Kenson’s Investment Management System is revolutionizing how clients approach investment planning by offering a suite of personalized tools and features designed to cater to individual financial behaviors and goals. As a powerful web and mobile application, it helps clients make informed decisions, analyze market trends, and manage portfolios with an unmatched level of customization. This blog will explore the insight capabilities of Kenson’s app, focusing on how it can analyze your investment behavior, predict market trends, and provide personalized advice that aligns with your financial objectives.

Understanding Investment Behavior with Kenson’s App

Kenson’s app takes a unique approach by offering in-depth analytics based on your investment behavior. Upon logging into the system, users are greeted with a Dashboard that displays comprehensive financial data, such as funds invested, profits earned, and the performance of individual portfolios. This visual representation allows users to easily understand their current financial standing, making it easier to track their behavior over time.

One standout feature of the app is its Growth Calculator, which helps users visualize the impact of compounding on their investments. Whether you are a seasoned investor or a beginner, this tool provides insight into how long-term strategies can maximize growth. By offering a clear view of potential earnings, the app encourages more informed decision-making and fosters a deeper understanding of how your behavior affects financial outcomes.

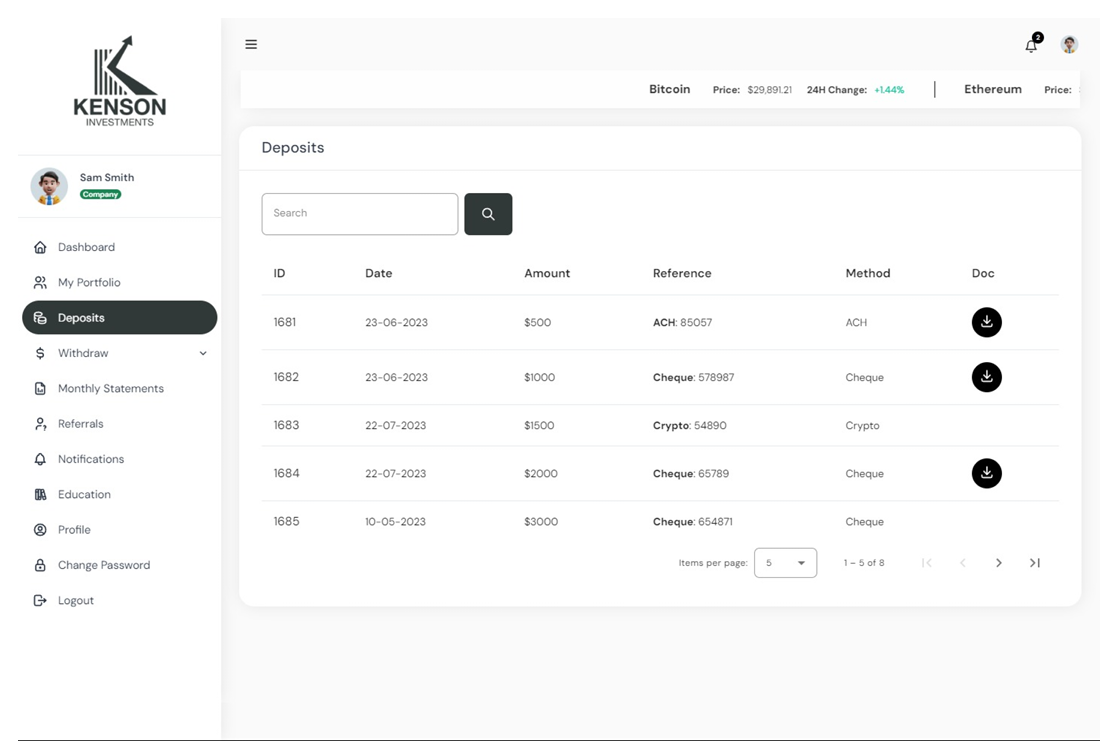

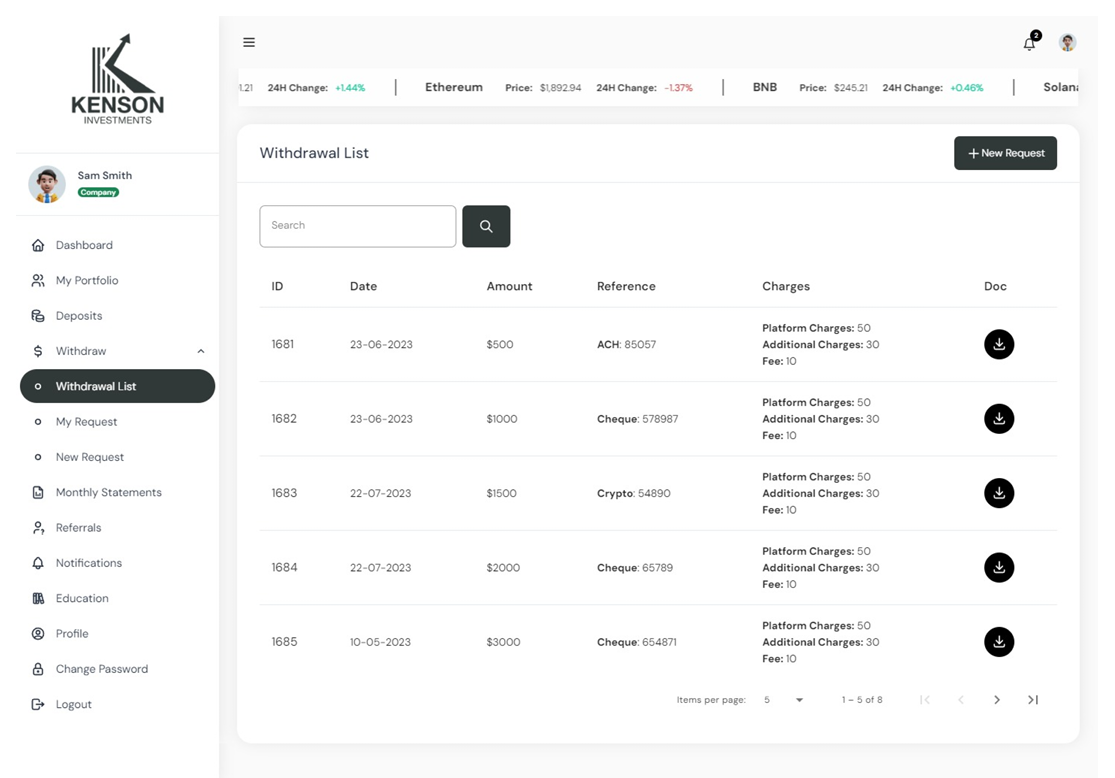

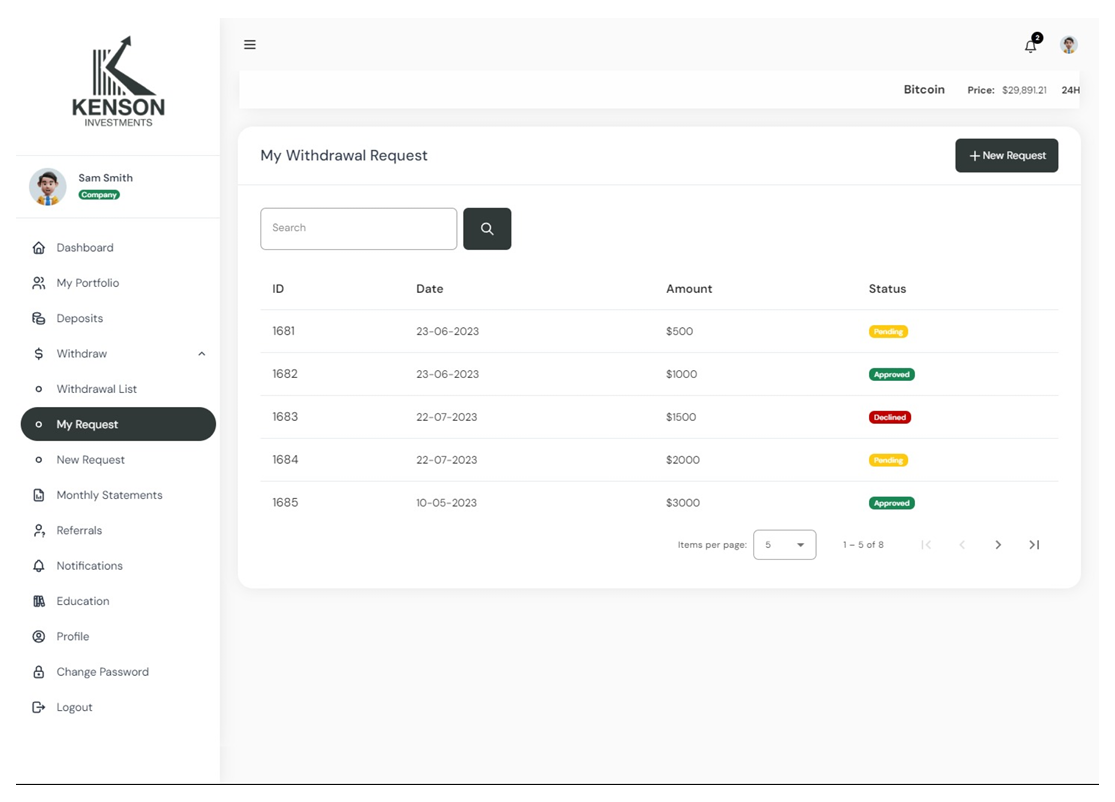

Additionally, the app provides detailed Portfolio Performance Charts that break down deposits, withdrawals, and earnings. These charts allow clients to observe the nuances of their investment behavior—whether they are frequently withdrawing funds or consistently reinvesting their profits. This insight into personal habits helps users identify areas of strength and potential improvement.

(Read more here: Revolutionizing Financial Management: A Complete Breakdown of Kenson Investments’ App)

Predicting Market Trends and Staying Informed

In today’s fast-paced financial world, keeping up with market trends is critical. Kenson’s app addresses this need through its Investment Newsfeed feature, which curates relevant financial news and market updates for its users. By staying informed about market movements and economic shifts, clients can better anticipate changes and adjust their strategies accordingly.

The app also provides real-time alerts and notifications, ensuring that clients never miss critical updates. Whether it’s an important market development or an opportunity to capitalize on, users receive immediate notifications, allowing them to make timely adjustments to their investments. This feature is especially valuable for those who prefer a proactive approach to their portfolios, as it empowers them to act swiftly when market trends shift.

Moreover, the app’s predictive capabilities extend to helping clients make informed decisions about future investments. Through its Goal-Based Planning feature, clients can set specific financial objectives, such as saving for retirement or funding education. By comparing these goals with current market trends and investment behavior, the app provides personalized recommendations that align with both short-term and long-term aspirations.

Personalized Investment Advice Aligned with Your Financial Goals

Perhaps the most powerful feature of Kenson’s app is its ability to deliver personalized advice based on your unique financial circumstances. The app’s Goal-Based Planning tool allows users to establish clear financial targets and receive tailored advice on how to achieve them. Whether you are focused on accumulating wealth for retirement or generating passive income, the app adjusts its recommendations based on the specifics of your financial plan.

For long-term clients, Kenson’s app offers a specialized Dedicated Dashboard that excludes features like withdrawal and deposit screens, emphasizing quarterly statements instead. This dashboard is designed to encourage a long-term growth mindset, reinforcing the importance of reinvesting profits to achieve greater returns over time. By catering to the specific needs of long-term investors, Kenson’s app ensures that every client receives advice that is relevant to their unique financial strategy.

Additionally, the app’s customized notifications provide ongoing guidance by alerting clients when they are nearing important milestones, such as hitting their budget limits or achieving a set financial goal. This real-time support ensures that users stay on track and make adjustments as needed to optimize their investment outcomes.

Enhancing User Engagement and Financial Literacy

Kenson’s app goes beyond investment management by fostering continuous user engagement through interactive features. One key element is the inclusion of educational content, where clients can access videos and tutorials that explain complex financial strategies and market behaviors. By providing these resources, the app enhances users’ financial literacy, empowering them to make better-informed decisions about their investments.

Another feature designed to boost engagement is the Live Chat functionality, which allows clients to communicate directly with Kenson representatives for personalized support. Whether a user has a question about a specific investment or needs help understanding their portfolio, the live chat option ensures that assistance is always just a click away. This immediate access to expert advice further enhances the personalized experience, allowing users to feel confident in their financial decisions.

The app also includes social sharing features, enabling clients to share their investment achievements and experiences with their network on social media platforms. This feature not only helps promote the app but also creates a sense of community among users, allowing them to learn from each other’s successes and strategies.

Kenson’s Investment Management System provides a robust platform for users to gain personalized insights into their investment behavior, predict market trends, and receive tailored advice that aligns with their financial goals. From the intuitive dashboard and growth calculator to real-time notifications and goal-based planning, the app equips clients with the tools needed to make informed decisions and achieve long-term financial success. With its unique features, such as live chat support, educational content, and social sharing capabilities, the app stands out as a comprehensive solution for both novice and experienced investors alike.

Embrace the New Era of Digital Asset Management

Join Kenson Investments and explore innovations in the blockchain and digital assets sector. Our digital asset management consultant are here to help you navigate the complexities of digital asset portfolios and defi services. Whether you’re interested in bitcoin investment consultants, altcoin investment options, or digital asset investment solutions, we’re here to guide you. Our blockchain asset consulting and digital assets consulting services will help you understand this evolving market.

Call now to discover how we’re moving the industry forward!

Disclaimer: The information provided on this page is for educational and informational purposes only and should not be construed as financial advice. Crypto currency assets involve inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.

“The crypto currency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC, including equities, registered securities, ETFs, stocks, bonds, or equivalents.”