The world of finance is undergoing a digital revolution, and at the forefront of this transformation is a concept called tokenization. In essence, tokenization refers to the process of converting ownership rights of real-world assets into digital tokens on a blockchain network. This seemingly simple idea holds immense potential to reshape the way we manage, invest in, and trade traditional assets.

Demystifying Tokenization Benefits

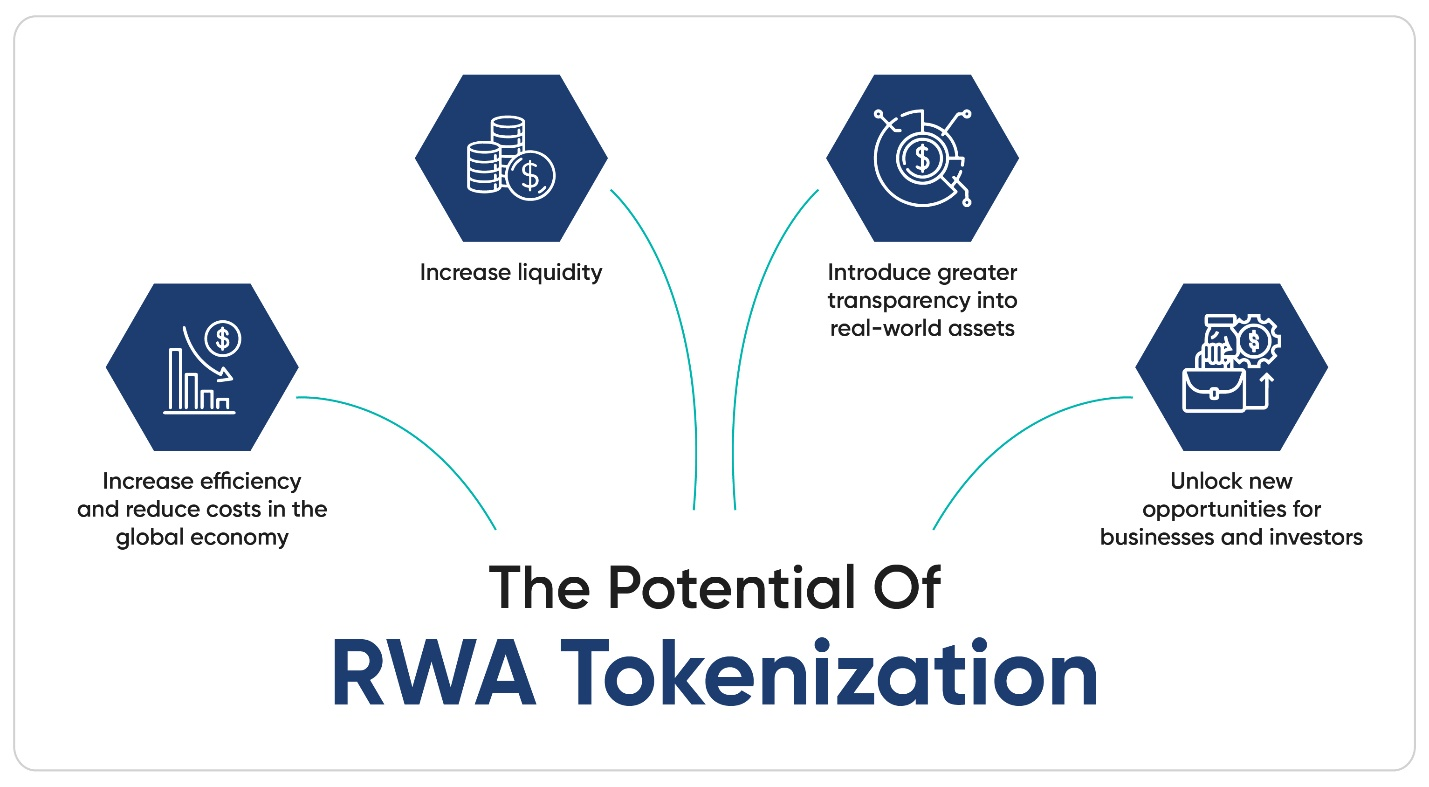

While the concept of tokenization might seem like something out of science fiction, the benefits it offers for real-world assets are demonstrably real and hold significant potential. Let’s delve deeper into some of the key advantages that position tokenization as a transformative force in the future of asset management.

Enhanced Liquidity: Traditional assets like real estate, fine art, or private equity can be notoriously illiquid, presenting challenges for investors who want to enter or exit their positions. Tokenization offers a solution by fragmenting these assets into smaller, more manageable digital units. This allows for a broader investor base to participate, fostering greater liquidity. Increased liquidity benefits both investors, who can more easily buy and sell their holdings, and asset owners, who can potentially achieve higher returns by attracting a wider pool of potential buyers.

Unlocking Digital Asset Basics: From Cryptocurrencies to Real-World Asset Tokenization

Democratization of Investment: Tokenization unlocks opportunities for a much wider range of investors to participate in asset ownership. By lowering the minimum investment amount required to own a piece of an asset, tokenization makes previously inaccessible assets like high-value real estate or exclusive artwork available to a larger pool of individuals. This fosters greater financial inclusion and diversification for investors, allowing them to build more well-rounded portfolios with smaller initial investments.

Fractional Ownership: One of the most compelling aspects of tokenization is the ability to achieve fractional ownership of assets. Imagine co-owning a Picasso with a group of friends or investing in a piece of prime real estate without the hefty upfront cost. Tokenization makes this a reality. This flexibility caters to a wider range of investment strategies and risk appetites.

Investors with smaller budgets can now participate in ownership of high-value assets, while those seeking to diversify their portfolios can invest in a wider variety of assets without needing to allocate large sums of capital to each one.

Streamlined Transactions: Blockchain technology, the underlying infrastructure of tokenization, offers a secure and transparent platform for recording and managing transactions. This eliminates the need for intermediaries like banks or custodians, streamlining the entire process from asset issuance to trading.

Automated smart contracts further enhance efficiency by removing the need for manual paperwork and human error. Smart contracts are self-executing agreements written in code, ensuring that transactions are completed precisely as programmed, eliminating delays and the potential for mistakes.

Reduced Costs: By eliminating intermediaries and automating processes, tokenization can significantly reduce transaction costs associated with asset management. These savings can be passed on to both investors and asset owners. Investors benefit from lower fees associated with buying, selling, and holding tokenized assets. Asset owners can enjoy reduced costs for tasks like issuance, administration, and regulatory compliance. This creates a win-win situation for all participants in the market.

Increased Security: Blockchain technology offers unparalleled security and tamper-proof records. Each token represents a unique ownership stake on the blockchain, making it virtually impossible to counterfeit or steal. This provides investors with greater peace of mind regarding the security of their holdings. Unlike traditional ownership certificates, which can be lost or forged, blockchain records are immutable and publicly verifiable, offering a robust layer of security.

Improved Transparency: All transactions related to tokenized assets are permanently recorded on a public blockchain ledger. This provides complete transparency and auditability, allowing anyone to view the ownership history and transaction details of an asset. This fosters trust and reduces the risk of fraud for all stakeholders involved. Investors can be confident in the legitimacy of their holdings, and regulators can more easily monitor activity within the market.

Global Accessibility: Blockchain networks operate 24/7, removing geographical barriers and facilitating global participation in asset ownership. This opens up new investment opportunities for international investors, allowing them to diversify their portfolios with assets located in different countries. Asset owners can also tap into a wider investor pool, potentially attracting buyers from around the world. This global accessibility can increase liquidity and potentially lead to higher valuations for tokenized assets.

Benefits Beyond Investment

The impact of tokenization extends beyond the realm of investment. Here are some additional benefits that impact asset ownership and management:

Improved Efficiency: Streamlined processes and automated smart contracts can significantly improve the efficiency of asset management. This translates to faster settlement times, simplified compliance procedures, and reduced administrative burdens.

Enhanced Traceability: The immutable nature of blockchain records allows for detailed tracking of ownership history and asset provenance. This is particularly beneficial for asset classes like luxury goods or art, where verifying authenticity is crucial.

Programmable Assets: Smart contracts embedded within tokens can be programmed to automate specific actions, such as dividend distributions or voting rights management. This adds a layer of programmability to traditional assets, unlocking new possibilities.

The Road Ahead: Challenges and Considerations

While tokenization offers immense potential, it’s important to acknowledge the evolving landscape and address some key challenges:

Regulatory Uncertainty: Regulations governing tokenized assets are still under development in many jurisdictions. This lack of clarity could hinder widespread adoption until a more robust regulatory framework is established.

Technological Infrastructure: The underlying blockchain technology needs further development to handle large-scale asset tokenization and ensure smooth integration with existing financial systems.

Investor Education: Creating awareness and educating investors about tokenization and its associated risks is crucial for ensuring responsible participation and building trust in this new paradigm.

Embracing the Tokenized Future

Despite the challenges, the potential benefits of real world asset tokenization for both investors and asset owners are undeniable. With ongoing advancements in blockchain technology and regulatory frameworks, Security tokens and real world asset tokenization are poised to revolutionize asset management. As the future unfolds, embracing this transformative technology will be key to unlocking new avenues in the real world asset market, investment strategies, and a more efficient and inclusive financial ecosystem.

Reach out to us today at Kenson Investments.