In the fast-evolving landscape of finance and technology, Real World Assets (RWAs) have emerged as a focal point, particularly in connection with cryptocurrencies. Understanding RWAs and their interplay with digital currencies is crucial for navigating the complexities of modern financial systems. In this comprehensive guide, we delve into everything you need to know about RWAs and their significance in the realm of cryptocurrencies.

Unpacking Real World Assets (RWAs)

RWAs are tangible or physical assets with intrinsic value and these assets are available in various types, including real estate, commodities, and intellectual property rights. Unlike purely digital cryptocurrencies, RWAs have a physical presence and are subject to conventional valuation methods.

One of the key characteristics of RWAs is their tangibility, which provides investors with a sense of security and stability. Unlike digital assets whose value may be subject to investor sentiment and market volatility, RWAs derive their worth from real-world demand and utility. This inherent value makes RWAs an attractive investment option for individuals seeking to diversify their portfolios and hedge against market uncertainties.

The Intersection of RWAs and Cryptocurrencies

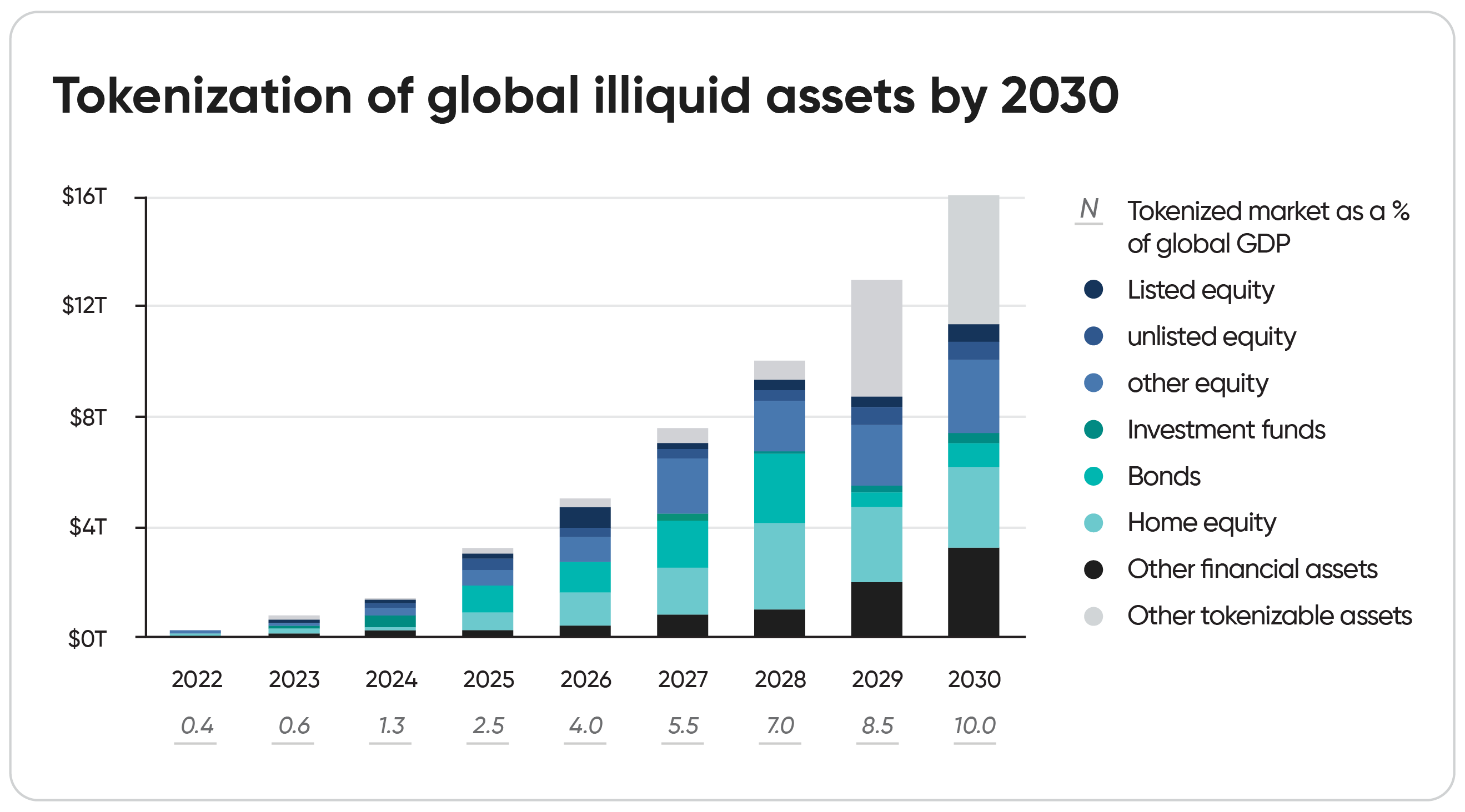

While RWAs and cryptocurrencies may seem worlds apart, they are increasingly intersecting in the realm of decentralized finance (DeFi). DeFi platforms use blockchain technology to tokenize real-world assets, which can bridge the gap between traditional finance and the digital economy. Through tokenization, assets like real estate properties, artwork, and commodities can be represented as digital tokens on a blockchain.

The tokenization of RWAs offers several advantages, including increased liquidity, fractional ownership, and enhanced accessibility. By converting physical assets into digital tokens, investors can trade and transfer ownership with greater ease and efficiency. Tokenization enables the seamless integration of RWAs into decentralized finance ecosystems, opening up new avenues for asset-backed trading and investment.

Advantages Of Investing In Real World Assets

Investing in Real World Assets (RWAs) offers numerous advantages that appeal to both seasoned investors and newcomers to the financial market. Unlike purely digital assets, RWAs provide tangible benefits and intrinsic value that contribute to long-term stability and wealth preservation.

One of the primary advantages of investing in RWAs is their inherent tangibility. Unlike cryptocurrencies and other digital assets, which exist purely in the digital realm, RWAs have a physical presence and utility in the real world. Whether it’s real estate properties, commodities, or precious metals, RWAs derive their worth from real-world demand and utility, making them less susceptible to market volatility and speculative bubbles.

Investing in RWAs enables individuals to diversify their investment portfolios and hedge agai

nst inflation and economic uncertainties. Traditional asset classes like stocks and bonds are often correlated with broader market trends, making them vulnerable to systemic risks and market downturns.

By allocating a portion of their portfolios to RWAs, investors can mitigate these risks and achieve greater diversification. RWAs tend to have a low correlation with traditional financial markets, providing a hedge against inflation and currency depreciation.

Another advantage of investing in RWAs is their potential for income generation and wealth preservation. Unlike speculative investments that rely solely on capital appreciation, RWAs offer various avenues for generating passive income and preserving wealth over the long term.

For example, real estate properties can generate rental income, while commodities such as gold and silver serve as storehouses of value during times of economic uncertainty. By investing in income-producing RWAs, individuals can create a steady stream of cash flow to supplement their investment returns and support their financial goals.

RWAs provide investors with greater control and transparency over their investments. Unlike traditional financial instruments that are often controlled by intermediaries, RWAs offer direct ownership and visibility into the underlying assets. Through blockchain technology and tokenization, investors can securely trade and transfer ownership of tokenized RWAs without the need for intermediaries or centralized authorities. This decentralized ownership structure fosters accountability, and trust in the investment process, empowering individuals to take control of their financial destinies.

The Role of RWAs in DeFi Ecosystems

Within the growing DeFi landscape, RWAs play a crucial role in increasing value and expanding financial inclusivity. By tokenizing real-world assets, DeFi platforms facilitate the creation of innovative financial products and services that were previously inaccessible to many individuals.

Asset-backed lending has emerged as a prominent use case for RWAs in DeFi. By pledging tokenized assets as collateral, borrowers can secure loans without the need for conventional intermediaries like banks. This decentralized lending model not only reduces counterparty risk but also enables individuals to access liquidity against their real-world holdings. Decentralized exchanges enable users to trade tokenized RWAs directly, creating a more efficient and transparent marketplace for asset exchange.

Overcoming Challenges and Regulatory Considerations

Despite the potential benefits of integrating RWAs into decentralized finance, there are various challenges and regulatory considerations that must be addressed. One of the primary concerns relates to legal compliance, as tokenizing real-world assets involves navigating complex jurisdictional frameworks and ensuring adherence to securities laws.

The valuation and custody of tokenized RWAs pose significant challenges, as these assets may be subject to fluctuations in market demand and liquidity. Ensuring transparency in the tokenization process is essential to maintain investor confidence and mitigate risks associated with fraud and manipulation.

Interoperability between different blockchain networks remains a challenge, hindering the seamless transfer and exchange of tokenized RWAs across platforms. Addressing these technical hurdles requires collaboration among industry stakeholders and the development of standardized protocols for asset tokenization.

Invest In Real World Assets By Connecting With Our Investment Consultants

For tailored guidance and expert insights into the dynamic world of digital assets, turn to Kenson Investments. As a leading digital asset strategy consulting firm, we offer comprehensive investment solutions.

With our innovative approach and industry expertise, we provide customized consulting services, from evaluating digital asset management to navigating NFT investments. Partner with our team of seasoned professionals for strategic advice on cryptocurrency investments, hedge fund management, and decentralized finance.

At Kenson Investments, we specialize in blockchain and digital asset consulting, helping clients maximize their returns and navigate the complexities of the digital asset market. From enhancing ROI with digital asset consulting to exploring NFT investment platforms for unique tokens, we provide tailored solutions to meet your unique needs. With Kenson Investments, you can confidently navigate the digital asset landscape and unlock your full potential for growth and success.

Contact us today to explore innovative investment opportunities and secure your financial future.