking exposure to digital assets.

Cryptocurrency exchanges, such as Coinbase and Binance, have become key infrastructure providers, offering a wide range of trading services and investment products to cater to diverse investor preferences. Additionally, the rise of decentralized finance (DeFi) platforms has introduced innovative investment opportunities, such as yield farming, liquidity provision, and algorithmic trading, further expanding the cryptocurrency investment landscape.

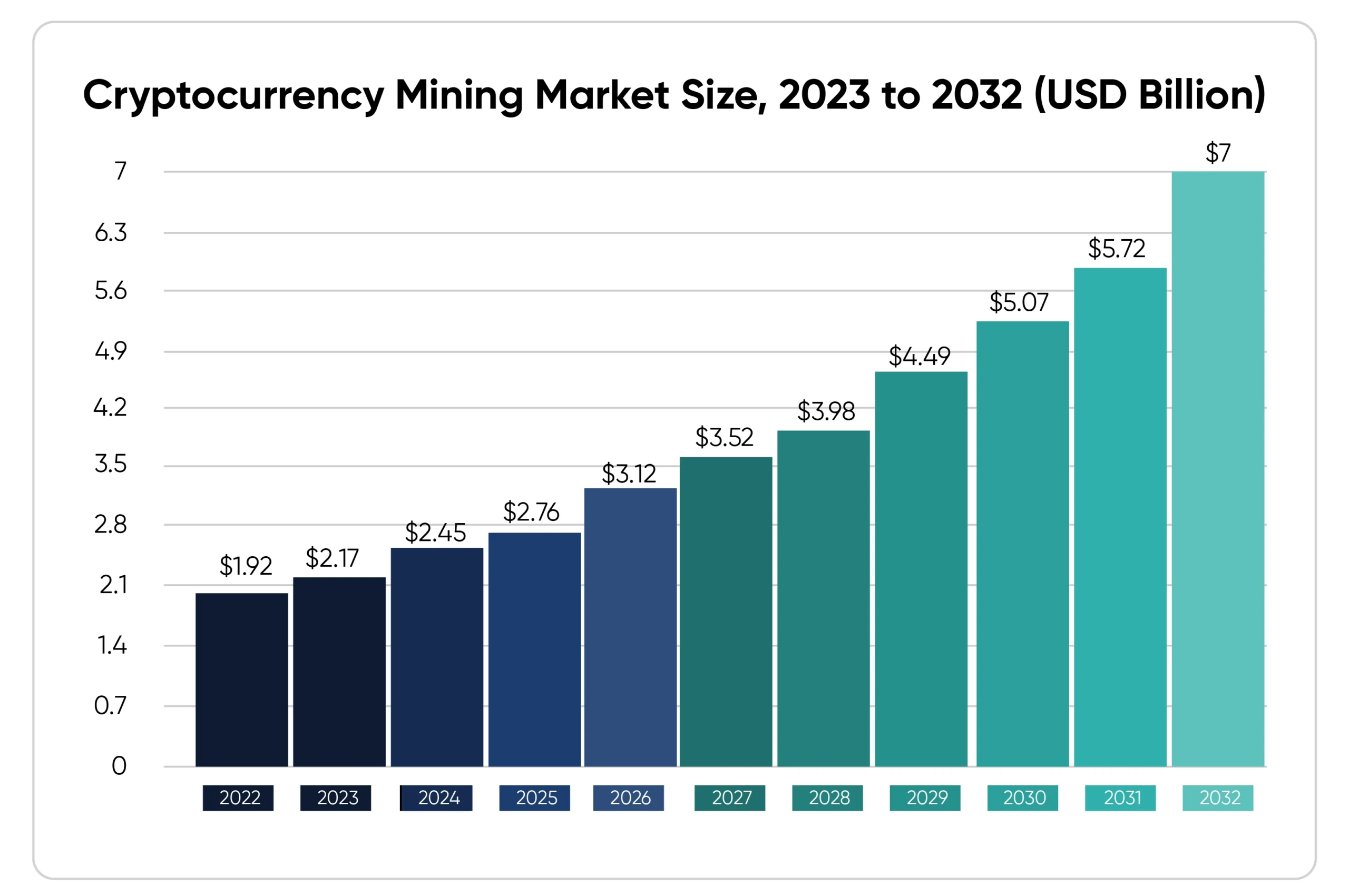

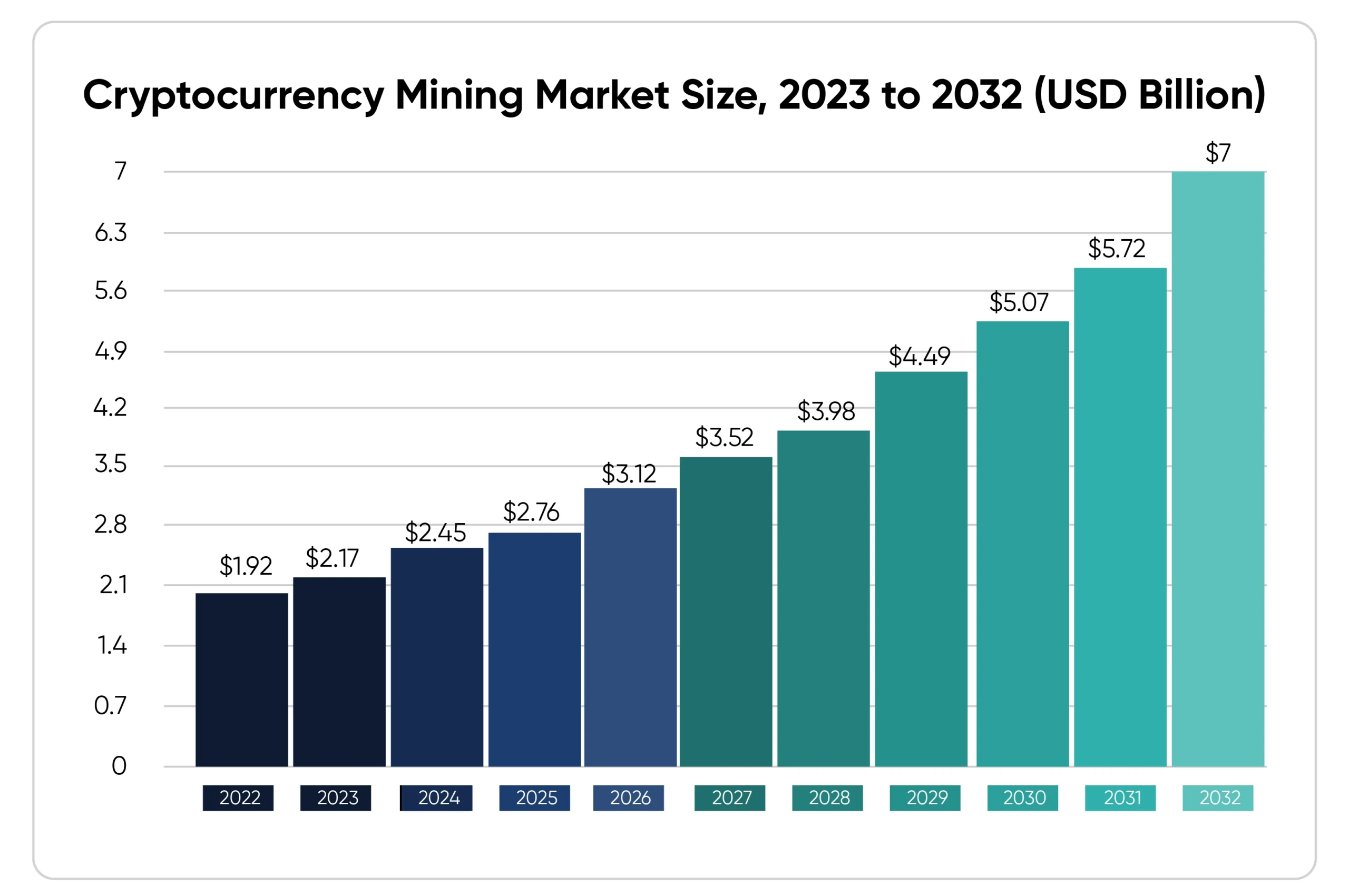

Cryptocurrency Mining

Cryptocurrency mining plays a critical role in the operation and security of blockchain networks, serving as the backbone of decentralized systems. However, this process comes with its share of environmental considerations that warrant careful examination and mitigation strategies.

Proof of Work (PoW)

PoW consensus mechanisms, as exemplified by cryptocurrencies like Bitcoin, necessitate miners to solve intricate mathematical puzzles to validate transactions and maintain the integrity of the network. While PoW has proven effective in ensuring network security, its reliance on computational power comes at a significant cost to the environment.

The energy-intensive nature of PoW mining has raised valid concerns regarding its sustainability, as evidenced by studies estimating Bitcoin’s annual energy consumption comparable to that of entire countries. This realization has spurred ongoing debates within the cryptocurrency community and beyond about the environmental impact of PoW mining and the necessity for greener alternatives.

In the Bitcoin network, miners compete to solve complex mathematical puzzles in order to validate transactions and add them to the blockchain. Miners use computational power to solve these puzzles, and the first one to solve it gets to add the next block to the blockchain and receive a reward in Bitcoin. This process requires significant energy consumption as miners continuously run powerful computers to compete for block rewards.

Proof of Stake (PoS)

PoS consensus mechanisms, championed by cryptocurrencies like Ethereum 2.0, offer a more energy-efficient alternative to PoW. In PoS systems, block validation rights are granted based on the amount of cryptocurrency staked by validators rather than computational power. This approach not only reduces energy consumption but also incentivizes stakeholders to secure the network through their financial investments. PoS has emerged as a promising solution to address the environmental concerns associated with PoW, paving the way for a more sustainable future for blockchain technology.

Ethereum 2.0 is an upgrade to the Ethereum blockchain that introduces a PoS consensus mechanism. Instead of miners solving puzzles, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency (ETH) they hold and lock up as stake. Validators are selected randomly, and those with more stake have a higher chance of being chosen. Validators are incentivized to act honestly as they have a financial stake in the network.

Mining Pools

Mining pools serve as collaborative platforms where miners combine their computational resources to increase their chances of successfully mining blocks and earning rewards. While mining pools enhance efficiency and profitability for individual miners, they also introduce centralization risks that undermine the decentralization ethos of cryptocurrencies. Concentration of mining power in a few large pools can potentially compromise network security and decentralization, highlighting the importance of promoting diverse and distributed mining practices.

F2Pool is one of the largest mining pools in the cryptocurrency industry. It allows individual miners to combine their computational resources and collectively mine blocks. By pooling their resources together, miners increase their chances of successfully mining blocks and earning rewards. F2Pool distributes the rewards among its members based on their contributions to the pool’s computational power. While mining pools like F2Pool enhance efficiency and profitability for miners, they also raise concerns about centralization of mining power.

Environmental Concerns

The environmental impact of cryptocurrency mining has become a focal point of criticism from environmental advocates and policymakers alike. The energy-intensive nature of mining operations, primarily driven by PoW consensus mechanisms, has led to concerns about carbon emissions, energy wastage, and ecological damage. In response, there has been growing pressure on the cryptocurrency industry to adopt sustainable mining practices and transition towards renewable energy sources. Initiatives such as the Bitcoin Mining Council, comprising industry leaders committed to promoting transparency and sustainability in mining operations, represent positive steps towards addressing these concerns and fostering a more environmentally conscious approach to cryptocurrency mining.

Greenidge Generation Holdings is a Bitcoin mining firm that has faced criticism for its environmental impact. Located in New York, Greenidge operates a power plant that generates electricity primarily through burning natural gas. The firm uses this electricity to power its Bitcoin mining operations, leading to concerns about carbon emissions and environmental degradation. Critics argue that such mining practices contribute to climate change and undermine efforts towards sustainability in the cryptocurrency industry.

Cryptocurrency Wallets

Cryptocurrency wallets act as the backbone of the digital asset ecosystem, storing your valuable holdings and facilitating transactions. But unlike traditional wallets that hold physical bills, crypto wallets secure your access to cryptocurrencies on the blockchain through cryptographic keys. Choosing the right wallet and implementing strong security measures are paramount to safeguarding your investments.

Here’s a closer look at the various wallet types and their security considerations:

Hardware Wallets

These physical devices, resembling USB drives, offer the highest level of security by storing your private keys offline. Popular options include Ledger Nano S and Trezor Model One. A recent study found that hardware wallets significantly reduced the risk of crypto theft by over 95% compared to software wallets, making them ideal for holding large amounts of cryptocurrency.

Software Wallets

Offering convenient access and user-friendly interfaces, software wallets come in desktop, mobile, and web-based versions. Examples include MetaMask and Coinbase Wallet. While their ease of use is a plus, they are more vulnerable to online attacks. A report revealed that malware attacks targeting software wallets resulted in over $1 billion in stolen cryptocurrency in 2023.

Paper Wallets

For those seeking an air-gapped (completely offline) storage solution, paper wallets provide a low-tech alternative. These involve generating and printing your private keys on a physical piece of paper. While highly secure, paper wallets present the risk of loss or damage if not stored carefully. A 2024 survey indicated that over 20% of paper wallet users reported challenges in physically safeguarding their keys.

Essential Practices

With the ever-evolving landscape of cyber threats, fortifying your cryptocurrency wallets is not just advisable but imperative. Here are some key security measures to adopt to safeguard your digital assets effectively:

Strong Passwords & Two-Factor Authentication (2FA)

Just as you would with any online account, employing robust, unique passwords for your cryptocurrency wallets is paramount. Complex passwords comprising a combination of letters, numbers, and special characters significantly bolster security. Additionally, enabling two-factor authentication (2FA) adds an extra layer of protection by requiring a secondary verification code for login attempts. This additional barrier deters unauthorized access even if your password is compromised, enhancing the overall security of your wallets.

Software Updates

Staying vigilant and proactive about software updates for your cryptocurrency wallet is crucial. These updates frequently include essential security patches designed to address vulnerabilities exploited by cyber attackers. By promptly installing updates as they become available, you ensure that your wallet remains fortified against emerging threats and exploits. Neglecting updates leaves your wallet susceptible to known vulnerabilities, increasing the risk of unauthorized access and potential loss of funds.

Secure Key Storage

Your private keys serve as the ultimate gateway to your cryptocurrency holdings, underscoring the importance of secure storage practices. Hardware wallets stand out as the gold standard for private key storage, offering unparalleled protection against various forms of cyber threats. If opting for software wallets, exercise caution and refrain from storing private keys on your device or in cloud storage, as these avenues are susceptible to hacking and unauthorized access. Consider leveraging a reputable password manager specifically designed for secure key storage to safeguard your private keys effectively.

Diversification

Mitigating risk through diversification is a prudent strategy when it comes to managing your cryptocurrency holdings. Distributing your assets across different wallet types and platforms helps minimize the impact of potential security breaches or vulnerabilities affecting a single wallet. For instance, you might allocate a smaller portion of your holdings for everyday transactions in a mobile wallet while reserving the bulk of your assets in a hardware wallet for long-term security. By diversifying your holdings across multiple wallets, you reduce the likelihood of a single point of failure compromising your entire cryptocurrency portfolio.

Regular Security Audits

Proactive vigilance is essential in the realm of cryptocurrency security. Conducting regular security audits of your wallets and overall crypto holdings enables you to identify and address potential weaknesses before they can be exploited by malicious actors. Consider enlisting the services of reputable firms that specialize in security audits to comprehensively evaluate the integrity of your wallets and assess your overall security posture. These audits provide invaluable insights and recommendations for enhancing the security of your cryptocurrency holdings and safeguarding your assets against emerging threats and vulnerabilities.

Security Best Practices

Ensuring the security of cryptocurrency holdings is paramount to safeguarding against theft, fraud, and unauthorized access.

Private Key Management

Imagine your private keys as the master keys to your cryptocurrency vault. These unique digital codes grant access and control over your funds. Given their immense importance, secure storage and management of private keys are paramount. Hardware wallets, resembling sleek USB drives, offer a robust solution. They store private keys offline, shielded from the ever-present dangers lurking in the online world. By minimizing online exposure, hardware wallets significantly reduce the vulnerability of your keys to cyberattacks.

Two-Factor Authentication (2FA)

Two-factor authentication (2FA) serves as a powerful additional security measure for your cryptocurrency accounts. Think of it as a two-step verification process. Beyond the standard password entry, 2FA necessitates an additional form of verification, typically a unique code delivered to your registered mobile device or email. This additional hurdle significantly impedes unauthorized access attempts. Even if a malicious actor obtains your password, they’ll be thwarted by the need for the secondary code, significantly bolstering your account’s security posture.

Cold Storage: Taking Security to Sub-Zero Levels

For an extra layer of protection, consider cold storage, the practice of keeping your cryptocurrency keys entirely offline, completely severing their connection to the internet. This effectively freezes them out of reach of online threats like hacking attempts and phishing scams that prey on unsuspecting users. Several cold storage solutions exist, including hardware wallets (mentioned previously), paper wallets (where private keys are physically printed on paper), and even dedicated offline computer systems solely for cryptocurrency storage. By employing cold storage, you significantly reduce the attack surface for potential security breaches.

Scrutinize Transactions

Scrutinizing transactions is a critical aspect of cryptocurrency management, as even a single error can lead to irreversible loss of funds. It’s imperative to double-check recipient wallet addresses meticulously before initiating any transfers. Statistics show that a significant number of cryptocurrency users have fallen victim to erroneous transactions due to typographical errors in wallet addresses.

To mitigate this risk, consider leveraging copy-and-paste functionality when inputting wallet addresses. This simple yet effective precaution can drastically reduce the likelihood of errors, as manually typing out lengthy alphanumeric strings increases the chance of mistyping. Moreover, utilizing reputable cryptocurrency wallets with built-in address verification features can provide an added layer of security by flagging potentially incorrect addresses before transactions are finalized.

Additionally, it’s advisable to verify the first few and last few characters of the recipient’s wallet address to ensure consistency and accuracy. Scammers often employ tactics such as creating fraudulent addresses that closely resemble legitimate ones, hoping to capitalize on human error. By exercising diligence and attention to detail, users can thwart such attempts and safeguard their funds against potential loss.

Prioritize Software Updates

According to a study by Chainalysis, in 2023, over $20 billion worth of cryptocurrency was lost or stolen due to hacking incidents. Many of these breaches were perpetrated by exploiting software vulnerabilities. Maintaining the latest updates for your cryptocurrency wallets, operating systems, and web browsers is paramount.

These updates frequently include security patches that address recently discovered weaknesses. With cybercriminals constantly innovating exploitation techniques, software updates act as a vital shield against these evolving threats. By promptly installing updates, you ensure your software remains protected against the latest security risks.

Be Wary of Social Engineering

Social engineering scams are a devious method employed by attackers to manipulate users into divulging sensitive information like private keys or login credentials. These scams can be meticulously crafted to appear legitimate, often taking the form of emails, websites, or even phone calls impersonating trusted entities. Cultivate a habit of scrutinizing all communications with a critical eye. Be especially wary of unsolicited investment offers that promise outsized returns with minimal risk. If an offer appears too good to be true, it most likely is. When faced with uncertainty, don’t hesitate to reach out to the official channels of the platform or service in question to verify the authenticity of a communication.

Distribute Your Holdings and Leverage Hardware Wallets

Mitigating risk can be achieved by dispersing your cryptocurrency holdings across multiple wallets. In the unfortunate event that one wallet is compromised, the damage is confined. Consider a multi-pronged approach, utilizing hot wallets for easy access to frequently used funds and cold storage for larger holdings intended for long-term investment. Hardware wallets, known for their enhanced security features, can also be effectively integrated into everyday transactions. These tamper-evident devices store your private keys offline, significantly reducing the attack surface for hackers who primarily target online systems.

Embrace Multi-Factor Authentication (MFA)

MFA adds an extra layer of security to your cryptocurrency accounts, requiring not only your password but also a secondary verification factor, such as a code from your phone or a fingerprint scan. This significantly reduces the risk of unauthorized access, even if your password is compromised. Look for platforms and wallets that offer robust MFA options and enable them wherever available.

Practice Smart Password Management

Strong, unique passwords are crucial for protecting your cryptocurrency accounts. Avoid using easily guessable information like birthdays or pet names. Consider using a password manager to generate and store complex passwords for all your online accounts. Remember, password reuse across different platforms exposes you to a domino effect if one account is breached.

Stay Informed and Vigilant

The cryptocurrency landscape is constantly evolving, and so are the threats it faces. Staying informed about the latest security threats and best practices empowers you to take proactive measures to safeguard your assets. A wealth of knowledge can be gleaned from reputable sources such as security blogs, forums maintained by cryptocurrency exchanges, and educational content from established blockchain companies. By diligently staying informed, you equip yourself to stay ahead of emerging threats and proactively safeguard your cryptocurrency investments.

Navigating the Cryptocurrency Market

Navigating the cryptocurrency market successfully requires a multifaceted approach, incorporating comprehensive analysis, strategic planning, and a keen awareness of regulatory guidelines. Let’s delve deeper into each aspect to elucidate their significance in the dynamic realm of digital currencies.

Market Analysis

The foundation of any successful venture in the cryptocurrency space rests on a solid understanding of market dynamics. This involves delving into various facets, such as cryptocurrency trends, market sentiment, and fundamental indicators. Techniques like technical analysis, which scrutinizes price charts and trading volumes, can help discern patterns and make informed decisions. Similarly, fundamental analysis delves into the underlying factors driving a cryptocurrency’s value, including its technology, team, and real-world utility. Additionally, sentiment analysis gauges the collective mood of market participants, offering valuable insights into potential market movements.

Investment Strategies

Cryptocurrency investment strategies are as diverse as the assets themselves, catering to individual risk appetites, investment objectives, and time horizons. For those with a long-term outlook, hodling, or holding onto assets for an extended period can prove lucrative, especially for fundamentally strong projects. Dollar-cost averaging (DCA) is another popular strategy wherein investors regularly purchase a fixed dollar amount of a cryptocurrency, mitigating the impact of short-term volatility. Furthermore, portfolio diversification across different cryptocurrencies and asset classes can spread risk and enhance overall stability.

Regulatory Considerations

In an environment marked by regulatory uncertainty and evolving compliance standards, staying abreast of regulatory developments is paramount. Cryptocurrency investors, exchanges, and service providers must navigate a complex landscape of legal frameworks and compliance obligations across various jurisdictions. By keeping a close eye on regulatory updates and adhering to applicable guidelines, investors can mitigate regulatory risks and ensure their activities remain within the bounds of the law.

Risk Management

Cryptocurrency markets are renowned for their volatility, presenting both opportunities and risks. Implementing robust risk management strategies is essential to safeguard investments against adverse market movements. Techniques such as setting stop-loss orders, diversifying across assets with varying risk profiles, and allocating only a portion of one’s portfolio to cryptocurrencies can help mitigate downside risk.

In recent years, the cryptocurrency market has experienced significant fluctuations, with prices often exhibiting rapid and unpredictable movements. By setting stop-loss orders, investors can establish predefined price levels at which their assets will be automatically sold to limit losses in the event of adverse price movements. Diversification across assets with different risk profiles, such as combining high-capacity cryptocurrencies with stablecoins or traditional assets, can further spread risk and enhance portfolio resilience. Additionally, allocating only a portion of one’s investment portfolio to cryptocurrencies, particularly for conservative investors, can mitigate exposure to the inherent volatility of digital assets.

Security Best Practices

Protecting one’s cryptocurrency holdings from theft, hacking, and other security threats is paramount in the digital realm. Adhering to security best practices such as using hardware wallets, enabling two-factor authentication (2FA), and employing strong, unique passwords can fortify defenses against unauthorized access. Additionally, staying vigilant against phishing attempts and regularly updating software and firmware further enhances security posture.

Recent data breaches and security incidents have underscored the importance of robust security measures in safeguarding cryptocurrency holdings.

Utilizing hardware wallets, which store private keys offline and require physical access to initiate transactions, provides an added layer of protection against remote hacking attempts. Enabling two-factor authentication (2FA) adds an extra step to the login process, requiring users to provide a secondary form of verification, such as a code sent to their mobile device, to access their accounts. Moreover, employing strong, unique passwords generated using password management tools can prevent unauthorized access to accounts.

Market Psychology

Understanding the behavioral patterns and psychological biases that drive market participants can provide valuable insights into market dynamics. Greed, fear, and herd mentality often influence investor decisions, leading to irrational exuberance or panic selling. By cultivating emotional discipline, investors can avoid falling prey to impulsive actions and make more rational, informed choices.

Recent studies have highlighted the significant impact of market psychology on cryptocurrency prices and trading volumes. This underscores the importance of considering market sentiment alongside fundamental and technical analysis when making investment decisions.

Technological Innovations

The cryptocurrency landscape is characterized by rapid technological innovation, with new projects and protocols continually emerging. Staying abreast of technological developments, such as advancements in blockchain scalability, interoperability solutions, and privacy enhancements, can inform investment decisions and identify promising opportunities for growth. Some of the recent developments to take advantage of include:

Biometric Authentication: Fingerprint and facial recognition technologies are becoming increasingly sophisticated, offering a convenient and secure method for accessing your cryptocurrency accounts. However, it’s crucial to choose platforms that implement these technologies responsibly, with appropriate safeguards to prevent unauthorized access from biometric data breaches.

Decentralized Identity (DID): DIDs are emerging as a potential solution to the problem of managing digital identities in a secure and self-sovereign manner. By leveraging blockchain technology, DIDs empower users to control their personal information and grant access selectively, potentially reducing the reliance on centralized platforms that could become targets for hackers.

Community Engagement

Many successful cryptocurrency projects thrive on vibrant, engaged communities that support development, adoption, and network growth. Participating in community forums, attending conferences, and contributing to open-source projects can provide valuable insights into a project’s viability and foster connections within the broader cryptocurrency ecosystem.

Community engagement plays a pivotal role in driving the success of cryptocurrency projects, with active communities often serving as catalysts for innovation and adoption. By actively participating in community discussions, attending events, and contributing to project development, investors can gain valuable insights and contribute to the success of their chosen projects.

Conclusion

Cryptocurrencies have emerged as a transformative force in the global financial landscape, offering decentralized digital assets with the potential to revolutionize traditional banking systems, foster financial inclusion, and drive economic innovation. By understanding the core principles of blockchain technology, cryptography, and decentralization, as well as implementing robust security measures and navigating regulatory considerations, individuals and institutions can harness the power of cryptographic assets to participate in the digital revolution reshaping our world.

In conclusion, the future of cryptocurrencies holds immense promise, but it requires a nuanced understanding of technological advancements, market dynamics, and regulatory landscapes. With prudent risk management, strategic investment strategies, and a commitment to innovation and security, stakeholders can unlock the full potential of cryptocurrencies and contribute to the ongoing evolution of global finance.