In today’s rapidly evolving financial landscape, the enhancement of liquidity in real-world asset markets has become a pivotal area of focus. As markets become more interconnected and digital assets gain prominence, ensuring robust liquidity is essential for market efficiency and investor confidence.

According to a report, global real estate markets alone are expected to grow by 3.41%, reaching over $729.40 trillion of market volume by 2028, with liquidity playing a critical role in their stability and growth. Additionally, the integration of blockchain technology has opened new avenues for tokenizing real-world assets, further emphasizing the need for effective liquidity strategies.

So, if you need to know about enhancing liquidity in asset markets, this comprehensive guide will provide you with essential insights and practical tips. Let’s get started:

Understanding the Real-World Asset Market

Real-world asset markets encompass physical assets such as real estate, commodities, and tangible goods. These assets are traditionally characterized by lower liquidity compared to financial instruments like stocks and bonds. Liquidity, in this context, refers to the ease with which an asset can be bought or sold without significantly affecting its price. Enhanced liquidity in these markets facilitates smoother transactions, reduces volatility, and attracts a broader range of investors.

Bonus! Read our detailed guide (Team link to PB3: Mastering Advanced Crypto Trading: Integrating Derivatives and Real-World Asset Liquidity) to ensure you have all the basic information related to liquidity in crypto trading.

The Role of Liquidity in Asset Markets

Liquidity is a fundamental aspect of any market, influencing trade execution, market depth, and overall market health. In real-world asset markets, high liquidity ensures that transactions can occur seamlessly, reducing the risk of price manipulation and enhancing market stability. For investors, liquidity provides the flexibility to enter and exit positions efficiently, making the market more attractive and accessible.

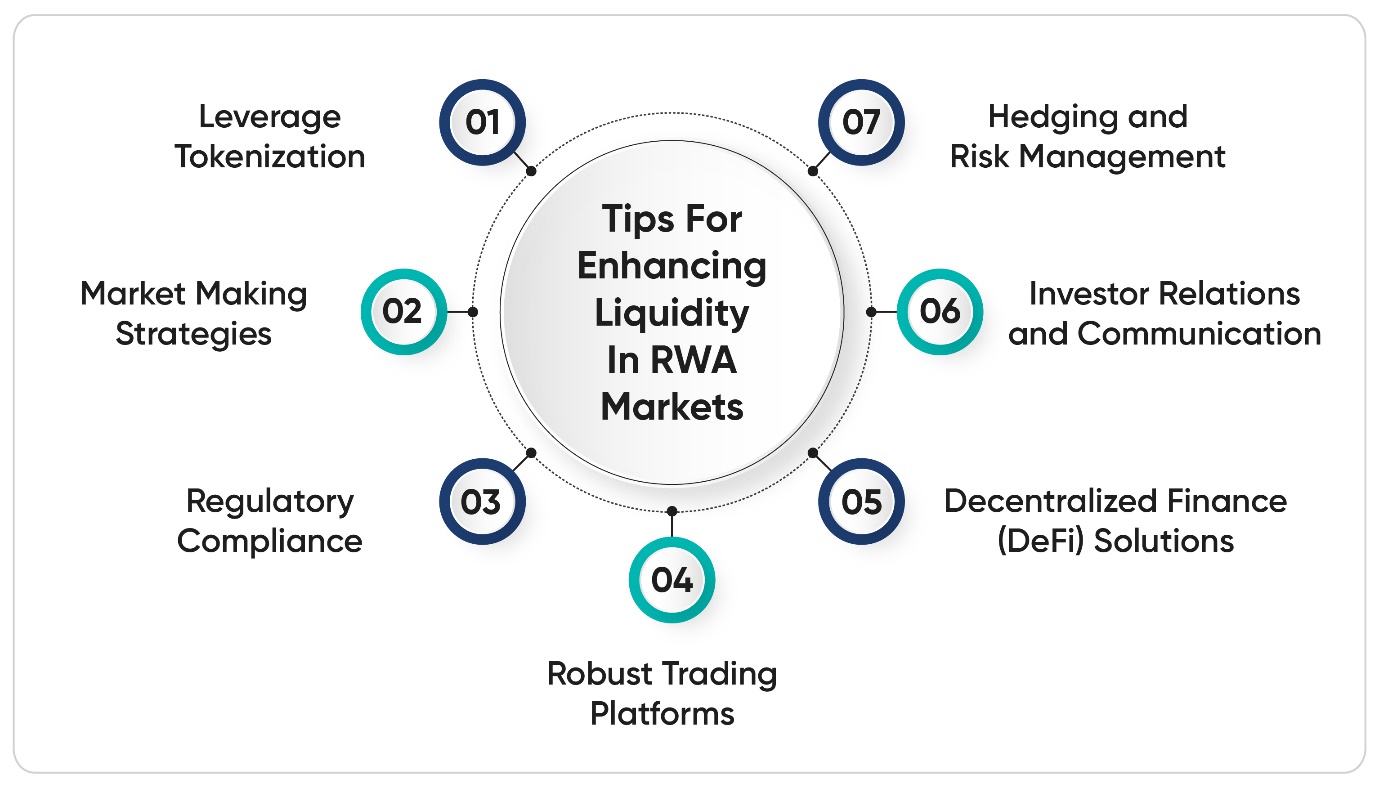

Practical Tips for Enhancing Liquidity in Real-World Asset Markets

1. Leverage Tokenization

Tokenization involves converting physical assets into digital tokens on a blockchain. This process enhances liquidity by fractionalizing ownership, allowing investors to buy and sell small portions of an asset rather than the entire asset. According to a statistical report, tokenized real estate is expected to dominate 1/3rd of global assets by 2030, becoming the largest type (in size) of tokenized assets. By implementing tokenization, markets can increase accessibility and attract a wider pool of investors, thereby boosting liquidity.

2. Implement Market-Making Strategies

Market making involves creating liquidity by simultaneously offering to buy and sell an asset at competitive prices. This practice reduces bid-ask spreads and increases market depth. Market makers play a crucial role in maintaining liquidity, especially in markets with lower trading volumes. Employing algorithmic trading and automated systems can enhance the efficiency and effectiveness of market-making strategies.

3. Foster Regulatory Compliance and Transparency

Regulatory compliance and transparency are paramount in building investor trust and enhancing liquidity. Markets that adhere to stringent regulatory standards and provide transparent reporting attract institutional investors who prioritize security and compliance. According to the Financial Stability Board, clear and consistent regulations can significantly reduce market fragmentation and improve liquidity.

4. Develop Robust Trading Platforms

Advanced trading platforms with user-friendly interfaces and sophisticated trading tools can enhance liquidity by facilitating seamless transactions. Features such as real-time data analytics, automated trading, and integrated risk management tools attract active traders and institutional investors, contributing to increased market activity and liquidity.

5. Promote Decentralized Finance (DeFi) Solutions

Decentralized Finance (DeFi) offers innovative liquidity solutions through decentralized exchanges (DEXs) and liquidity pools. DeFi platforms enable peer-to-peer trading without intermediaries, reducing transaction costs and enhancing liquidity. According to the report, the total value locked in DeFi protocols exceeded $100 billion in March 2024, highlighting the growing importance of DeFi in liquidity management.

6. Enhance Investor Relations and Communication

Effective investor relations and transparent communication are essential for maintaining investor confidence and promoting liquidity. Providing regular updates, detailed performance reports, and open communication channels helps build trust and encourages active participation in the market. Engaging with investors through webinars, newsletters, and social media can further enhance visibility and attract new participants.

7. Utilize Hedging and Risk Management Strategies

Hedging and risk management strategies help mitigate the impact of market volatility on liquidity. By using financial derivatives such as futures, options, and swaps, investors can protect their portfolios from adverse price movements. Implementing robust risk management frameworks ensures market stability and encourages greater participation, thereby enhancing liquidity.

Navigating the Future of Real-World Asset Markets

Enhancing liquidity in real-world asset markets is crucial for fostering market efficiency, stability, and investor confidence. By leveraging innovative solutions such as tokenization, market making, DeFi, and robust trading platforms, market participants can significantly improve liquidity. Kenson Investments, with its expertise in digital asset investment solutions and comprehensive advisory services, is uniquely positioned to help investors navigate this dynamic landscape. Our commitment to transparency, regulatory compliance, and customized strategies ensures that our clients achieve their investment goals with confidence and ease.

For more insights and expert guidance on enhancing liquidity in real-world asset markets, contact Kenson Investments today. Let us help you revolutionize your investments in this dynamic digital era.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be construed as financial advice. Crypto currency investments involve inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.