1. Introduction to Decentralized Finance (DeFi)

Defining DeFi

Decentralized Finance, or DeFi, refers to a burgeoning financial ecosystem that leverages blockchain technology to replicate and innovate upon traditional financial systems. Unlike centralized finance, DeFi operates without intermediaries like banks, relying on smart contracts to facilitate transactions directly between users. This approach democratizes access to financial services, enabling anyone with an internet connection to participate.

DeFi represents a paradigm shift in how financial services are conceived, delivered, and consumed. It challenges the traditional financial system’s reliance on centralized institutions, offering an alternative that is open, permissionless, and potentially more efficient. DeFi finance consulting services are becoming increasingly important as investors seek to navigate this new landscape.

Foundational Principles of DeFi

Decentralized Finance (DeFi) is a burgeoning financial ecosystem built on the bedrock principles of decentralization, transparency, and inclusivity. These core tenets differentiate DeFi from traditional finance by eliminating intermediaries, fostering trust, and expanding financial access.

Decentralization is the cornerstone of DeFi. By distributing control across a network of computers rather than concentrating power in the hands of a central authority, DeFi mitigates systemic risks, enhances resilience, and prevents censorship. This distributed governance model ensures no single entity can manipulate the system for personal gain.

Transparency is another hallmark of DeFi. Every transaction, contract, and protocol is recorded on a public blockchain, creating an immutable audit trail. This level of visibility fosters trust, accountability, and market efficiency. Users can independently verify the authenticity and integrity of financial operations, reducing the potential for fraud and corruption.

Inclusivity is a defining characteristic of DeFi. By removing geographical and financial barriers, DeFi democratizes access to financial services. Anyone with an internet connection can participate in the DeFi ecosystem, regardless of their location, income, or credit history. This has the potential to revolutionize financial inclusion by providing underserved populations with opportunities for savings, lending, and investment.

A digital asset strategy consulting firm can provide invaluable guidance to investors navigating the complexities of the DeFi landscape. By demystifying the underlying technologies and economic models, these firms empower individuals and institutions to make informed investment decisions. As DeFi continues to evolve, a deep understanding of these foundational principles will be essential for thriving in this dynamic and disruptive financial frontier.

The DeFi ecosystem is characterized by rapid innovation and constant growth. To capitalize on emerging opportunities, it is imperative to stay abreast of technological advancements, regulatory developments, and market trends. A strategic approach, coupled with expert advice, can help investors harness the full potential of DeFi while mitigating risks.

2. Historical Development of DeFi

Early Days of DeFi

The genesis of DeFi can be traced back to the groundbreaking introduction of Bitcoin in 2009. This pioneering cryptocurrency laid the foundation for a decentralized, peer-to-peer financial system, challenging the traditional banking model. However, it was the subsequent launch of Ethereum in 2015 that truly ignited the DeFi revolution.

Ethereum’s groundbreaking implementation of smart contracts introduced a paradigm shift. These self-executing contracts, with the ability to automate complex financial agreements, unlocked a world of possibilities. Suddenly, decentralized applications (dApps) could be created to manage a vast array of financial services without the need for intermediaries.

The early DeFi landscape was a fertile ground for experimentation. Developers and early adopters enthusiastically explored the uncharted territory, laying the groundwork for what would become a global phenomenon. As the potential of DeFi became increasingly apparent, a new breed of financial entities emerged. Crypto investment companies and cryptocurrency investment consultants began to recognize the opportunity and offered specialized services to guide investors through the complexities of this nascent ecosystem. These pioneers provided digital asset investment solutions and altcoin investment options, catering to the growing demand from individuals and institutions seeking exposure to the burgeoning DeFi space.

Key Milestones and Innovations

The evolution of DeFi has been punctuated by several groundbreaking milestones and innovations. One of the most pivotal developments was the launch of MakerDAO in 2017, which introduced the concept of decentralized stablecoins. By enabling users to lock up Ethereum (ETH) as collateral to mint DAI, a stablecoin pegged to the US dollar, MakerDAO demonstrated the potential of blockchain technology to disrupt traditional monetary systems. This groundbreaking concept of collateralized debt positions (CDPs) laid the foundation for the burgeoning DeFi lending and borrowing ecosystem.

The subsequent introduction of yield farming and liquidity mining in 2020 marked another inflection point. These incentive mechanisms, which rewarded users for providing liquidity to decentralized platforms with governance tokens, injected unprecedented liquidity into the DeFi space. The astronomical growth in total value locked (TVL) within DeFi protocols is a testament to the effectiveness of these strategies. This surge in capital and activity attracted the attention of traditional financial institutions, prompting many hedge fund investment companies to explore opportunities within the DeFi realm.

As the DeFi landscape matured, the demand for specialized expertise and guidance grew exponentially. Blockchain asset consulting and digital assets consulting firms emerged to meet this need. These firms offer a range of services, including market analysis, portfolio management, risk assessment, and regulatory compliance. By providing comprehensive support, these consulting firms empower investors and institutions to navigate the complexities of the DeFi ecosystem and make informed investment decisions. As the industry continues to evolve, the role of these consulting firms is expected to become even more critical in shaping the future of decentralized finance.

3. Core Technologies and Protocols in DeFi

Blockchain Technology

At the heart of DeFi lies blockchain technology, a revolutionary distributed ledger that underpins the entire ecosystem. This innovative system records transactions across multiple computers, creating a transparent and immutable record. Unlike traditional databases, a blockchain is decentralized, meaning no single entity controls it. This inherent decentralization ensures that data integrity is preserved, and the system is resistant to censorship and manipulation.

The security of blockchain is paramount to DeFi’s success. Each block in the chain contains a cryptographic hash of the previous block, forming an unbreakable link. Altering a single block would require changing all subsequent blocks, a computationally infeasible task. This robust architecture provides a high degree of trust and security, fostering confidence among users.

Ethereum, often referred to as the “world’s computer,” has emerged as the dominant platform for DeFi applications. Its sophisticated smart contract functionality enables developers to create complex financial instruments and protocols. However, the DeFi landscape is evolving rapidly, with other blockchains gaining prominence. Binance Smart Chain, Solana, and Avalanche, among others, offer varying degrees of scalability, speed, and cost-efficiency, attracting different types of DeFi projects and users.

The complexities of blockchain technology and the DeFi ecosystem can be overwhelming for investors. This is where blockchain asset investments consultants become invaluable. These experts possess in-depth knowledge of various blockchain platforms, their strengths, weaknesses, and suitability for different investment objectives. By providing tailored guidance, consultants help investors make informed decisions, assess risks, and optimize their portfolios within the dynamic DeFi space. As the industry continues to mature, the role of blockchain asset investment consultants is expected to become even more critical in unlocking the full potential of DeFi.

It’s important to note that while blockchain technology offers immense potential, it’s not without its challenges. Issues such as scalability, energy consumption, and regulatory uncertainties need to be addressed for DeFi to reach its full potential. However, ongoing research and development efforts are actively working to overcome these obstacles, paving the way for a more sustainable and efficient DeFi future.

Smart Contracts

Smart contracts are self-executing computer programs with the terms of an agreement directly written into code. These digital contracts operate on blockchain networks, automating the verification, negotiation, and execution of agreements without the need for intermediaries. When predetermined conditions are met, smart contracts automatically trigger the execution of specified actions, ensuring transparency, efficiency, and immutability.

Central to the DeFi ecosystem, smart contracts underpin a vast array of financial services. Decentralized lending platforms leverage smart contracts to automate loan origination, interest calculations, and repayments. Decentralized exchanges (DEXs) rely on smart contracts to facilitate token swaps, order matching, and settlement. Beyond lending and trading, smart contracts power derivatives, insurance, and other complex financial instruments within DeFi.

However, the complexity of smart contract development and the potential for vulnerabilities necessitate rigorous testing and auditing. A single coding error or security flaw can have catastrophic consequences, leading to financial losses and reputational damage. Smart contract auditing services have emerged to identify and mitigate these risks, providing critical assurance to users and investors.

Compliance is another crucial aspect of smart contract development. As DeFi intersects with traditional finance, regulatory scrutiny is increasing. Digital asset consulting firms for compliance help ensure that smart contracts adhere to relevant laws and regulations. By conducting thorough legal and regulatory assessments, these firms mitigate compliance risks and protect businesses from legal repercussions. As the DeFi industry matures and regulatory frameworks evolve, the importance of compliant smart contract development will only continue to grow.

It’s essential to note that while smart contracts offer significant advantages, they are not infallible. External factors, such as oracle vulnerabilities or network congestion, can impact their performance. Additionally, the interpretation of legal terms within smart contracts remains a complex area. Ongoing research and development are focused on addressing these challenges to enhance the reliability and robustness of smart contracts in the DeFi ecosystem.

Decentralized Applications (dApps)

Decentralized applications, or dApps, are software applications that operate on a distributed network, typically a blockchain. Unlike traditional applications hosted on centralized servers, dApps are characterized by decentralization, transparency, and security. They are open-source, meaning their code is publicly accessible, and operate autonomously without relying on a central authority. This architectural approach fosters trust, censorship resistance, and immutability.

Within the DeFi ecosystem, dApps have revolutionized financial services. They encompass a wide range of functionalities, including decentralized exchanges (DEXs) for peer-to-peer token trading, lending and borrowing platforms, yield farming aggregators, and decentralized insurance protocols. By leveraging smart contracts, dApps automate complex financial processes, eliminating intermediaries and increasing efficiency.

Ethereum has been the dominant platform for dApp development due to its robust smart contract capabilities. However, the burgeoning DeFi landscape has spurred the growth of dApps on other blockchains, such as Binance Smart Chain, Solana, and Avalanche. These platforms offer varying degrees of scalability, transaction speed, and developer tools, catering to different dApp use cases.

Startups entering the competitive DeFi market can significantly benefit from digital asset consulting services. These experts provide invaluable guidance on dApp development, deployment, and optimization. By leveraging their knowledge of blockchain technology, smart contracts, and user experience, consultants help startups build secure, compliant, and user-friendly dApps. Moreover, they can assist with token economics, fundraising, and go-to-market strategies, accelerating time-to-market and increasing the chances of dApp success.

While dApps hold immense potential, they also face challenges. Scalability, user experience, and regulatory compliance remain significant hurdles. Moreover, the evolving nature of blockchain technology necessitates continuous adaptation and innovation. Startups and developers must stay abreast of these challenges and leverage the latest technological advancements to build successful dApps.

4. Key Applications of DeFi

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) have emerged as a cornerstone of the DeFi ecosystem, offering a revolutionary approach to cryptocurrency trading. Unlike traditional centralized exchanges, DEXs eliminate the need for intermediaries by facilitating peer-to-peer trading directly between users. This decentralized model enhances security, transparency, and user control over their funds.

DEXs operate through smart contracts, self-executing programs that automate the exchange of assets based on predetermined conditions. These contracts ensure the integrity and security of transactions by eliminating the risk of human error or fraudulent activity. The most popular DEXs, including Uniswap, SushiSwap, and PancakeSwap, have captured significant market share by offering a diverse range of trading pairs, liquidity pools, and innovative features.

Beyond basic trading, DEXs have evolved to offer advanced functionalities such as yield farming, liquidity mining, and token launches. These features attract a growing user base and contribute to the overall growth of the DeFi ecosystem. However, DEXs also face challenges, including lower liquidity compared to centralized exchanges, higher transaction fees on certain blockchains, and potential vulnerabilities in smart contracts.

Crypto asset management firms play a crucial role in helping investors navigate the complexities of DEXs. These firms provide expert guidance on selecting the most suitable DEX for specific investment goals, assessing liquidity, and managing portfolio risk. Additionally, they offer digital asset portfolio management services, including asset allocation, rebalancing, and tax optimization. By leveraging their expertise, investors can effectively participate in the DeFi ecosystem while mitigating potential risks.

As the DeFi landscape continues to evolve, DEXs are expected to play an even more prominent role. The development of new technologies, such as layer-2 solutions and cross-chain interoperability, will further enhance the capabilities of DEXs, making them more accessible and efficient for a wider range of users.

It’s important to note that while DEXs offer numerous advantages, they also come with inherent risks. Users must conduct thorough research and due diligence before engaging in DEX trading. Security best practices, such as using secure wallets and avoiding phishing scams, are essential to protect digital assets.

Lending and Borrowing Platforms

DeFi lending and borrowing platforms have revolutionized the way individuals and institutions interact with financial markets. These decentralized platforms enable users to lend their digital assets to earn interest or borrow funds by providing collateral. Unlike traditional financial systems, DeFi lending operates without intermediaries, relying on smart contracts to automate the entire process. This eliminates the need for trust in third parties, enhancing transparency and efficiency.

A cornerstone of DeFi, lending platforms offer a diverse range of features. Aave, Compound, and MakerDAO are among the most prominent platforms, each with its unique strengths and offerings. Users can choose between variable and fixed interest rates, depending on their risk tolerance and investment horizon. Additionally, collateralized loans allow borrowers to access funds by pledging their digital assets as security, while flash loans provide a unique mechanism for executing complex arbitrage or liquidation strategies within a single transaction block.

The DeFi lending landscape is highly dynamic, with new platforms and features emerging regularly. To navigate this complex environment, investors often seek guidance from digital asset management consultants. These experts possess in-depth knowledge of various lending platforms, their risk profiles, and performance metrics. By conducting thorough research and analysis, consultants help clients identify suitable lending opportunities, optimize portfolio allocation, and manage risks effectively.

Moreover, digital asset management firms offer comprehensive services beyond platform selection. They provide ongoing portfolio monitoring, rebalancing, and tax optimization strategies. By leveraging their expertise, investors can maximize returns while mitigating potential losses.

However, DeFi lending is not without its risks. Smart contract vulnerabilities, market volatility, and liquidation risks are among the challenges that investors must consider. A well-diversified portfolio and a thorough understanding of the underlying protocols are crucial for managing these risks effectively.

For investors, digital asset management consultant services can provide insights into the best lending and borrowing platforms. These consultants help clients navigate the complexities of DeFi lending, ensuring that they can maximize their returns while minimizing risk.

Yield Farming

Yield farming, synonymous with liquidity mining, has emerged as a cornerstone of the DeFi ecosystem. This lucrative strategy involves providing liquidity to decentralized platforms in exchange for rewards, often in the form of governance tokens. By depositing digital assets into liquidity pools, users contribute to the platform’s functionality and earn a share of trading fees or protocol-issued tokens.

The allure of substantial returns has propelled yield farming into the spotlight, attracting billions of dollars in capital. However, this high-yield strategy is not without its risks. Impermanent loss, the potential loss incurred when the price of deposited assets fluctuates relative to each other, is a primary concern. Additionally, smart contract vulnerabilities pose a threat to the security of funds locked in liquidity pools.

To navigate the complexities and maximize the potential of yield farming, investors often seek the expertise of cryptocurrency investment consultants. These professionals possess in-depth knowledge of the DeFi landscape, including various yield farming strategies, risk assessment, and portfolio management. By conducting thorough research and analysis, consultants help clients identify optimal yield farming opportunities, diversify their portfolios, and implement robust risk management strategies.

Moreover, yield farming involves continuous monitoring and rebalancing to adapt to changing market conditions. Crypto investment consultants provide ongoing support, helping clients stay informed about emerging trends, protocol updates, and potential risks. Through their expertise, investors can make informed decisions, optimize their returns, and mitigate potential losses.

It’s crucial to approach yield farming with caution and a long-term perspective. While the potential rewards can be substantial, the risks are equally significant. Diversification across multiple platforms, understanding the underlying protocols, and regularly reviewing investment positions are essential for sustainable success in yield farming.

Cryptocurrency investment consultants can help clients understand the risks and rewards of yield farming. These consultants provide investment analysis and portfolio management services, helping clients optimize their yield farming strategies.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable price by pegging their value to a fiat currency, commodity, or other stable asset. Unlike volatile cryptocurrencies like Bitcoin and Ethereum, stablecoins offer a more predictable store of value, facilitating various DeFi applications. By mitigating price fluctuations, stablecoins enhance the usability of digital assets for everyday transactions and financial activities.

The most prominent stablecoins, including USDT (Tether), USDC (USD Coin), and DAI (MakerDAO), have become integral to the DeFi ecosystem. These stablecoins serve as a medium of exchange, enabling seamless trading on decentralized exchanges (DEXs) and providing liquidity to the market. Moreover, they act as a reliable collateral asset for borrowing, allowing users to leverage their holdings without liquidating their underlying cryptocurrency positions.

Beyond their role in trading and lending, stablecoins are increasingly used as a bridge between traditional finance and the decentralized world. They facilitate cross-border payments, remittances, and integration with fiat-based systems. This interoperability enhances the accessibility of DeFi for a broader audience, including institutions and businesses.

Given the growing importance of stablecoins, stablecoin investment consultants have emerged to guide investors through this complex landscape. These experts analyze various stablecoin types, their underlying mechanisms, and associated risks. They help investors assess the stability, transparency, and regulatory compliance of different stablecoins, enabling informed decision-making. Additionally, stablecoin investment consultants develop tailored strategies for utilizing stablecoins within broader investment portfolios, such as arbitrage opportunities, yield farming, and risk management.

5. Market Dynamics and Ecosystem

Major Players in the DeFi Ecosystem

The DeFi ecosystem is a complex interplay of various participants, each contributing to its growth and evolution. At its core are decentralized applications (dApps) built on blockchain technology, which automate financial processes without intermediaries. These dApps range from decentralized exchanges (DEXs) facilitating token trading to lending and borrowing platforms that enable peer-to-peer financial transactions. Additionally, yield farming protocols incentivize liquidity provision, while derivatives platforms offer complex financial instruments.

Central to the DeFi landscape are prominent platforms that have garnered significant attention and capital. Uniswap, a leading DEX, has revolutionized token trading through its automated market maker (AMM) model. Aave and Compound, pioneering lending protocols, have democratized access to credit and savings. MakerDAO, the creator of DAI, a decentralized stablecoin, has demonstrated the potential of blockchain-based monetary systems. These platforms, along with others, have established themselves as pillars of the DeFi ecosystem.

Behind the scenes, developers play a crucial role in building and innovating within the DeFi space. They create new protocols, improve existing platforms, and drive the technological advancements that propel the industry forward. Investors, both institutional and individual, provide the capital necessary for DeFi projects to thrive. Their support fuels growth, research, and development within the ecosystem.

The role of global digital asset consulting firms is indispensable in navigating the complexities of DeFi. These firms offer a range of services, including investment advisory, portfolio management, risk assessment, and regulatory compliance. By providing expert guidance, they empower investors to make informed decisions, identify promising opportunities, and mitigate risks. Moreover, consulting firms contribute to the overall maturity and adoption of DeFi by bridging the gap between traditional finance and the decentralized world.

Market Structure and Trends

The DeFi market is a dynamic ecosystem characterized by rapid innovation, intense competition, and heightened volatility. New platforms, protocols, and tokens emerge constantly, each promising unique features and investment opportunities. This rapid pace of development drives growth but also introduces significant risks for participants.

A key trend shaping the DeFi landscape is the rise of layer-2 scaling solutions. These technologies address the scalability limitations of Ethereum, the dominant blockchain for DeFi, by processing transactions off-chain and then committing them to the main chain in batches. This approach significantly improves transaction speeds and reduces costs, making DeFi more accessible to a wider audience.

The increasing popularity of stablecoins is another pivotal trend. These digital assets, pegged to fiat currencies or other stable assets, provide a more stable foundation for DeFi applications compared to volatile cryptocurrencies. Stablecoins facilitate various DeFi activities, including trading, lending, and payments, enhancing the overall usability of the ecosystem.

Tokenization of real-world assets (RWAs) is a burgeoning trend with immense potential. By representing real-world assets as digital tokens, DeFi can unlock new investment opportunities and improve liquidity. This process involves fractionalizing ownership of assets like real estate, art, and commodities, making them accessible to a broader investor base.

To navigate the complexities of the DeFi market, investors often seek guidance from specialized consultants. RWA tokenization investment consultants and real-world assets crypto investment consultants have become increasingly in demand as the tokenization trend gains momentum. These experts possess deep knowledge of asset valuation, regulatory compliance, and blockchain technology, enabling them to assess the viability of tokenization projects and identify promising investment opportunities.

As the DeFi market matures, it is likely to experience consolidation and increased institutional participation. Regulatory clarity will also be a critical factor in shaping the industry’s future. While challenges persist, the long-term potential of DeFi remains substantial, driven by its ability to disrupt traditional financial systems and create new economic opportunities.

RWA tokenization investment consultants and real-world assets crypto investment consultants are increasingly in demand as investors seek to tokenize real-world assets and bring them onto the blockchain.

6. Regulatory and Compliance Issues in DeFi

Current Regulatory Landscape

The regulatory landscape surrounding Decentralized Finance (DeFi) is a rapidly evolving and complex terrain. While DeFi’s core principles of decentralization and permissionlessness have fostered innovation, they have also presented challenges for regulators seeking to balance fostering growth with protecting investors and maintaining financial stability.

The United States has emerged as a focal point for DeFi regulation. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have taken an increasingly active role in overseeing the industry. The SEC has focused on determining which digital assets qualify as securities, subjecting them to stringent registration and disclosure requirements. The CFTC, on the other hand, has concentrated on regulating derivatives and commodities-based digital assets.

The European Union has also made significant strides in establishing a regulatory framework for cryptocurrencies and DeFi. The Markets in Crypto-Assets (MiCA) regulation, once implemented, will provide a comprehensive legal framework for the issuance, trading, and custody of crypto assets, including stablecoins. Other jurisdictions in Asia, such as Singapore, Hong Kong, and Japan, have adopted a more permissive approach, aiming to position themselves as global crypto hubs while implementing safeguards to protect investors.

Navigating this complex regulatory environment is crucial for DeFi platforms and investors alike. Non-compliance with regulations can lead to severe penalties, including fines, asset seizures, and even business closures. Digital asset consulting firms specializing in compliance have become indispensable to the industry. These firms provide expert guidance on regulatory interpretation, implementation, and risk management. By conducting thorough assessments and developing tailored compliance frameworks, these consultants help DeFi platforms mitigate legal risks and build trust with regulators and investors.

Digital asset consulting for compliance is crucial for DeFi platforms and investors alike. These consulting services help ensure that DeFi platforms are compliant with relevant regulations, reducing the risk of legal issues and penalties.

Compliance Challenges

The decentralized nature of DeFi poses significant challenges for regulatory compliance. Unlike traditional finance, where centralized institutions are subject to oversight, DeFi operates on a peer-to-peer basis, making it difficult to identify and regulate intermediaries. This decentralized structure creates a complex regulatory landscape that requires innovative approaches.

One of the primary challenges lies in implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These measures are essential for preventing financial crimes, but their application to DeFi is complex due to the anonymous nature of blockchain transactions. Traditional KYC processes, which rely on identity verification, become less effective in a decentralized environment. Moreover, tracing the flow of funds through multiple DeFi protocols can be arduous, making it difficult to identify suspicious activities.

Another compliance hurdle is the classification of digital assets. Determining whether a token is a security, a commodity, or a currency has far-reaching regulatory implications. This classification affects how these assets are regulated, traded, and taxed. The lack of clear regulatory guidance in this area creates uncertainty for both platforms and investors.

Furthermore, DeFi protocols often involve complex financial instruments and smart contracts. Ensuring these products comply with consumer protection and financial stability regulations is a formidable task. The potential for systemic risks arising from interconnected DeFi platforms adds another layer of complexity to the regulatory challenge.

Addressing these compliance challenges requires a collaborative effort between regulators, industry participants, and technology providers. Developing innovative solutions, such as blockchain analysis tools and self-regulatory frameworks, will be essential for fostering a compliant and sustainable DeFi ecosystem. As the industry matures, it is likely that regulatory frameworks will evolve to accommodate the unique characteristics of DeFi while maintaining the core principles of investor protection and financial stability.

Bitcoin investment consultants and blockchain and digital asset consulting firms are increasingly focusing on compliance issues, helping clients navigate the regulatory landscape and implement best practices for AML and KYC compliance.

Future Regulatory Developments

The future of DeFi regulation is uncertain, but it is likely that regulators will continue to focus on the space as it grows. Some potential developments include the introduction of new regulations specifically tailored to DeFi, as well as increased enforcement of existing regulations.

Regulators may also focus on the development of centralized solutions for DeFi, such as regulated custodians and AML/KYC solutions. These developments could help bridge the gap between DeFi and traditional finance, making it easier for institutional investors to participate in the DeFi space.

DeFi real world assets investment consultants and security tokens investment consultants will play a key role in helping clients navigate the evolving regulatory landscape. These consultants provide insights into the latest regulatory developments and help clients ensure compliance with relevant regulations.

7. Risk Assessment in DeFi

The DeFi ecosystem, while offering immense potential, is fraught with risks that investors and platform operators must carefully navigate. A deep understanding of these risks is crucial for making informed decisions and protecting assets.

Smart Contract Vulnerabilities

One of the most significant challenges in DeFi is the security of smart contracts. These self-executing contracts, the backbone of DeFi applications, are immutable once deployed, making them susceptible to vulnerabilities. A single coding error or oversight can be exploited by malicious actors, leading to substantial financial losses.

The DeFi landscape has witnessed several high-profile hacks that underscore the criticality of robust security measures. These incidents, involving millions of dollars in stolen funds, have highlighted the need for rigorous smart contract auditing and security testing. To mitigate these risks, digital asset management companies often incorporate smart contract auditing and security assessments into their service offerings. By conducting thorough code reviews and vulnerability assessments, these firms help DeFi platforms identify and address potential weaknesses before they are exploited.

Liquidity Risks

Liquidity risk is another inherent challenge in DeFi. As decentralized platforms rely on user-provided liquidity to facilitate trading and lending, fluctuations in liquidity can significantly impact platform operations and investor returns. Periods of low liquidity can lead to price slippage, increased transaction costs, and even market disruptions.

Yield farming and liquidity mining, while offering attractive rewards, exacerbate liquidity risks. The incentive to provide liquidity can lead to rapid inflows and outflows of funds, making it challenging for platforms to maintain optimal liquidity levels. To manage liquidity risk, investors can diversify their assets across multiple DeFi platforms and protocols. Digital asset portfolio management services often incorporate liquidity risk assessment and management strategies to help investors make informed decisions.

Market Volatility

DeFi is characterized by extreme price volatility, which can create both significant opportunities and risks. The decentralized nature of the ecosystem, coupled with the speculative nature of many digital assets, contributes to market instability. Leverage, commonly used in DeFi to amplify returns, can exacerbate volatility and increase the risk of liquidation.

To navigate this volatile environment, investors can employ various risk management strategies, including diversification, hedging, and stop-loss orders. Hedge fund investment consultation services often specialize in developing sophisticated risk management frameworks tailored to the unique characteristics of DeFi. By understanding the factors driving market volatility and implementing appropriate risk mitigation measures, investors can enhance their chances of long-term success.

Systemic Risk

Beyond individual platform risks, the interconnectedness of the DeFi ecosystem gives rise to systemic risks. A failure or exploit on one platform can have cascading effects on other platforms and the overall market. This interconnectedness highlights the importance of robust risk management practices across the entire ecosystem.

To address systemic risk, the industry is exploring various solutions, including decentralized insurance, collateralization requirements, and early warning systems. As DeFi matures, a deeper understanding of systemic risks and the development of effective mitigation strategies will be crucial for the long-term stability of the ecosystem.

It’s important to note that risk assessment in DeFi is an ongoing process. As the ecosystem evolves, new risks may emerge, requiring continuous monitoring and adaptation. A comprehensive approach that considers multiple risk factors is essential for safeguarding investments and ensuring the sustainability of DeFi.

8. Security Best Practices for DeFi Platforms

Securing Smart Contracts

Securing smart contracts is essential for ensuring the safety and reliability of DeFi platforms. Smart contract vulnerabilities can lead to significant financial losses, making security a top priority for developers and users alike.

Best practices for securing smart contracts include thorough code reviews, automated testing, and third-party audits. Developers should also consider implementing fail-safes and backdoors that allow them to pause or update the contract in the event of an emergency.

Digital asset management services often include smart contract security assessments. These services help ensure that smart contracts are secure and that user funds are protected.

Protecting User Assets

Protecting user assets is another critical aspect of DeFi security. Users should take steps to secure their private keys and use hardware wallets to store their assets. They should also be aware of phishing attacks and other scams that target DeFi users.

Platforms can also implement security measures to protect user assets, such as multi-signature wallets and decentralized insurance. These measures provide an additional layer of security, helping to protect user funds in the event of a breach.

Digital asset management company services often include user education and security training. These services help users understand the risks associated with DeFi and how to protect their assets.

9. Economic Impact and Future Prospects of DeFi

Broader Economic Implications

The rise of DeFi has significant implications for the broader economy. By democratizing access to financial services, DeFi has the potential to increase financial inclusion and reduce the dominance of traditional financial institutions.

DeFi also has the potential to disrupt traditional financial markets, particularly in areas such as lending, borrowing, and trading. As more users and institutions adopt DeFi, it could lead to a shift in the balance of power between centralized and decentralized finance.

Digital asset management consultant services are increasingly focused on the economic implications of DeFi. These services provide insights into how DeFi is shaping the future of finance and what it means for investors and institutions.

Predictions for the Future of DeFi

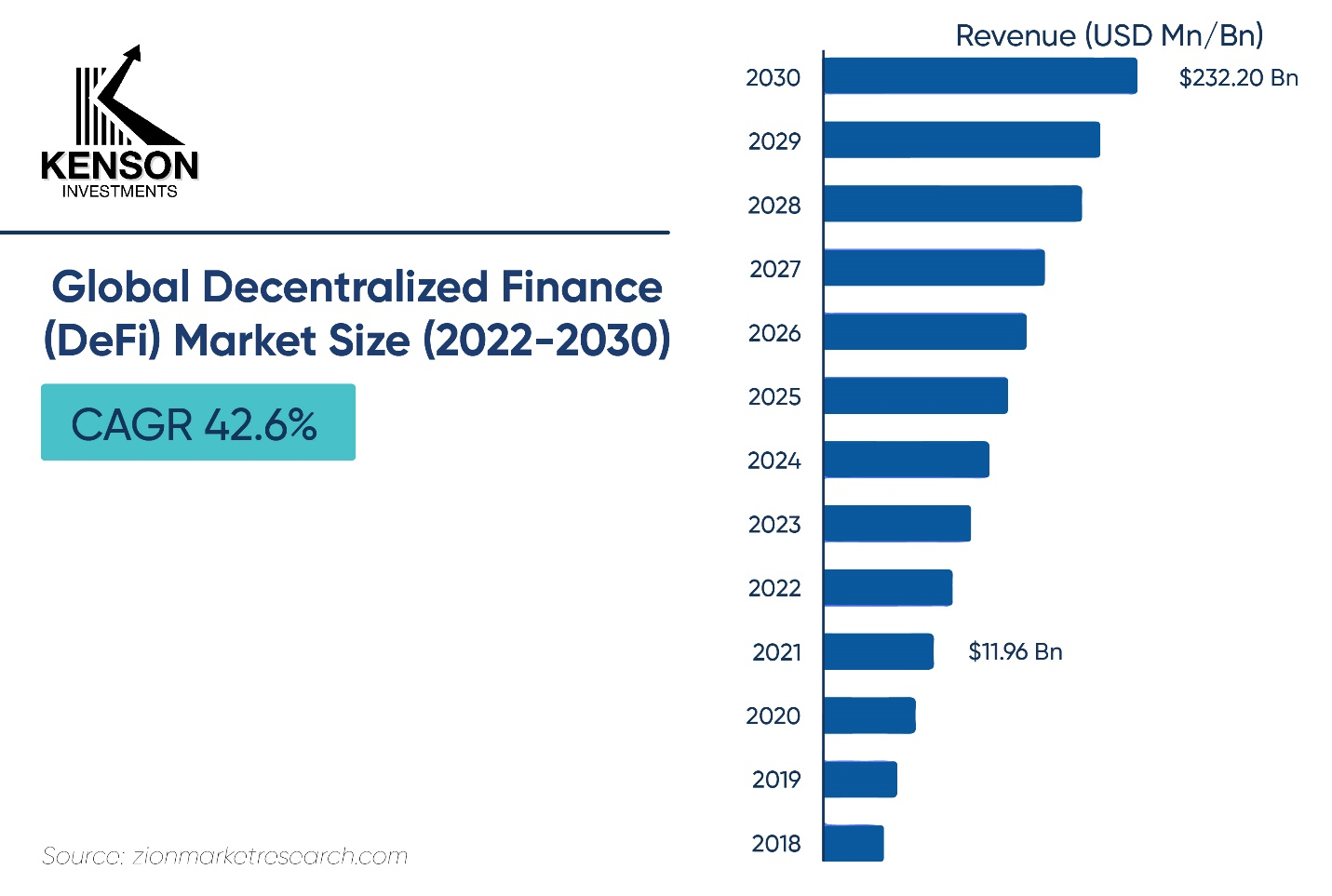

The trajectory of DeFi is poised for exponential growth, driven by a confluence of technological advancements, evolving regulatory frameworks, and increasing institutional interest. As the ecosystem matures, we can anticipate a landscape characterized by greater complexity, sophistication, and a wider range of financial services.

Real-world asset tokenization is a prime example of DeFi’s potential to revolutionize traditional finance. By representing physical assets as digital tokens, DeFi can unlock liquidity, fractional ownership, and new investment opportunities. This trend is likely to accelerate as blockchain technology becomes more scalable and efficient, and as regulatory clarity emerges. Real asset tokenization investment consultants will play a pivotal role in guiding investors through this emerging asset class, assessing opportunities, and managing risks.

Another transformative trend is the integration of NFTs into the DeFi ecosystem. Beyond their role as digital collectibles, NFTs can represent ownership of real-world assets, fractionalized securities, or even membership in decentralized autonomous organizations (DAOs). As the NFT market expands, we can expect to see innovative financial products and services built around these digital assets. NFT portfolio management will become increasingly important as investors seek to diversify their holdings and maximize returns.

Decentralized insurance is another area ripe for growth. By leveraging smart contracts and blockchain technology, DeFi can offer innovative insurance products with lower costs and faster claims processing. This could disrupt the traditional insurance industry and provide new opportunities for risk management.

Interoperability between different blockchains will be crucial for the future of DeFi. As cross-chain protocols mature, users will be able to seamlessly transfer assets and interact with a wider range of DeFi applications. This increased connectivity will foster competition, innovation, and the development of more complex financial products.

While the future of DeFi is promising, it is essential to approach it with caution and a long-term perspective. Regulatory developments, technological challenges, and market volatility will continue to shape the landscape. Investors should work closely with experienced digital asset consulting firms to navigate the complexities of the DeFi ecosystem and develop robust investment strategies.

By understanding the underlying technologies, market trends, and regulatory environment, investors can position themselves to capitalize on the growth opportunities that DeFi presents.

10. Conclusion

The DeFi revolution is transforming the financial landscape, offering new opportunities for investors and institutions alike. However, it also comes with significant risks, particularly in areas such as smart contract vulnerabilities, liquidity risks, and regulatory compliance.

To navigate the DeFi space successfully, investors must stay informed about the latest developments and work with digital asset consulting firms that specialize in DeFi. These firms can provide valuable insights and strategies for managing risk, optimizing returns, and staying compliant with regulations.

As DeFi continues to evolve, it will likely become an increasingly important part of the global financial system. Investors who can successfully navigate the DeFi landscape will be well-positioned to capitalize on this revolutionary shift in finance.

Are you intrigued by the world of decentralized finance (DeFi) but unsure where to start? Do you find yourself fascinated by blockchain technology and digital assets but need a clear, understandable guide to navigate this rapidly evolving landscape? At Kenson Investments, we’re here to illuminate your path with knowledge and insight.

Our mission is simple: to empower you with the education you need to understand the fundamentals of DeFi, blockchain, and digital assets. Whether you’re a beginner looking to grasp the basics or someone more familiar with these concepts but eager to dive deeper, we’re dedicated to providing you with clear, concise, and accurate information.

With the fast-paced changes and innovations in the DeFi space, staying informed is crucial. But this field can be complex and overwhelming. That’s why we focus on breaking down these topics into easy-to-digest materials that are accessible to everyone. We believe that with the right knowledge, anyone can navigate the world of DeFi with confidence.

At Kenson Investments, you’ll discover a wealth of educational resources designed to help you understand the opportunities and risks within the DeFi ecosystem. We aim to help you make informed decisions based on a solid foundation of knowledge.

So why wait? Start your educational journey with Kenson Investments today. Dive into our resources, learn at your own pace, and equip yourself with the understanding you need to explore the future of finance. Your journey into the world of DeFi begins with knowledge, and we’re here to guide you every step of the way. Get in touch with our team today.