In the rapidly evolving landscape of cryptocurrency, perpetual contracts have emerged as a key instrument within the derivatives market. These contracts have redefined how traders and investors engage with digital assets, offering a flexible and continuous trading opportunity without the constraints of expiration dates. This blog explores the advanced concept of perpetual contracts, analyzing their mechanics, their impact on market liquidity and volatility, and how they are reshaping strategies for both retail and institutional investors.

Understanding Perpetual Contracts

Perpetual contracts, often referred to as “perps,” are a type of derivative product that allows traders to speculate on the price of an asset without actually owning it. Unlike traditional futures contracts, which have a set expiration date, perpetual contracts do not expire. This unique characteristic means that traders can hold their positions indefinitely, provided they meet the necessary margin requirements.

The absence of an expiration date is a significant departure from traditional derivatives and has made perpetual contracts incredibly popular in the cryptocurrency space. These contracts are typically traded on margin, allowing traders to amplify their positions using leverage. The leverage options vary across platforms, but they generally range from 2x to 100x, offering traders the ability to make significant profits—or suffer substantial losses—on relatively small price movements.

Mechanics of Perpetual Contracts

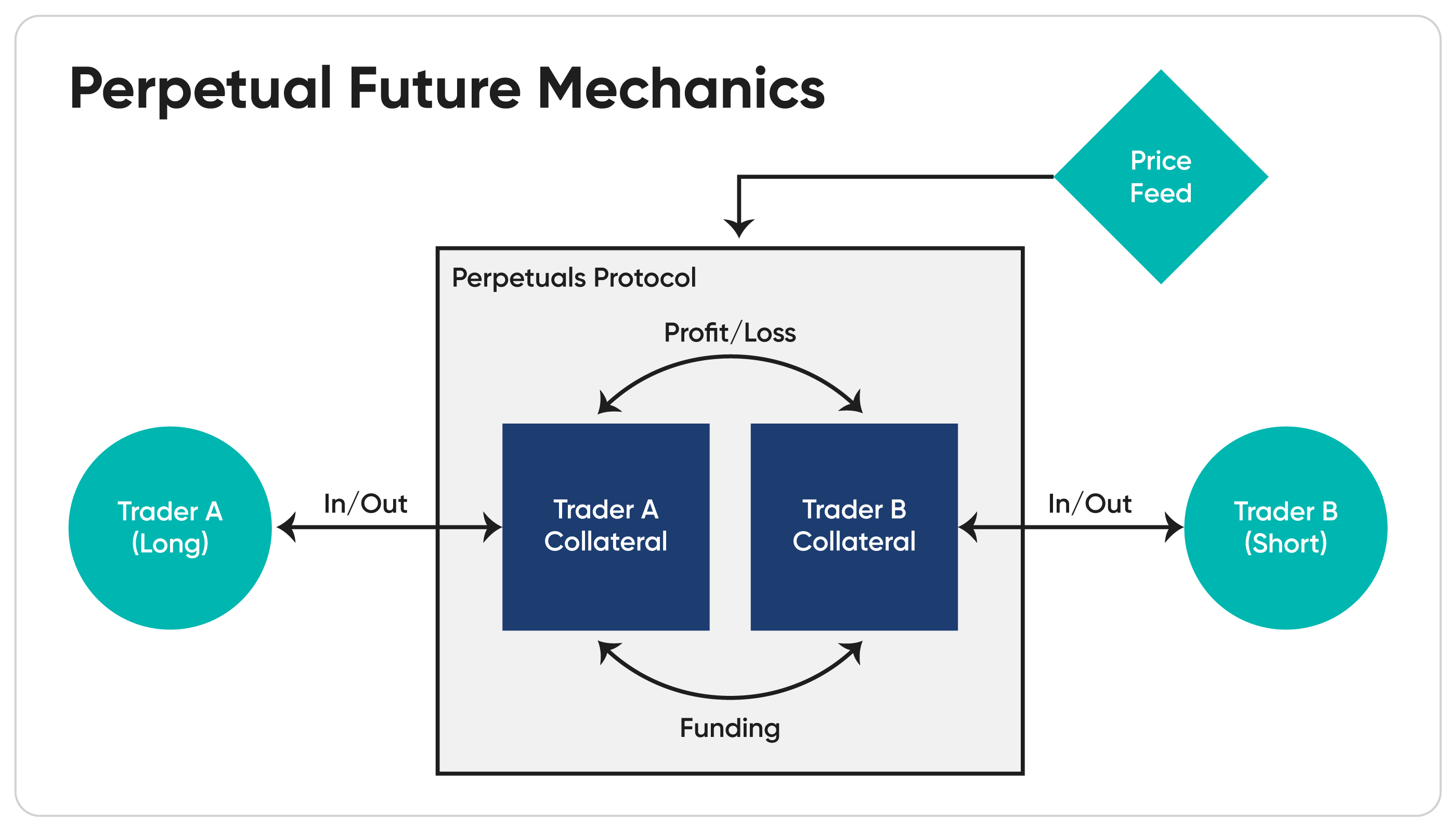

The mechanics of perpetual contracts are complex, but they can be broken down into a few key components:

Funding Rate

One of the critical mechanisms that differentiate perpetual contracts from traditional futures is the funding rate. This is a periodic payment made between buyers and sellers, designed to keep the contract price in line with the underlying asset’s spot price. When the contract price is above the spot price, those holding long positions pay those holding short positions, and vice versa. This mechanism ensures that the contract price does not diverge too far from the asset’s actual market price.

Mark Price

To prevent manipulation and ensure fairness in the market, exchanges use a marked price to calculate unrealized profits and losses. The mark price is an average of the asset’s price across multiple exchanges and is used to trigger liquidations. This mechanism helps maintain stability in a market that can be highly volatile.

Leverage and Margin

Perpetual contracts are typically traded with leverage, meaning traders can control a large position with a relatively small amount of capital. However, with higher leverage comes higher risk, and traders must maintain a certain margin level to avoid liquidation. Margin calls and liquidations are common in the world of perpetual contracts, particularly in highly leveraged positions, which adds another layer of complexity to the market dynamics.

Impact on Market Liquidity and Volatility

The introduction of perpetual contracts has had a profound impact on market liquidity and volatility in the crypto space.

Liquidity

Perpetual contracts have significantly enhanced liquidity in the crypto derivatives market. Because these contracts do not expire, they attract a continuous stream of traders, which keeps the market active at all times. High liquidity is crucial for traders, as it ensures that they can enter and exit positions without causing significant price fluctuations. Moreover, the presence of perpetual contracts has attracted institutional investors, who bring substantial capital and further enhance market liquidity.

Volatility

While increased liquidity generally leads to reduced volatility, perpetual contracts have also contributed to heightened volatility in certain circumstances. The availability of high leverage means that even small price movements can lead to significant liquidations, which can trigger cascading effects across the market. These liquidation events can result in sharp price swings, amplifying volatility in an already volatile market.

Reshaping Investment Strategies

Perpetual contracts are not just a tool for speculative trading; they are also reshaping investment strategies for both retail and institutional investors.

Retail Investors

For retail investors, perpetual contracts offer a way to participate in the crypto market with a relatively small amount of capital. The ability to trade on margin allows them to amplify their potential profits, making these contracts particularly appealing. However, the high risk associated with leveraged trading means that retail investors must approach perpetual contracts with caution. Many retail investors use these contracts for short-term trading, taking advantage of market volatility to make quick profits.

Institutional Investors

Institutional investors are also increasingly turning to perpetual contracts as part of their crypto investment strategies. These investors typically have more capital at their disposal and can deploy sophisticated trading strategies, such as hedging and arbitrage, to take advantage of the perpetual market. The continuous nature of these contracts allows institutions to maintain their positions without the need to roll over contracts, reducing transaction costs and improving efficiency.

Moreover, perpetual contracts have opened the door for algorithmic trading in the crypto space. The combination of high liquidity, continuous trading opportunities, and leverage makes perpetual contracts an ideal instrument for algorithmic traders, who use complex mathematical models to execute trades at high speeds.

The Future of Perpetual Contracts in Crypto Derivatives

As the crypto derivatives market continues to mature, the role of perpetual contracts is likely to become even more significant. Exchanges are continuously innovating, offering new features and products to attract traders. For example, some platforms are introducing multi-collateral perpetual contracts, allowing traders to use a variety of digital assets as collateral rather than being limited to a single asset like Bitcoin or Ethereum.

In addition, the regulatory landscape for crypto derivatives is evolving, and how governments and regulatory bodies choose to address perpetual contracts will have a major impact on their future. In regions where crypto derivatives are regulated, perpetual contracts may face stricter oversight, which could influence trading behavior and market dynamics.

However, the inherent flexibility and continuous nature of perpetual contracts make them an attractive option for a wide range of investors, from retail traders looking to capitalize on short-term price movements to institutional investors seeking to diversify their portfolios and hedge their positions.

Perpetual contracts have revolutionized the crypto derivatives market by offering continuous trading opportunities without the constraints of expiration dates. Their unique mechanics, including the funding rate and leverage options, have made them a popular choice among traders and investors alike. While they have contributed to increased liquidity, they have also introduced new levels of volatility, particularly during liquidation events. As the market evolves, perpetual contracts will continue to play a central role, shaping the strategies of both retail and institutional investors in the crypto space.

Embrace the New Era of Digital Asset Management

Join Kenson Investments and explore the blockchain and digital assets sector. Our digital asset specialists are here to help you navigate through the complexities of blockchain technology and digital asset portfolios. We are committed to providing a legitimate and transparent service, enhancing your experience in the dynamic world of cryptocurrency solutions and defi services.

Call now to discover how we’re moving the industry forward!

Disclaimer: The information provided on this page is for educational and informational purposes only and should not be construed as financial advice. Crypto currency assets involve inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.

“The crypto currency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC, including equities, registered securities, ETFs, stocks, bonds, or equivalents.”