Introduction

The global financial system is undergoing a significant transformation driven by the emergence of decentralized finance (DeFi). This innovative ecosystem offers a compelling alternative to traditional finance by leveraging blockchain technology and smart contracts to create a more open, transparent, and accessible financial landscape.

This white paper aims to provide a comprehensive overview of DeFi, exploring its core principles, key players, innovative protocols, and the transformative impact it has on traditional financial systems. Additionally, the paper will also help learn about the challenges associated with DeFi, including security risks, regulatory uncertainties, and integration issues. Finally, it will discuss the future outlook of DeFi and the potential opportunities and challenges that lie ahead.

Overview of Decentralized Finance (DeFi)

Decentralized finance (DeFi) has emerged as a revolutionary force in the financial landscape. Unlike traditional finance, which relies on centralized institutions like banks and brokerage firms, DeFi leverages blockchain technology and smart contracts to create a peer-to-peer (P2P) financial ecosystem. This disintermediation empowers individuals to participate in financial activities directly, cutting out intermediaries and potentially reducing costs and increasing accessibility.

Importance of DeFi in Revolutionizing Financial Systems

The current financial system faces several limitations, including:

- Limited Access: Millions of people globally lack access to basic financial services due to geographical constraints, bureaucratic hurdles, or stringent eligibility criteria.

- High Fees and Opaque Processes: Traditional financial institutions often charge significant fees for transactions and investment products, and their processes can be complex and non-transparent.

- Centralized Control: The reliance on centralized institutions creates vulnerabilities to financial crises, manipulation, and censorship.

DeFi offers a potential solution by:

- Promoting Financial Inclusion: DeFi applications can be accessed by anyone with an internet connection, regardless of location or financial status.

- Enhancing Transparency: Blockchain technology provides an immutable record of transactions, fostering transparency and trust within the DeFi ecosystem.

- Facilitating Efficiency and Cost Reduction: By eliminating intermediaries, DeFi potentially reduces transaction fees and streamlines financial processes.

- Empowering Users: DeFi enables individuals to manage their finances independently and participate in a broader range of financial activities.

Understanding Decentralized Finance (DeFi)

Definition and Conceptual Framework

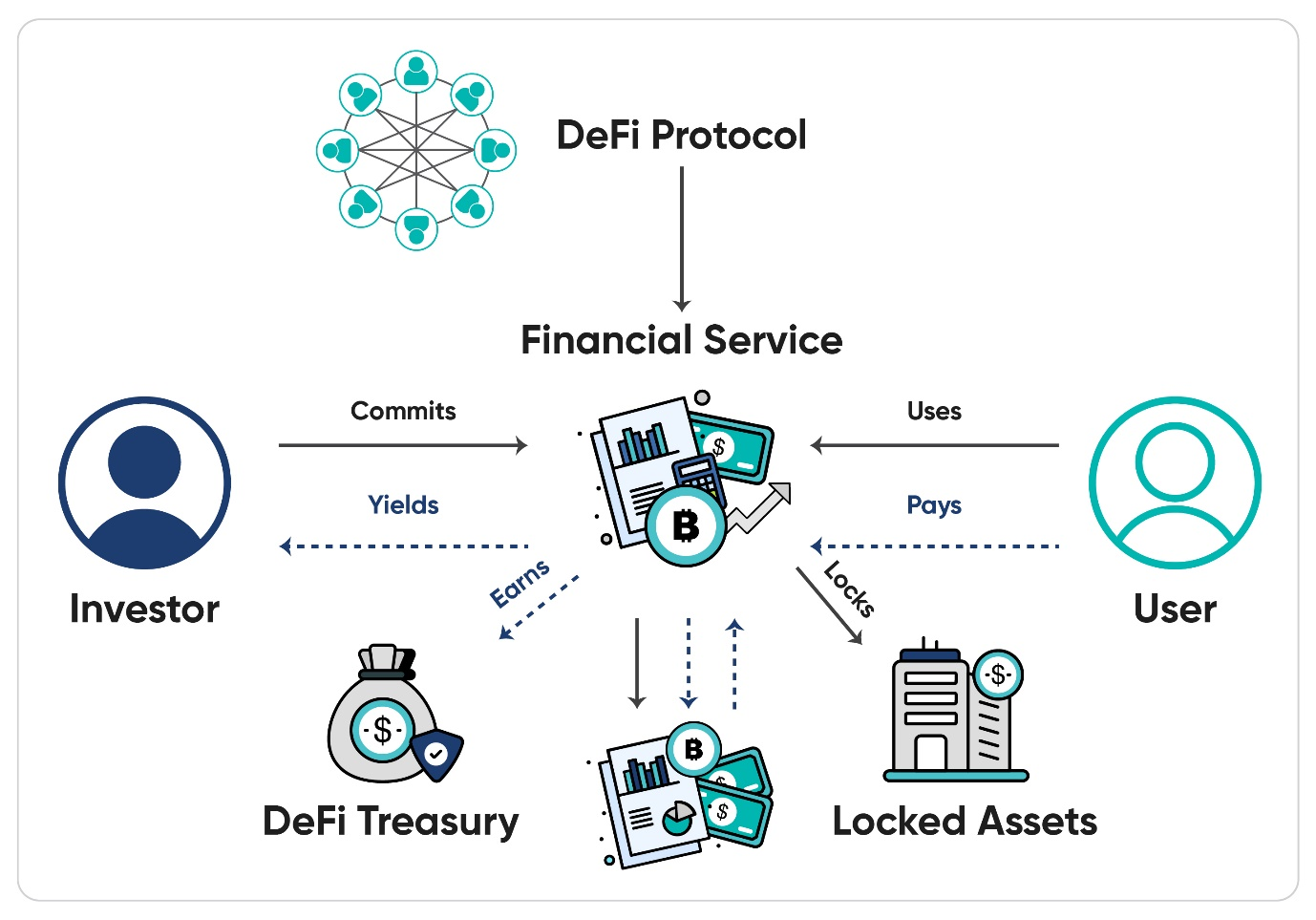

Decentralized Finance (DeFi) has emerged as a revolutionary force in the financial landscape. It represents a suite of innovative financial applications built upon the secure foundation of public blockchains, primarily Ethereum. These applications leverage the power of smart contracts – self-executing code stored permanently on the blockchain – to automate financial transactions and agreements in a decentralized and transparent manner.

Unlike traditional financial systems that rely on centralized intermediaries like banks, DeFi fosters a peer-to-peer (P2P) approach, empowering individuals to participate directly in financial activities without the need for gatekeepers.

The core functionalities offered by DeFi protocols cater to a broad spectrum of financial needs. Users can:

- Borrow and Lend Cryptocurrencies with Autonomy: DeFi protocols disrupt the traditional lending and borrowing landscape by facilitating P2P transactions. This eliminates the need for traditional financial institutions, potentially offering users more competitive interest rates and greater control over their assets.

- Trade Digital Assets through Decentralized Exchanges (DEXs): DEXs operate on a distributed network, allowing users to trade cryptocurrencies directly with each other without relying on a central authority. This fosters increased transparency, security, and potentially lower fees compared to centralized exchanges.

- Earn Interest on Cryptocurrency Holdings: DeFi platforms offer innovative ways for users to earn interest on their cryptocurrency holdings. Through mechanisms like liquidity pools and staking, users can generate passive income by contributing their digital assets to the DeFi ecosystem.

- Access a New Frontier of Financial Products: DeFi paves the way for a wave of innovative financial products built on blockchain technology. This includes access to decentralized derivatives that allow users to speculate on the future value of assets and even decentralized insurance products that offer peer-to-peer risk mitigation solutions.

Other direct benefits of P2P transactions are represented by the infographic below:

Historical Evolution and Background

The concept of DeFi originated with the emergence of Bitcoin in 2009, which established the foundation for a decentralized financial system by challenging the traditional model dominated by centralized institutions. However, the development of DeFi applications truly began with the launch of Ethereum in 2015. Ethereum’s revolutionary introduction of smart contracts – self-executing code stored permanently on the blockchain – opened a new chapter in financial innovation. Smart contracts enabled the creation of programmable financial instruments directly on the Ethereum blockchain, fostering a fertile ground for the development of DeFi applications.

Early DeFi protocols primarily focused on disrupting the lending and borrowing landscape by facilitating peer-to-peer transactions of cryptocurrencies. This eliminated the need for traditional financial institutions, potentially offering users more control over their assets and potentially more competitive interest rates. Over time, the DeFi ecosystem has grown exponentially, transforming from a niche concept into a diverse and thriving marketplace.

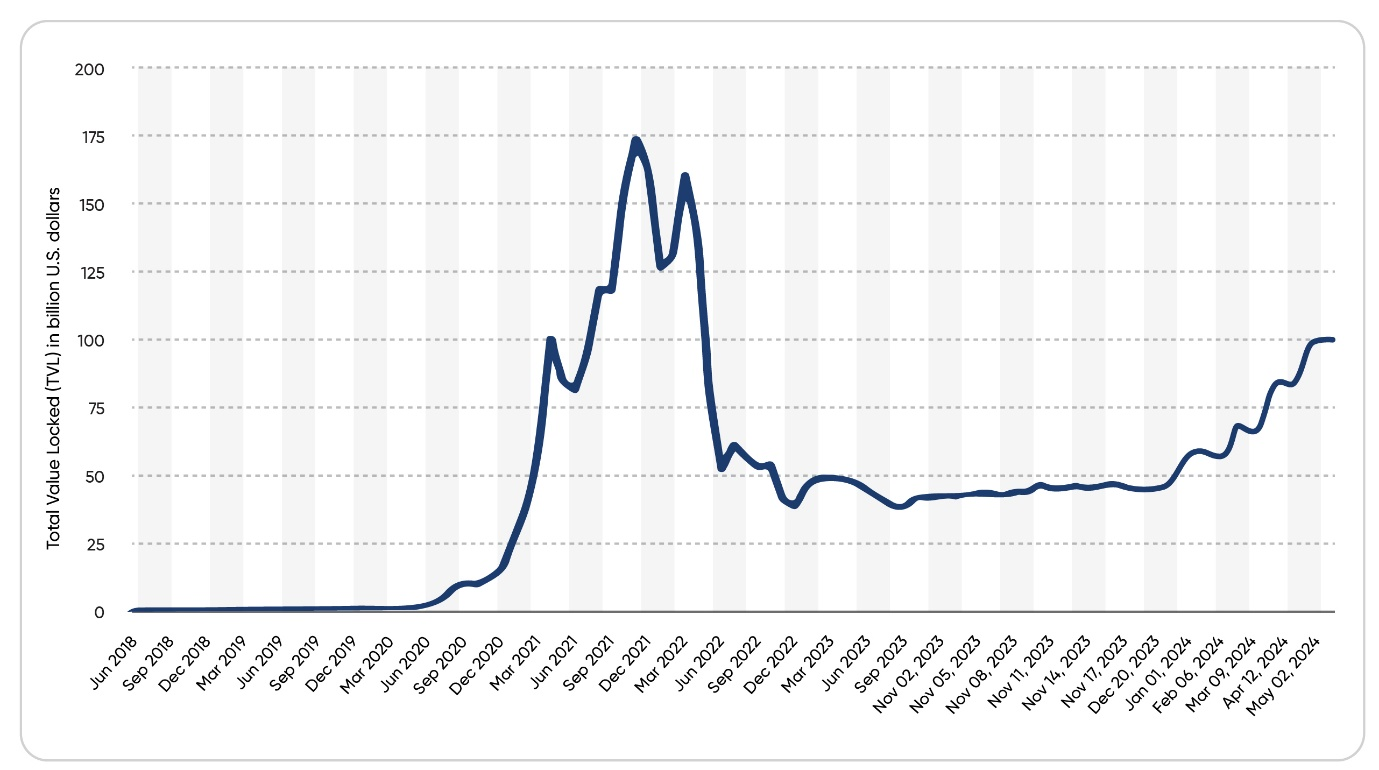

According to a recent report, the total value locked (TVL) in DeFi protocols again surpassed a staggering $100 billion mark in May 2024. This exponential growth, after seeing an all-time low in 2023, and with TVL surging from a mere $1 billion in early 2020, signifies the rapid adoption and immense potential of DeFi. As DeFi continues to evolve, it’s projected to attract even greater participation from individuals, institutions, and traditional financial players seeking to tap into this dynamic and innovative financial frontier.

Characteristics and Principles of DeFi

DeFi stands tall on four pillars that fundamentally redefine the way we interact with financial services:

- Decentralization: DeFi operates on a distributed network, dismantling the reliance on central authorities like banks or financial institutions. This empowers users to take control of their finances, eliminating the need for intermediaries to approve transactions or manage their assets. Imagine a financial system where you, not a bank, hold the private keys to your digital wallet and have complete autonomy over your funds.

- Transparency:All transactions within a DeFi protocol are immutably recorded on a public blockchain ledger. This fosters complete transparency, allowing anyone to verify the legitimacy and details of any transaction. This stands in stark contrast to traditional financial systems, where transaction details can be opaque and shrouded in layers of bureaucracy.

- Accessibility: DeFi applications are designed with inclusivity in mind. Anyone with an internet connection and a compatible digital wallet can access a vast array of financial services offered by DeFi platforms. This eliminates geographical limitations and empowers individuals from all over the world, even those who are unbanked or under-banked by traditional financial institutions, to participate in the global financial system.

- Programmability: Smart contracts, the backbone of DeFi, are self-executing code stored on the blockchain. These contracts automate complex financial processes and agreements, eliminating the need for manual intervention and human error. This fosters greater efficiency and reduces the risk of errors or fraud that can plague traditional financial transactions. For example, a DeFi lending protocol can leverage smart contracts to automatically disburse loan funds upon fulfillment of predefined collateralization requirements, streamlining the entire lending process.

Comparison with Traditional Finance Systems

| Feature | Traditional Finance | Decentralized Finance (DeFi) |

| Intermediaries | Relies on banks, brokers, and other institutions | Peer-to-peer (P2P) transactions |

| Transparency | Transactions may be opaque and complex | All transactions are recorded on a public ledger (blockchain) |

| Accessibility | Limited access for some demographics | Open to anyone with an internet connection and a digital wallet |

| Fees | Transaction fees can be high | Potentially lower fees due to reduced number of intermediaries |

| Control | Centralized control by institutions | User-controlled and self-custodial |

Key Players and Ecosystem of DeFi

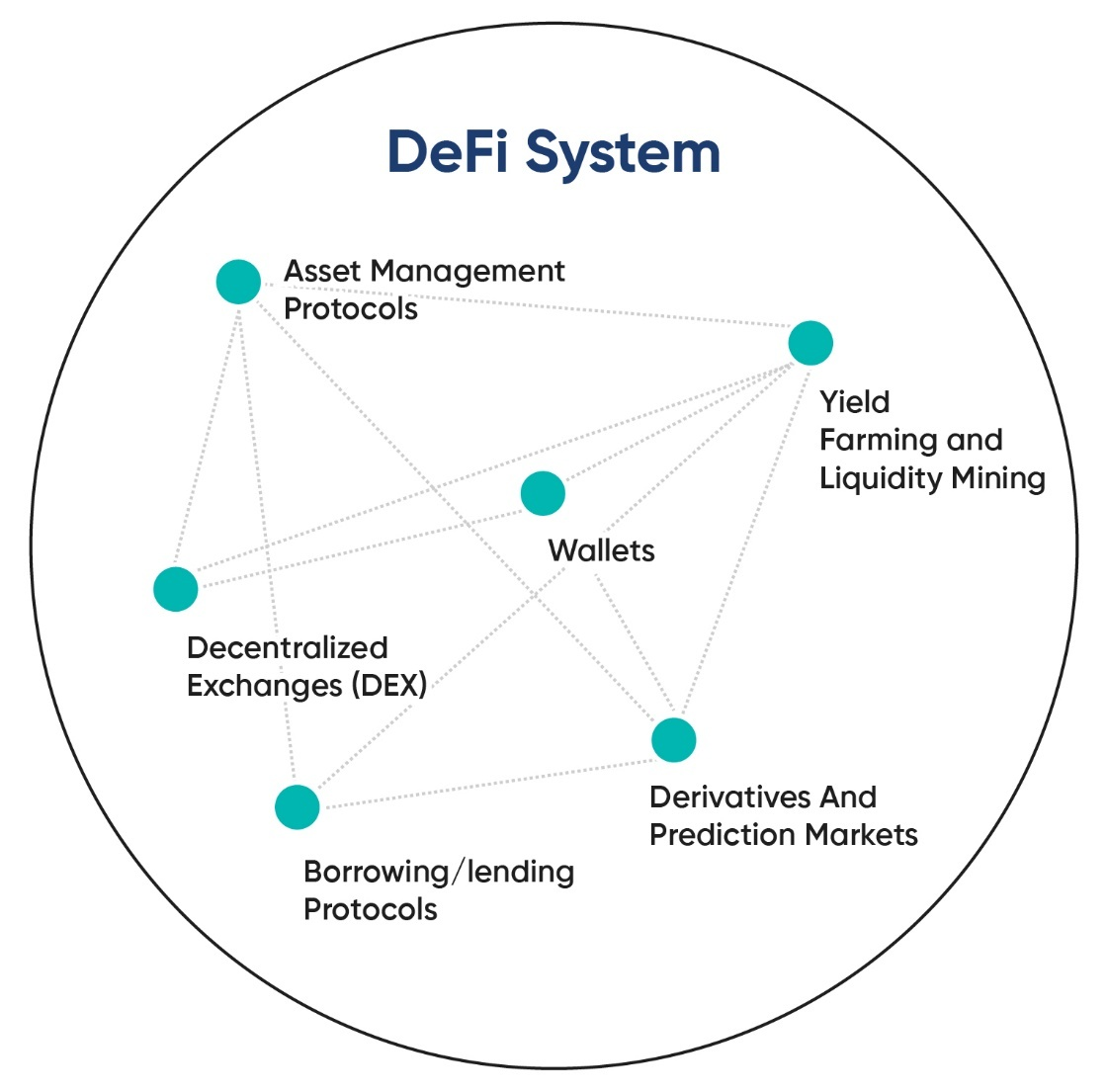

The DeFi ecosystem thrives on a network of interconnected protocols, platforms, and participants. Understanding these key players is crucial to grasping the intricate workings of DeFi.

Protocols and Platforms

Ethereum and Smart Contracts

Ethereum, the second-largest blockchain by market capitalization, serves as the foundation for most DeFi applications. It provides a platform for developers to build decentralized applications (dApps) using smart contracts. Smart contracts are self-executing contracts stored on the blockchain that automatically execute pre-defined terms and conditions upon meeting specific criteria. They eliminate the need for intermediaries, fostering trust and transparency within the DeFi ecosystem.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) facilitate peer-to-peer (P2P) trading of cryptocurrencies and other digital assets. Unlike traditional centralized exchanges (CEXs) controlled by a single entity, DEXs operate on a distributed network, allowing users to trade directly with each other without relying on a central authority. This eliminates the risk of exchange hacks and custodial issues associated with CEXs.

There are two main types of DEXs:

- Order Book DEXs: These DEXs function similarly to traditional order book exchanges, where users submit buy and sell orders that are matched by an automated system. However, instead of relying on a central order book, they utilize on-chain order books stored on the blockchain.

- Automated Market Makers (AMMs): AMMs rely on smart contracts to automate liquidity provision and price discovery. Users can deposit their crypto assets into liquidity pools, which are then used to facilitate trading between other users. The price of assets within an AMM pool is determined by a predetermined mathematical formula based on the ratio of deposited assets.

Lending and Borrowing Platforms

DeFi lending and borrowing platforms allow users to borrow and lend cryptocurrencies without relying on traditional financial institutions. These platforms leverage smart contracts to create a permission-less lending marketplace. Users can deposit their crypto holdings into these platforms to earn interest, while borrowers can access crypto loans at potentially lower interest rates compared to traditional lenders.

Automated Market Makers (AMMs) as a Special Case

While previously mentioned as a type of DEX, AMMs deserve further exploration due to their unique functionality that extends beyond just facilitating cryptocurrency trading. AMMs play a crucial role in DeFi by providing liquidity for other DeFi protocols and fostering a more efficient ecosystem. Here’s a deeper dive into how AMMs function:

- Liquidity Pools: AMMs rely on liquidity pools created by users who deposit their crypto assets. These pools provide the necessary liquidity for trading on the platform. Users who contribute to liquidity pools earn fees from trading activity on the platform.

- Automated Price Discovery: AMMs utilize mathematical formulas to determine the price of assets within a liquidity pool. These formulas typically rely on the constant product market maker (CPMM) model, where the price of an asset is inversely proportional to the amount of that asset in the pool. The innovation of AMMs lies in their ability to facilitate decentralized trading and liquidity provision without the need for traditional order books or market makers. This fosters a more automated and efficient financial ecosystem.

Governance Models

Many DeFi protocols operate through decentralized autonomous organizations (DAOs). DAOs are community-driven entities where governance decisions are made collectively by token holders. These token holders participate in voting on proposals related to the protocol’s development, upgrades, and fee structures. This ensures a transparent and democratic governance process where users have a say in the future of the protocol.

Role of Developers and Community

The DeFi ecosystem thrives on a vibrant community of developers, entrepreneurs, and enthusiasts. Developers play a critical role by building innovative DeFi protocols and dApps that continuously expand the functionalities of the ecosystem. Additionally, the DeFi community plays a vital role in:

- Maintaining and securing the network: DeFi protocols are open-source, allowing anyone to contribute to their development and security.

- Promoting awareness and adoption: DeFi enthusiasts actively promote DeFi and educate users about its benefits and functionalities.

- Governance participation: Through active participation in DAO voting, the community helps shape the direction of DeFi protocols.

Innovative Protocols in Decentralized Finance

DeFi boasts a diverse range of innovative protocols that cater to various financial needs. Let’s explore some of the most prominent categories:

Decentralized Exchanges (DEXs)

As previously discussed, DEXs facilitate peer-to-peer trading of digital assets. Here, we’ll explore some leading DEXs and their unique features:

- Uniswap (v1, v2, v3): A pioneering DEX known for its user-friendly interface and automated liquidity provision through AMMs. Uniswap offers various versions, each with distinct functionalities:

- Uniswap v1: The original version, reliant on a simple automated market maker (AMM) model.

- Uniswap v2: Introduced increased flexibility for liquidity providers and fee structures.

- Uniswap v3: Offers concentrated liquidity pools, allowing users to deposit capital into specific price ranges for potentially higher returns.

- SushiSwap (SUSHI): A fork of Uniswap, offering similar functionalities with additional features like its native SUSHI token, used for governance and earning rewards.

- PancakeSwap (CAKE): A popular DEX built on the Binance Smart Chain (BSC), known for its faster transaction speeds and lower fees compared to Ethereum-based DEXs. It offers its native CAKE token for staking and governance purposes.

Lending and Borrowing Protocols

These protocols enable users to earn interest on deposited crypto assets or borrow crypto at competitive rates. Here are some notable examples:

- Compound (COMP): A leading DeFi lending and borrowing platform known for its simplicity and ease of use. Users can deposit various cryptocurrencies and earn interest or borrow crypto at variable interest rates. COMP, the platform’s token, grants governance rights.

- Aave (AAVE): A versatile DeFi platform offering a wider range of functionalities compared to Compound. Aave allows users to supply and borrow various crypto assets, including stablecoins, at both fixed and variable interest rates. Additionally, it facilitates flash loans – unsecured loans that must be repaid within the same transaction block. AAVE, the platform’s token, serves for governance purposes.

- MakerDAO (MKR): A decentralized lending platform known for its native stablecoin, DAI. Unlike other stablecoins pegged to fiat currencies, DAI is algorithmically generated and backed by collateralized debt positions (CDPs). Users can deposit crypto assets as collateral to mint DAI and borrow against it. MKR, the platform’s token, serves for governance and system parameter adjustments.

Yield Farming and Liquidity Mining

These incentivize users to provide liquidity to DeFi protocols. Here’s how they work:

- Yield Farming: Users deposit their crypto assets into liquidity pools on DeFi protocols like Uniswap or Compound. In return, they earn rewards in the form of the platform’s native token or other cryptocurrencies.

- Liquidity Mining: Similar to yield farming, but users are explicitly rewarded with tokens issued by the DeFi protocol itself. This incentivizes users to provide liquidity and fosters the growth of the protocol.

It’s important to note that yield farming and liquidity mining can involve high risks due to potential impermanent loss – a situation where the value of the deposited assets fluctuates, leading to a potential loss upon withdrawal.

Derivatives and Prediction Markets

DeFi enables the creation of decentralized derivatives and prediction markets:

- Derivatives: These are financial contracts derived from the value of underlying assets like cryptocurrencies. DeFi allows for peer-to-peer derivatives trading without relying on traditional exchanges. Examples include decentralized options and futures markets.

- Prediction Markets: These are platforms where users can speculate on the outcome of future events by buying and selling tokens representing different outcomes. DeFi prediction markets can be used for various purposes, such as forecasting cryptocurrency prices or election results.

Tokenization of Assets

DeFi facilitates the tokenization of real-world assets. This involves creating digital tokens on a blockchain that represent ownership or rights to a physical asset like real estate, artwork, or even intellectual property. Tokenization allows for fractional ownership, increased liquidity, and potentially more efficient asset trading.

Regulatory Challenges and Compliance in DeFi

The rapid growth of DeFi has attracted the attention of regulators worldwide. As this innovative financial ecosystem continues to evolve, establishing a clear and effective regulatory framework remains a complex challenge. This section dives deep into the intricate landscape of DeFi regulation and its implications for both projects and users.

Regulatory Landscape

- Global Perspectives: Unlike traditional financial systems governed by well-defined regulations, DeFi currently operates in a regulatory grey area. There’s no single, unified global framework overseeing DeFi activities. Different countries are taking a wait-and-see approach, cautiously observing developments before implementing regulations. Others are actively exploring potential regulatory frameworks to address the unique challenges posed by DeFi. This lack of global consensus creates uncertainty for both DeFi projects and users who may operate across different jurisdictions with varying regulatory environments.

- Jurisdictional Variations: The regulatory landscape for DeFi can be a labyrinth, with significant variations from country to country. Some regions may adopt a more lenient stance, allowing DeFi to flourish with minimal restrictions. Conversely, other regions might impose stricter regulations, potentially hindering innovation and limiting access to DeFi services for users within their borders. This inconsistency across jurisdictions makes it challenging for DeFi projects to navigate the regulatory landscape and ensure compliance with a patchwork of rules.

Compliance Challenges

DeFi poses several challenges for regulators, including:

- Know Your Customer (KYC) and Anti-Money Laundering (AML)Regulations: Traditional financial institutions are subject to stringent KYC/AML regulations. These regulations require verification of user identities and monitoring of transactions to prevent money laundering and terrorist financing. However, DeFi protocols, by design, are often permission-less. This means that anyone with an internet connection and a digital wallet can participate in DeFi activities without necessarily going through identity verification processes. This anonymity makes it difficult for regulators to enforce KYC/AML regulations within the DeFi ecosystem, raising concerns about potential misuse of illegal activities.

- Securities Laws: The line between utility tokens used within a DeFi protocol and securities can sometimes be blurry. Regulatory bodies may classify certain DeFi projects as unregistered securities offerings. This classification could subject these projects to stricter regulations and registration requirements, potentially stifling innovation and hindering the growth of DeFi. Additionally, such regulations could limit access to DeFi for certain users who may not meet investor accreditation standards typically required for securities offerings.

- Tax Implications: The tax treatment of DeFi activities remains a source of confusion for users. The complexities surrounding cryptocurrency transactions and DeFi interactions with traditional financial systems often lead to unclear tax regulations. This lack of clarity can make it difficult for users to accurately report their DeFi earnings and activities to tax authorities, potentially leading to unintended tax consequences.

Emerging Regulatory Responses

Despite the challenges, regulators are exploring potential solutions:

- Regulatory Sandboxes: These controlled environments provide a safe space for DeFi projects to experiment and test their protocols under the watchful eye of regulators. This allows regulators to gain valuable insights into the inner workings of DeFi while enabling projects to refine their offerings within a defined regulatory framework. Regulatory sandboxes foster innovation while promoting responsible development within the DeFi space.

- Self-Regulatory Initiatives: Recognizing the need for self-governance, some DeFi projects are taking the initiative to develop self-regulatory frameworks. These frameworks establish best practices and address compliance concerns within their respective DeFi communities. These efforts help build trust and legitimacy within the DeFi ecosystem, demonstrating the industry’s commitment to responsible operation.

- DeFi-Specific Regulations: In some jurisdictions, regulators are exploring the development of regulations specifically tailored to DeFi. These regulations aim to strike a balance between encouraging innovation and protecting investors. By creating a regulatory framework that acknowledges the unique characteristics of DeFi, these efforts aim to provide greater clarity for both DeFi projects and users. This fosters a more predictable environment where innovation can flourish within a defined set of regulatory boundaries.

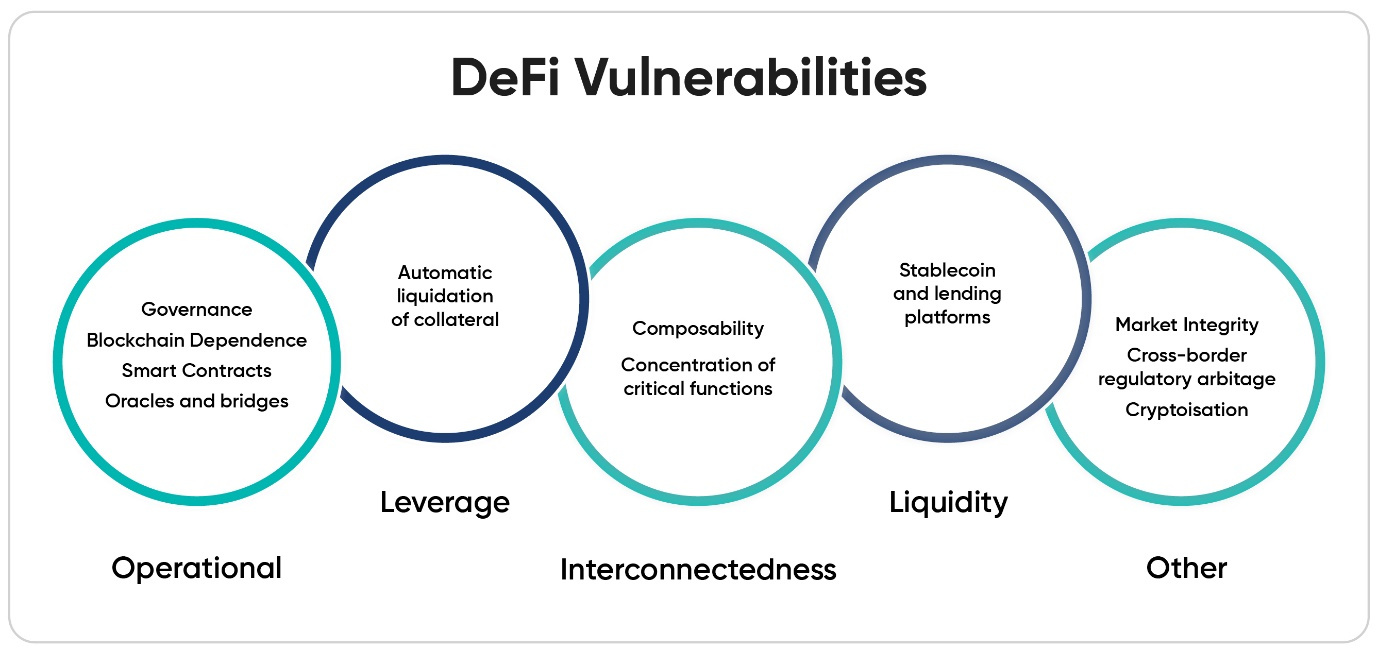

Security and Risks in DeFi

While DeFi unlocks a world of financial possibilities, it’s paramount to be aware of the inherent security risks that lurk within this innovative ecosystem. Unlike traditional financial institutions with established security protocols and regulatory oversight, DeFi operates on a frontier brimming with both immense potential and significant risks. Here, we delve deeper into the key security concerns that DeFi users should be aware of:

Smart Contract Vulnerabilities

The backbone of DeFi applications lies in smart contracts – self-executing code stored permanently on the blockchain. These contracts automate complex financial transactions and agreements, eliminating the need for intermediaries. However, smart contracts, like any software, are susceptible to vulnerabilities and bugs. These vulnerabilities, if exploited by malicious actors, can lead to devastating consequences, resulting in the loss of user funds. Unlike traditional software where patches can be deployed to fix bugs, smart contracts, once deployed on the blockchain, are immutable. This immutability makes patching vulnerabilities a complex and challenging task. Even a seemingly minor bug in a smart contract can be exploited, potentially leading to the theft of millions of dollars’ worth of cryptocurrency from unsuspecting users.

Hacks and Exploits

DeFi protocols, brimming with valuable digital assets, have become a prime target for hackers and cybercriminals. These malicious actors employ a diverse arsenal of techniques to launch attacks on DeFi platforms. Here are some common attack methods:

- Flash Loan Attacks: Flash loans allow users to borrow a large amount of cryptocurrency on a DeFi platform without upfront collateral. Hackers can exploit this feature to manipulate DeFi protocols and drain them of their assets before the borrowed funds need to be repaid. These attacks are complex and require a deep understanding of DeFi protocols, but their potential for large-scale theft makes them a significant threat.

- Exploiting Smart Contract Vulnerabilities: As mentioned earlier, vulnerabilities in smart contracts are a major security concern. Hackers constantly scan DeFi protocols for weaknesses in their code. Once a vulnerability is identified, they can exploit it to steal user funds, manipulate DeFi functionalities, or disrupt the entire protocol.

Oracles and Data Feeds

Many DeFi protocols rely on oracles to function. Oracles act as bridges between the blockchain and the external world, providing crucial data feeds such as cryptocurrency prices or real-world asset valuations. The accuracy and reliability of these data feeds are essential for the proper functioning of DeFi applications. However, if oracles are compromised or provide inaccurate data, it can have a cascading effect. For instance, if a DeFi lending protocol relies on an oracle to determine collateralization requirements for loans, compromised or inaccurate data could lead to users losing their assets or the entire protocol becoming insolvent.

Custodial Risks

While some DeFi applications operate in a completely non-custodial manner, others require users to deposit their assets into wallets controlled by the protocol itself. These custodial wallets are a double-edged sword. On the one hand, they offer convenience and ease of use for beginners. However, on the other hand, they introduce an element of trust. If the DeFi platform suffers a security breach or the entity controlling the custodial wallet is compromised, users could lose their entire digital holdings. It’s crucial for users to carefully evaluate the security practices and reputation of DeFi platforms before entrusting them with their assets.

Regulatory Risks

The regulatory landscape surrounding DeFi is still evolving. While some governments are exploring ways to embrace and foster innovation within the DeFi space, others are taking a more cautious approach, implementing stricter regulations or even outright bans. This regulatory uncertainty can create challenges for DeFi projects and users alike. Changing regulations could disrupt existing DeFi applications, limit access to certain services, or even stifle innovation within the ecosystem.

Staying informed about regulatory developments and choosing DeFi platforms operating within compliant frameworks is essential for mitigating these risks. Here are some ways to avoid the risks:

Smart Contracts

Smart contracts are the cornerstone of DeFi applications. However, even the most well-intentioned code can harbor vulnerabilities. To mitigate this risk, thorough security audits conducted by reputable firms are essential.

These audits involve a meticulous examination of the smart contract code by experienced security professionals. The auditors identify potential vulnerabilities, bugs, and logic flaws that malicious actors could exploit. By proactively addressing these vulnerabilities before deployment, smart contract audits play a vital role in safeguarding user funds and ensuring the integrity of DeFi protocols.

Best Practices

Security in DeFi is a shared responsibility. Both developers and users have a role to play in upholding robust security practices. Developers should adhere to secure coding techniques, employing well-established best practices throughout the development lifecycle. This includes utilizing secure coding libraries, implementing unit tests to identify bugs early in the development phase, and conducting code reviews by other developers to identify potential weaknesses.

Furthermore, users should prioritize keeping their DeFi-related software up-to-date. Updates often include security patches that address newly discovered vulnerabilities. By adopting a culture of security consciousness, both developers and users can contribute to a more secure DeFi ecosystem.

Decentralized Oracles

As discussed earlier, oracles represent a potential Achilles’ heel for DeFi. Their role as the bridge between the blockchain and the external world makes them a prime target for attacks. A single point of failure within an Oracle system can have devastating consequences for DeFi protocols that rely on accurate data feeds.

To mitigate this risk, the adoption of decentralized oracles is gaining traction. Decentralized oracles source data from multiple independent providers, fostering greater reliability and resilience. If one data feed is compromised or inaccurate, the others can still provide a relatively accurate picture, minimizing the impact of a single point of failure.

Self-Custody

While some DeFi applications offer user-friendly custodial wallets, these solutions introduce an element of trust. By entrusting your digital assets to a third-party platform, you are essentially relying on their security practices to safeguard your funds. For users who prioritize maximum control over their assets, self-custody solutions offer an alternative.

Self-custody wallets grant users complete control over their private keys, eliminating the reliance on third-party custodians. However, it’s crucial to remember that self-custody solutions also place the onus of security entirely on the user. Losing your private keys can result in permanent loss of access to your digital assets.

Staying Informed

The world of DeFi is constantly evolving, and so are the security threats it faces. Staying abreast of the latest developments in both the technological and regulatory landscape is vital for users seeking to navigate DeFi safely. Following reputable security blogs and news outlets focused on DeFi can help users stay informed about emerging security threats and vulnerabilities. Additionally, keeping track of regulatory developments is crucial. Understanding how evolving regulations might impact the security landscape of DeFi allows users to make informed decisions and choose platforms that operate within compliant frameworks.

Decentralized Finance and Financial Inclusion

DeFi has the potential to revolutionize financial inclusion by:

Accessibility and Financial Empowerment

DeFi applications are accessible to anyone with an internet connection and a digital wallet, regardless of location or financial background. This empowers individuals who are currently unbanked or under-banked to access financial services and participate in the global financial system.

Banking the Unbanked

An estimated 1.4 billion adult’s worldwide lack access to a traditional bank account. DeFi offers an alternative solution for these individuals, allowing them to store their wealth, send and receive payments, and access financial products like loans and insurance.

Microfinance and Peer-to-Peer Lending

DeFi can facilitate peer-to-peer lending, enabling individuals to borrow and lend funds directly from each other without relying on traditional financial institutions. This can make microfinance more accessible and potentially reduce borrowing costs for individuals in developing economies.

However, challenges remain in achieving full financial inclusion through DeFi:

- Limited Internet Access: Not everyone has access to a reliable internet connection, which is a prerequisite for using DeFi applications.

- Technological Literacy: Using DeFi applications requires a certain level of technological literacy. Initiatives are needed to educate users about DeFi and how to use it safely.

- Regulatory Uncertainty: The unclear regulatory landscape can create hesitation for individuals and businesses to participate in DeFi.

Transformative Impact on Traditional Financial Systems

DeFi is poised to disrupt traditional financial systems in several ways:

- Disintermediation: DeFi eliminates the need for intermediaries like banks and brokerage firms in many financial transactions. This can lead to lower fees, faster transaction times, and greater control for users over their finances.

- Democratization of Finance: DeFi makes financial products and services more accessible to a wider range of individuals. This can help to level the playing field and create a more inclusive financial system.

- Efficiency and Cost Reductions: By automating many financial processes, DeFi can potentially lead to increased efficiency and cost reductions. This can benefit both users and financial institutions.

- Impact on Centralized Institutions: DeFi presents both challenges and opportunities for traditional financial institutions. While DeFi may disrupt some of their traditional business models, it can also create new opportunities for collaboration and innovation.

Here’s a more detailed breakdown of these potential impacts:

Challenges

- Loss of Market Share: Traditional financial institutions may lose market share to DeFi platforms, particularly for specific services like lending and borrowing.

- Regulatory Scrutiny: Increased regulatory scrutiny of DeFi could also indirectly impact traditional financial institutions, as regulators may seek to impose stricter regulations on the entire financial system.

Opportunities

- New Products and Services: Traditional financial institutions can leverage DeFi technologies to develop new products and services that appeal to a broader customer base. For example, they could offer DeFi-based investment products or custody solutions for digital assets.

- Collaboration: Collaboration between traditional financial institutions and DeFi projects can be mutually beneficial. Financial institutions can provide DeFi projects with much-needed regulatory expertise and compliance infrastructure, while DeFi projects can offer traditional institutions access to innovative technologies and a wider customer base.

Future Outlook and Potential Challenges

DeFi is a rapidly evolving ecosystem with immense potential to reshape the future of finance. However, several challenges need to be addressed to ensure its continued growth and adoption.

Scalability Issues

Current DeFi protocols often face scalability issues, particularly on the Ethereum blockchain. These issues can lead to slow transaction times and high fees. Several solutions are being explored to address scalability, such as layer-2 scaling solutions and alternative blockchain platforms designed specifically for DeFi.

Interoperability Challenges

DeFi protocols often operate on different blockchains, which can create interoperability challenges. This can make it difficult for users to seamlessly move their assets between different DeFi applications. The development of interoperable blockchain protocols and cross-chain bridges can help address these challenges.

Integration with Traditional Finance

Integration between DeFi and traditional finance can unlock new opportunities and benefits for both sectors. However, challenges remain, such as regulatory hurdles and the need for standardized infrastructure.

Technological Advancements and Innovation

The future success of DeFi hinges on continuous technological advancements and innovation. Here’s a deeper dive into some key areas of exploration:

Scalable Blockchains

Current DeFi applications often face scalability bottlenecks on blockchains like Ethereum. These bottlenecks limit the number of transactions that can be processed per second, leading to slow transaction times and high fees. To overcome these limitations, several promising solutions are emerging:

- Layer-2 Scaling Solutions:These solutions operate "on top" of existing blockchains like Ethereum, inheriting their security while processing transactions off-chain. This allows for faster and cheaper transactions while leveraging the security of the main blockchain. Examples of Layer-2 scaling solutions for DeFi include Polygon, Optimism, and Arbitrum.

- Alternative Blockchain Platforms:Blockchain platforms specifically designed for DeFi applications are being developed. These platforms prioritize scalability, low transaction fees, and features tailored to DeFi functionalities. Examples include Solana, Avalanche, and Fantom.

Enhanced Security

Security remains a paramount concern in DeFi. Here are some potential advancements in security:

- Formal Verification of Smart Contracts: Formal verification involves using mathematical techniques to prove that a smart contract functions as intended and is free of vulnerabilities. While challenging to implement, formal verification can significantly enhance the security of DeFi protocols.

- Bug Bounty Programs: Offering bug bounties incentivizes security researchers to identify and disclose vulnerabilities in smart contracts before they are exploited by attackers.

- Secure Multi-Party Computation (MPC):This cryptographic technique allows multiple parties to compute a function on their inputs without revealing their individual data. MPC can be used to enhance the security of DeFi protocols by keeping sensitive information, like private keys, confidential.

Improved User Experience

Making DeFi more accessible to a wider audience requires user-friendly interfaces and applications. Here are some potential advancements:

- Simplified User Interfaces (UIs):Currently, some DeFi applications can be complex and intimidating for new users. Designing intuitive and user-friendly UIs with clear instructions and visualizations can significantly improve user experience.

- Mobile Wallets and Applications:Developing user-friendly mobile wallets and applications will make DeFi more accessible to individuals on the go. This can further promote wider adoption and participation.

- DeFi Education and Awareness Initiatives: Educating users about DeFi functionalities, risks, and best practices is crucial for responsible participation. Initiatives like online tutorials, educational resources, and community forums can play a vital role in promoting DeFi literacy.

Social and Economic Implications

The widespread adoption of DeFi has the potential to trigger significant social and economic transformations. Here’s a closer look at some potential consequences:

Increased Financial Inclusion

DeFi offers financial services without geographical limitations or reliance on traditional financial institutions. This can empower individuals in:

- Unbanked and Under-banked Regions: DeFi can provide access to financial services for those who lack access to traditional banking systems. This can be particularly impactful in developing economies or regions with limited financial infrastructure.

- The Underserved: DeFi can offer financial products and services to individuals who might be excluded by traditional financial institutions due to factors like credit history or location.

New Economic Models

DeFi fosters innovation and facilitates the emergence of new economic models, including:

- Decentralized Autonomous Organizations (DAOs): DAOs are community-governed organizations that operate on the blockchain. DeFi enables the creation of DAOs for various purposes, like venture capital funding or collective ownership of assets.

- Peer-to-Peer Lending and Borrowing:DeFi platforms can facilitate direct lending and borrowing between individuals, potentially offering better interest rates and more flexible terms compared to traditional loan options.

- Fractional Ownership:DeFi enables the tokenization of real-world assets, allowing for fractional ownership. This can make previously illiquid assets more accessible to a wider range of investors.

Global Financial System Transformation

The widespread adoption of DeFi could transform the global financial system in several ways:

- Increased Efficiency and Transparency:Automation of financial processes through DeFi can lead to a more efficient financial system with reduced operational costs. Additionally, the transparent nature of blockchain technology fosters greater transparency within the financial system.

- Reduced Barriers to Entry: DeFi eliminates the need for intermediaries, potentially reducing barriers to entry for new financial service providers and fostering greater competition within the financial sector.

- Empowerment of Individuals: DeFi empowers individuals to manage their finances independently, make investment decisions, and participate in a broader range of financial activities.

It’s important to note that these social and economic implications are potential outcomes. While DeFi presents significant opportunities, it’s crucial to address regulatory hurdles, security challenges, and user education gaps to ensure its responsible use.

Conclusion

DeFi represents a paradigm shift in the financial landscape, fostering a more open, transparent, and accessible financial ecosystem. Through its innovative protocols and applications, DeFi empowers individuals to manage their finances independently and participate in a broader range of financial activities. While security risks, regulatory uncertainties, and scalability challenges remain, the potential benefits of DeFi are undeniable.

Increased efficiency, transparency, and accessibility are all hallmarks of a DeFi-driven financial system. However, for DeFi to reach its full potential, collaboration across the financial industry is paramount.

Similarly, a cautious and informed approach is crucial when engaging with DeFi. Thorough research into projects, a clear understanding of the inherent risks, and a commitment to good security hygiene are all essential for safe participation in the DeFi ecosystem.

By working together, stakeholders across the financial industry can ensure the responsible development and widespread adoption of DeFi, ultimately creating a more inclusive, efficient, and transparent financial system for all.

Disclaimer: The information provided in this white paper is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.