Bitcoin, the pioneering cryptocurrency, operates on a revolutionary concept: a finite supply. Unlike traditional fiat currencies with ever-expanding issuance, Bitcoin’s total supply is capped at 21 million coins. This scarcity is programmed into Bitcoin’s core protocol, with new coins released at a predictable rate through a process called mining. Every four years or so, however, a significant event occurs – the Bitcoin halving.

What is Bitcoin Halving?

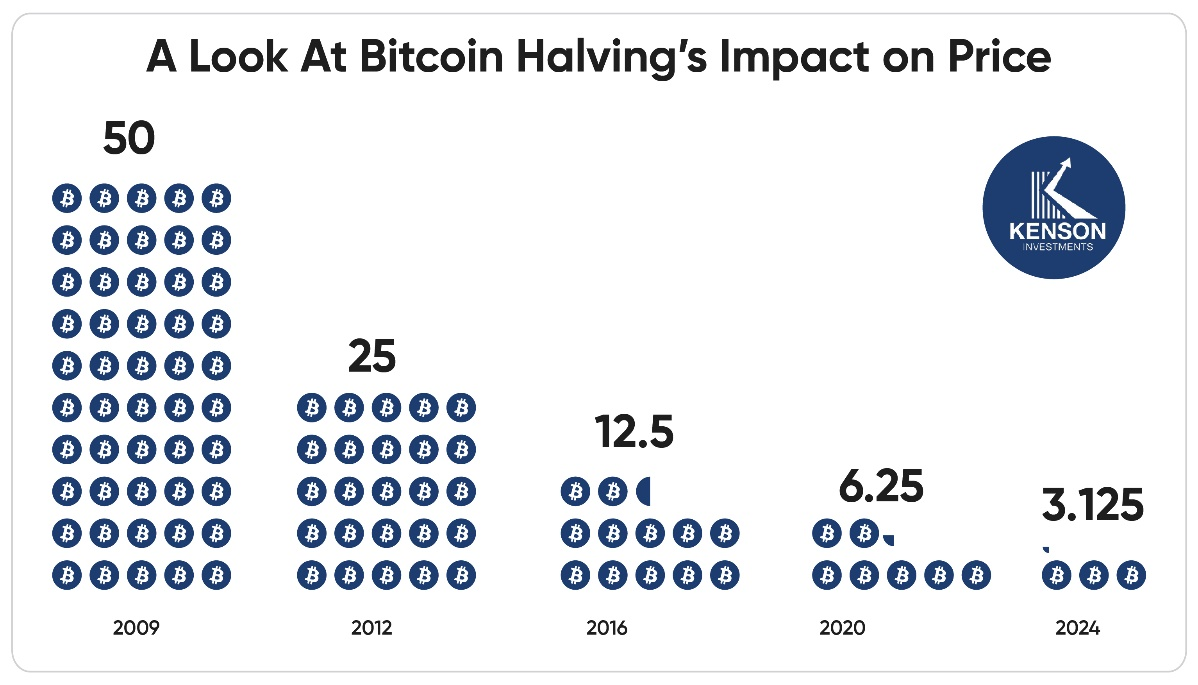

Bitcoin halving is an event where the reward for mining new Bitcoin blocks is halved, reducing the rate at which new coins are generated. The term “halving” might not be the most popular among crypto enthusiasts, but it effectively describes what happens.

The process involves Bitcoin mining, akin to geological mining for precious metals. Miners solve complex mathematical formulas to uncover new bitcoins, or in crypto terminology, “a block” is created and added to the blockchain—a virtual public Bitcoin ledger.

Explore More: Blockchain Unveiled: Understanding the Backbone of Digital Assets

Miners, who solve the formula first, receive a batch of bitcoins as a reward. This competitive race encourages miners to build powerful computer networks to increase their chances of solving these formulas first.

The halving, which occurs approximately every 210,000 blocks (roughly every four years), cuts the miners’ rewards in half. This deliberate mechanism is embedded in Bitcoin’s computational code to control the inflation rate and ensure the total supply of Bitcoin never exceeds 21 million.

Historical Impact of Halving Events on Bitcoin Price

While the exact cause-and-effect relationship remains debated, halving events have historically coincided with significant price increases for Bitcoin. Let’s explore the impact of the past halvings.

- First Halving (November 2012):The price of Bitcoin jumped from around $12 to over $1,100 within a year of the first halving, marking an over 90x increase.

- Second Halving (July 2016):The price rose from around $250 to over $8,000 within two years after the second halving, representing a more than 30x increase.

- Third Halving (May 2020):Despite the global economic slowdown due to the COVID-19 pandemic, Bitcoin’s price surged from around $5,000 to a peak above $60,000 within a year after the third halving, reflecting a 10x increase.

- 4th Halving (April 2024): While it’s still early to definitively say what the long-term price impact of the 4th halving will be. However, some analysts predict a potential price surge similar to previous halvings, citing the fundamental decrease in new Bitcoin supply. Others argue that market factors like increased regulation and broader economic conditions might play a more significant role this time around. Regardless, the 4th halving has undoubtedly sparked renewed interest in Bitcoin, with some early signs of increased trading activity and media coverage.

Possible Explanations for Price Increases After Halving

- Reduced Supply: The halving event fundamentally alters Bitcoin’s supply dynamics. With fewer new coins entering circulation, existing Bitcoins become relatively scarcer, potentially driving up their price due to increased demand.

- Increased Media Attention: Halving events receive significant media coverage, raising public awareness of Bitcoin and potentially attracting new investors. This influx of new capital can contribute to price increases.

- Investor Confidence: The halving can be interpreted as a positive signal for Bitcoin’s long-term viability. The predetermined and transparent nature of the halving schedule might instill confidence in investors, leading to increased buying pressure.

The Mechanics of Bitcoin Halving

Bitcoin relies on a decentralized network of miners who solve complex mathematical problems to add new blocks to the blockchain. As a reward for their efforts, miners receive newly minted bitcoins and transaction fees from the transactions included in the block.

Halving events are built into Bitcoin’s code to control inflation by reducing the supply of new bitcoins over time. The fixed supply and decreasing issuance rate are designed to mimic the scarcity of precious metals like gold, contributing to Bitcoin’s reputation as “digital gold.”

Market Impacts of Bitcoin Halving

Supply Shock and Scarcity

Bitcoin halving events introduce a supply shock to the market by reducing the rate at which new bitcoins enter circulation. With a fixed total supply of 21 million coins, the reduced issuance rate increases scarcity, which can drive up demand and price. The predictable nature of halvings also allows market participants to anticipate and plan for these events.

Miner Economics

Halvings directly impact miners, as their rewards are cut in half. For miners to remain profitable, Bitcoin’s price generally needs to increase to offset the reduced rewards. This can lead to a temporary decrease in mining activity and hash rate, as less efficient miners may shut down their operations. However, as Bitcoin’s price typically rises following a halving, mining profitability tends to recover, attracting more miners back to the network.

Market Sentiment and Speculation

Halving events often generate significant media attention and market speculation. The anticipation of reduced supply and potential price increases can lead to heightened buying activity, driving up prices even before the halving occurs. This speculative behavior can create short-term volatility and sharp price movements, contributing to the broader market dynamics surrounding halvings.

Long-Term Price Trends

Historical data suggests a correlation between halving events and long-term bullish trends in Bitcoin’s price. While price movements are influenced by various factors, the reduction in new supply coupled with increasing demand has consistently led to significant price appreciation following each halving. Investors often view these events as catalysts for long-term price growth.

Investment Opportunities Around Bitcoin Halving

Accumulation Strategy

Given the historical price appreciation following halvings, one common investment strategy is to accumulate Bitcoin in the months leading up to the event. This approach sometimes allows investors to minimize associated risks and benefit from potential price increases driven by the anticipated supply shock. Dollar-cost averaging (DCA) is a popular method, where investors regularly buy Bitcoin over time to mitigate the impact of short-term price volatility.

Long-Term Holding (HODLing)

Long-term holding, or “HODLing,” is a strategy where investors buy and hold Bitcoin with the expectation of significant price appreciation over several years. Halving events can reinforce the conviction of long-term holders, as the reduced issuance rate and historical price trends suggest sustained upward momentum. HODLing requires patience and a strong belief in Bitcoin’s long-term potential.

Trading and Speculation

For more active investors, trading Bitcoin around halving events can offer lucrative opportunities. The increased volatility and market activity can create short-term trading opportunities, allowing traders to minimize risks on price swings. However, trading requires a deep understanding of market dynamics and technical analysis, as well as a risk tolerance.

Diversification with Altcoins

Bitcoin halvings often influence the broader cryptocurrency market, affecting the prices of altcoins. As Bitcoin’s price rises, capital may flow into other cryptocurrencies, leading to minimized risks in the altcoin markets. Investors can diversify their portfolios by including promising altcoins that may benefit from the positive market sentiment surrounding Bitcoin halvings. For comprehensive advice, consult with our bitcoin investment consultants to explore altcoin investment options effectively.

Recommended Read: Bitcoin: Evolution, Investment Strategies, and Market Outlook

Learn More About Bitcoin Halving

At Kenson Investments, we specialize in blockchain and digital asset consulting. Our team, including experienced digital asset management consultants, focuses on understanding market cycles like Bitcoin halving events, empowering our clients to make informed investment decisions. Whether you’re a novice investor looking to get started or an experienced trader seeking to diversify your portfolio, get in touch to access exclusive insights and market analysis to stay ahead of trend.