The growing institutional adoption of Bitcoin has been one of the most significant developments in the financial world over the past few years. What started as a niche interest for tech enthusiasts and libertarians has now captured the attention of some of the world’s largest financial institutions.

| Did You Know? Bitcoin was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. For many years, it was primarily associated with the fringes of finance, used by tech-savvy individuals and online black markets. However, as the cryptocurrency matured, it began to attract attention from mainstream financial players. |

Bitcoin: Evolution, Investment Strategies, and Market Outlook

The Early Days of Bitcoin: A Tale of Four Waves

Early Milestones

The inaugural wave comprised a passionate group of enthusiasts – developers, investors, and true believers in Satoshi Nakamoto’s vision. They were the first to embrace Bitcoin, laying the groundwork for future adoption.

Witnessing history unfold, they saw Bitcoin achieve parity with the US dollar for the first time in February 2011. They also experienced the thrill of the first-ever Bitcoin halving in November 2012, a significant event in the cryptocurrency’s mining process.

A major turning point came in November 2012 when WordPress, a leading content management system, became the first major company to accept Bitcoin payments. This move signaled Bitcoin’s potential as a viable medium of exchange.

By October 2013, the first Bitcoin ATM was installed in Vancouver, Canada, marking another milestone in user adoption and accessibility. Bitcoin’s market capitalization also surpassed $1 billion for the first time, demonstrating its growing influence. The first wave culminated in a price surge in November 2013, with Bitcoin exceeding the price of gold for the first time.

The Crypto Crusaders

After a bear market in 2014, a new wave of adopters emerged – the Crypto Crusaders. These tech enthusiasts, traders, and even institutional investors saw an opportunity in Bitcoin’s potential.

The most fortunate Crypto Crusaders entered the market in January 2015 when Bitcoin hit rock bottom at $171. This marked the last chance to buy Bitcoin for under $200.

Around 2013-2015, venture capital firms began investing in Bitcoin-related startups. Notable investments included Andreessen Horowitz and Union Square Ventures backing companies like Coinbase and Blockstream. These early investments laid the groundwork for broader institutional participation by providing the infrastructure necessary for larger players to enter the market.

Regulatory frameworks began to take shape in 2015 with the New York State Department of Financial Services initiating an investigation into Bitcoin. This ultimately led to the creation of the BitLicense, a regulatory framework for cryptocurrency businesses in New York.

The Bitcoin network’s hash rate, a measure of its computing power and security, reached a significant milestone in 2016 by surpassing 1 exahash/second. This demonstrated the network’s growing strength and resilience.

Hedge Funds, Banks, and Corporations Join In

From 2018 to 2021, a new wave of heavyweight players – hedge funds, banks, and corporations – began to enter the Bitcoin market. This wave, dubbed the “Institutional Titans,” marked a significant shift in Bitcoin’s perception.

The wave began in December 2018, with these institutional investors entering the market when Bitcoin prices dipped as low as $3,191. Their entry signaled a growing confidence in Bitcoin’s long-term potential.

The involvement of these established institutions brought a degree of stability to the market. This, along with Bitcoin’s price surge solidified its position as a legitimate asset class and garnered significant mainstream attention. The participation of these major players also opened doors for other cryptocurrencies and decentralized finance (DeFi) projects to flourish.

The Global Masses

The current wave, which began in November 2022, is characterized by the broadest range of participants yet. It includes:

- Retail Investors: Mainstream retail investors are entering the market in ever-increasing numbers.

- Celebrity Influence: High-profile celebrities are publicly endorsing Bitcoin, further propelling its popularity.

- Emerging Markets: Individuals in developing economies are increasingly looking to Bitcoin as a potential hedge against inflation and a tool for financial inclusion.

- Governmental Interest: Some forward-thinking governments are even exploring the incorporation of Bitcoin into their financial systems.

Those who entered the market during this wave have already seen a potential ROI increase. While the future remains uncertain, Bitcoin’s journey so far indicates a strong likelihood of continued growth and adoption.

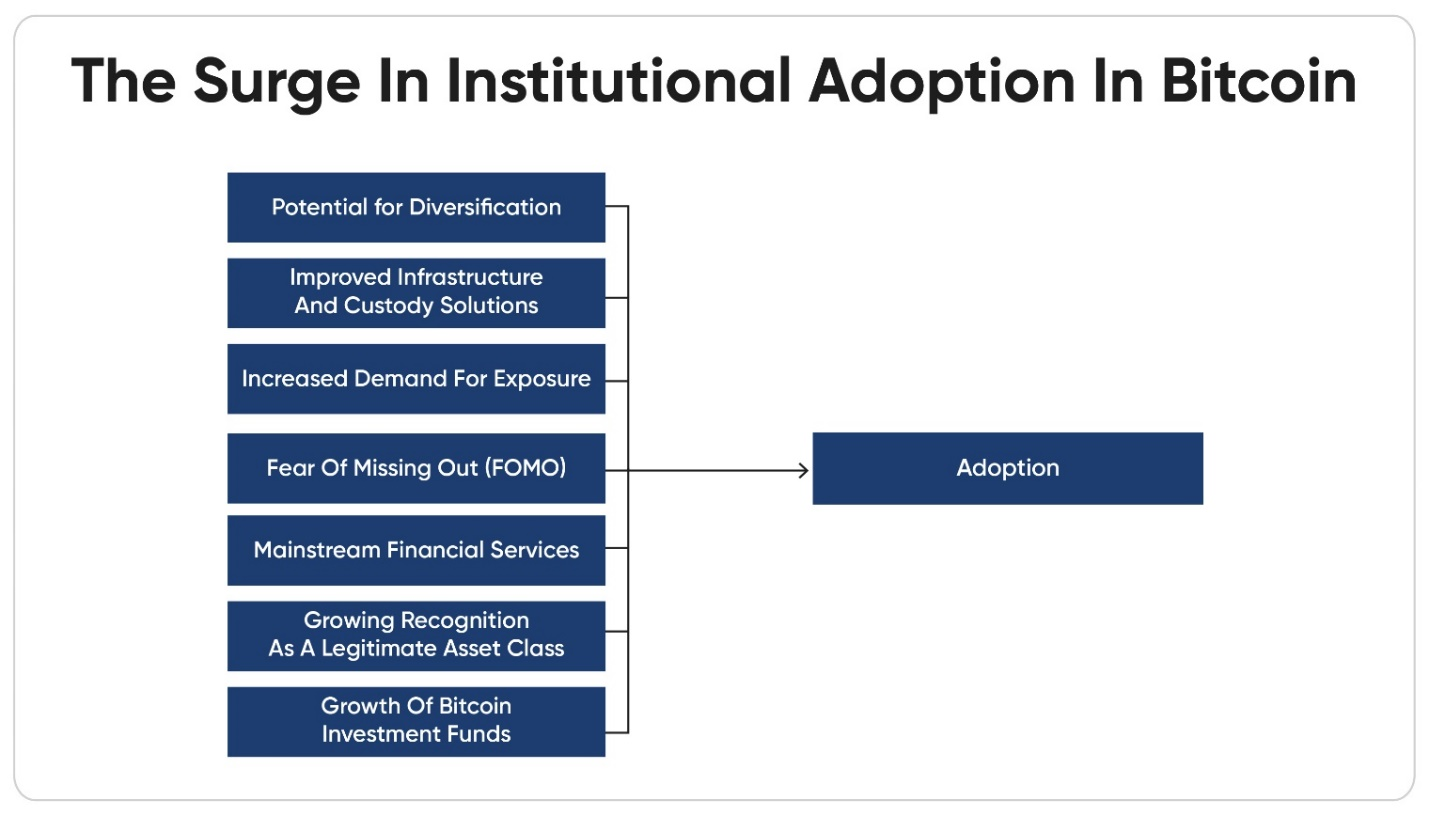

Key Factors Contributing To the Surge in Institutional Interest in Bitcoin

Potential for Diversification: Bitcoin’s unique characteristics offer diversification benefits for traditional portfolios. Its limited supply and historically low correlation with other asset classes (like stocks and bonds) make it a potential hedge against inflation and market volatility.

Improved Infrastructure and Custody Solutions: Early concerns about the security and lack of robust infrastructure surrounding Bitcoin are diminishing. Regulated custodians and secure trading platforms are emerging, providing institutional investors with the tools and confidence to enter the market.

Increased Demand for Exposure: As Bitcoin’s price appreciates and its market capitalization grows, institutional investors seek ways to gain exposure. Investment products like Bitcoin futures contracts and exchange-traded funds (ETFs) are facilitating institutional participation.

Fear of Missing Out (FOMO): Some institutions may be motivated by FOMO, fearing they will miss out on potential returns if they don’t participate in this rapidly evolving market.

Growing Recognition as a Legitimate Asset Class: The success of Bitcoin and the broader cryptocurrency market are attracting mainstream attention. Regulatory frameworks are evolving, and established financial institutions are acknowledging the potential of digital assets.

Growth of Bitcoin Investment Funds: Investment funds that focus on Bitcoin and other cryptocurrencies have proliferated. Grayscale’s Bitcoin Trust (GBTC) has been particularly popular, attracting billions of dollars in assets under management. These funds provide a way for institutions to gain exposure to Bitcoin without dealing with the complexities of direct ownership.

Mainstream Financial Services: Traditional financial services firms are increasingly integrating Bitcoin into their offerings. PayPal, for instance, now allows its users to buy, sell, and hold Bitcoin. Similarly, major credit card companies like Visa and Mastercard are exploring ways to support Bitcoin transactions.

Recommended Read: Bitcoin: The Original Digital Gold—A Guide for Investors

Implications of Institutional Adoption of Bitcoin

Legitimization of Bitcoin: Institutional adoption has helped legitimize Bitcoin in the eyes of the broader public and the financial community. As more reputable institutions embrace Bitcoin, it gains credibility as a legitimate asset class.

Market Stability and Liquidity: The entry of institutional investors has contributed to greater market stability and liquidity. Large institutions tend to have a long-term investment horizon, which can reduce volatility compared to a market dominated by retail traders.

Regulatory Developments: Increased institutional participation is likely to accelerate the development of regulatory frameworks. As institutions demand clearer guidelines, regulators are more likely to provide the necessary clarity to facilitate further growth.

Infrastructure Development: The demand from institutions has spurred the development of robust infrastructure. This includes more sophisticated trading platforms, better custody solutions, and improved regulatory compliance tools. These developments benefit the entire Bitcoin ecosystem.

Impact on Traditional Finance: The rise of Bitcoin and other cryptocurrencies challenges traditional financial systems. Banks and financial institutions may need to adapt their business models to accommodate the growing demand for digital assets. This could lead to increased competition and innovation in the financial sector.

Macro-Economic Implications: As Bitcoin becomes a significant part of institutional portfolios, its performance could have broader macro-economic implications. For example, significant price movements in Bitcoin could impact the broader financial markets, especially if institutions need to rebalance their portfolios in response to Bitcoin’s volatility.

Chart Your Course in the Evolving Digital Asset Landscape

The implications of institutional adoption for Bitcoin are complex and constantly evolving. Kenson Investments offers all the insights and market updates to help you stay informed through blockchain and digital asset consulting. Schedule a free consultation with our bitcoin investment consultants to discuss how Bitcoin might fit into your digital asset investment strategy. Our digital asset management consultant services can help you manage your portfolio effectively, and we also provide guidance on altcoin investment options to diversify your holdings.