Decentralized finance (DeFi) is one of the most transformative developments in the world of finance. Offering a new way to access financial services without relying on traditional intermediaries like banks, DeFi has gained popularity among investors, tech enthusiasts, and anyone interested in the future of finance. But what exactly is DeFi, and how does it work? This beginner’s guide will explore the fundamental principles of DeFi, how it operates, and why it has the potential to revolutionize the financial landscape.

Understanding DeFi: A New Financial Paradigm

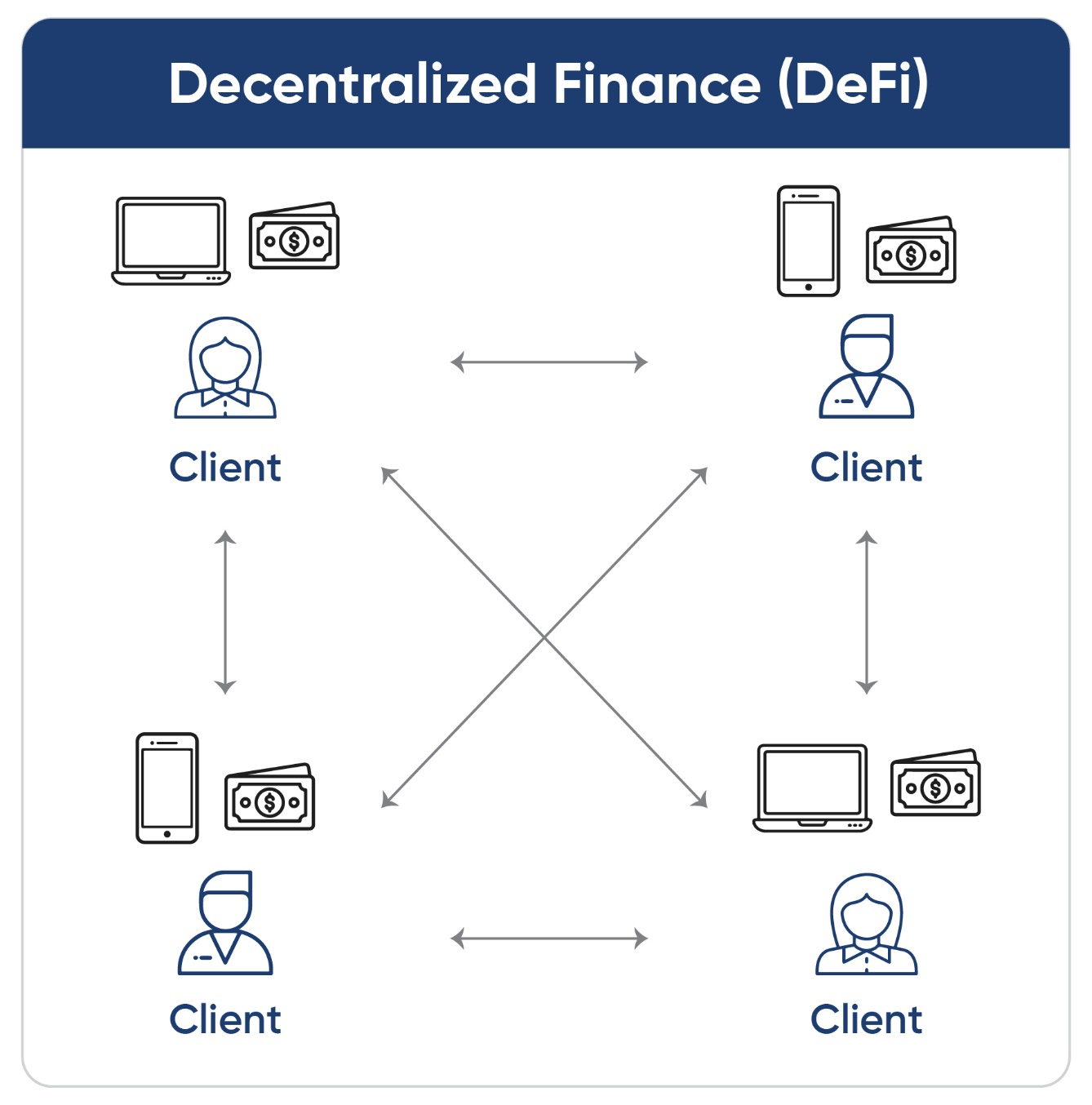

DeFi, short for decentralized finance, refers to a collection of financial services that are built on blockchain technology. Unlike traditional finance, which relies on centralized institutions to facilitate transactions, DeFi operates on decentralized networks where transactions are executed by smart contracts. These smart contracts are self-executing agreements with the terms directly written into code, allowing for secure and transparent transactions, not requiring a middleman.

The primary goal of DeFi is to create a financial system that is open, transparent, and accessible to everyone, regardless of location or economic status. By leveraging the power of blockchain, DeFi allows users to engage in a wide range of financial activities—such as lending, borrowing, trading, and investing—without the restrictions and fees typically associated with traditional financial institutions.

How Does DeFi Work?

Now that we have a basic understanding of the components of DeFi, let’s explore how it works in practice. DeFi operates on blockchain technology, which ensures that all transactions are secure, transparent, and immutable. Here’s a step-by-step breakdown of how DeFi works:

1. Accessing DeFi Platforms

To start using DeFi, you’ll need a digital wallet, such as MetaMask, that supports Ethereum or other blockchain networks. This wallet will allow you to interact with DeFi platforms, store your assets, and sign transactions. Once your wallet is set up, you can connect it to various DeFi DApps, such as decentralized exchanges, lending platforms, or yield farming protocols.

2. Interacting with Smart Contracts

When you use a DeFi platform, you’re interacting with smart contracts that automate the processes involved. For example, if you’re using a decentralized exchange to trade cryptocurrencies, the smart contract will match your trade with a counterparty and execute the transaction automatically. Similarly, if you’re lending assets on a DeFi platform, the smart contract will manage the loan agreement and ensure that interest is paid according to the terms.

3. Providing Liquidity and Earning Rewards

Many DeFi platforms rely on user-provided liquidity to function. By depositing your assets into a liquidity pool, you can earn rewards in the form of transaction fees or native tokens. This process, known as yield farming, allows you to generate passive income while contributing to the platform’s liquidity. However, it’s important to be aware of the risks involved, such as impermanent loss and smart contract vulnerabilities.

4. Borrowing and Lending

DeFi platforms also offer lending and borrowing services, allowing users to earn interest on their assets or access liquidity without selling their holdings. To borrow assets, you’ll need to provide collateral in the form of other cryptocurrencies. The smart contract will automatically manage the loan, ensuring that interest is paid and that the collateral is returned once the loan is repaid.

5. Managing Risk and Compliance

While DeFi offers numerous benefits, it also comes with risks, such as smart contract vulnerabilities and market volatility. To mitigate these risks, many users turn to digital asset strategy consulting firms or blockchain asset consulting services for guidance. These firms provide valuable insights into the DeFi market, helping users develop strategies for managing their digital asset portfolios and ensuring compliance with regulatory requirements.

The Role of DeFi Consulting Services

As the DeFi ecosystem continues to grow, the demand for consultancy services has increased. Whether you’re an individual investor or a startup looking to enter the DeFi space, consultancy for DeFi finance investments can provide the assistance needed to navigate this complex market.

1. Digital Asset Strategy Consulting

A digital asset strategy consulting firm can help you develop a comprehensive plan for managing your digital assets. This includes investment analysis, portfolio management, and risk mitigation strategies. By working with a global digital asset consulting firm, you can gain insights into the latest trends in DeFi and make informed decisions about your investments.

2. Blockchain Asset Consulting

Blockchain asset investments consultants specialize in helping clients understand the technical aspects of DeFi. This includes evaluating the security of smart contracts, assessing the risks of different platforms, and providing guidance on how to participate in yield farming, liquidity mining, and other DeFi activities.

3. Compliance and Regulation

As DeFi operates in a rapidly evolving regulatory environment, digital asset consulting for compliance is essential for ensuring that your activities are in line with legal requirements. Consultants can help you navigate the complexities of DeFi regulation, providing advice on how to comply with local laws and mitigate potential risks.

Work With Us

At Kenson Investments, we believe that financial empowerment starts with knowledge. Our mission is to provide clear, accessible education that helps you understand the intricacies of today’s financial landscape, including digital asset portfolio management, cryptocurrency investment solutions, stablecoins for investment, and altcoin investment. Whether you’re just starting out or looking to expand your understanding, we’re here to guide you with insights that make a difference. Let Kenson Investments be your resource for financial learning. Get in touch with us today to start your journey toward financial clarity.

Disclaimer: The information provided on this page is for educational and informational purposes only and should not be construed as financial advice. Crypto currency assets involve inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.

“The crypto currency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered as financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC including, equities, registered securities, ETFs, stocks, bonds, or equivalents”