Liquidity is a fundamental aspect of any financial market, but it holds particular importance in the rapidly evolving world of digital assets. High liquidity indicates a healthy market where transactions can occur quickly and at stable prices. For digital assets, which can be prone to high volatility and rapid price movements, ensuring liquidity is crucial for both short-term traders and long-term investors. This blog looks at various strategies that can significantly improve liquidity in digital asset markets, including enhancing market infrastructure, optimizing trading strategies, integrating decentralized finance (DeFi), and adhering to regulatory standards.

Let’s explore these strategies in detail to understand how they contribute to creating more liquid and efficient markets:

Understanding Market Infrastructure and Its Role in Liquidity

The foundation of enhancing liquidity in digital asset markets lies in robust market infrastructure. Key elements include trading platforms and liquidity providers that facilitate asset transactions. Traders can gain from exchange connectivity, which allows them to execute orders across multiple exchanges, increasing market efficiency by leveraging larger pools of liquidity. Furthermore, market-making is essential as it involves continuously quoting bid and ask prices, thus stabilizing the trading environment and reducing transaction costs through algorithms and risk management strategies.

(Read more here: Utility Tokens Unveiled: Driving Value and Innovation in Blockchain Networks)

Trading Strategies: Enhancing Efficiency and Minimizing Market Impact

In the dynamic world of digital asset trading, enhancing market liquidity while minimizing the market impact of large trades is critical for maintaining a healthy trading environment. This can be achieved through a variety of sophisticated trading strategies, each tailored to the unique challenges and opportunities of the digital asset markets.

Algorithmic Trading

Algorithmic trading has become a cornerstone of modern trading strategies, particularly useful in digital asset markets. These systems execute pre-defined trading instructions based on a set of variables, including price, timing, and volume, all at high speeds and often involving complex quantitative models. The advantage of algorithmic trading lies in its ability to process vast amounts of data faster than human traders, executing trades at optimal prices and significantly reducing the cost of trading by minimizing market impact.

Smart Order Routing

Smart order routing systems enhance trading efficiency by automatically selecting the best trading venue based on factors like price, cost, and liquidity. These systems are crucial in environments where multiple trading venues exist, as they help in navigating fragmented liquidity by routing orders to the places where they can be executed most favorably. This not only helps in achieving better pricing but also plays a vital role in enhancing the overall liquidity of digital assets.

Liquidity Mining and Incentive Programs

Liquidity mining is a novel concept that has gained traction within the decentralized finance (DeFi) sector. It involves rewarding users with tokens for providing liquidity to trading platforms, particularly decentralized exchanges (DEXs). This strategy not only enhances liquidity but also incentivizes participants to contribute to the ecosystem, thereby maintaining a constant flow of assets within the market. Such programs are pivotal in ensuring that there is enough market depth for executing large orders without significant price slippages.

Dealing with Impermanent Loss in AMMs

Automated Market Makers (AMMs) are critical in DeFi, allowing continuous trading without the need for traditional market makers. However, they come with the risk of impermanent loss, where the price of tokens in a liquidity pool changes after they are deposited. Some AMMs have started to incorporate features like insurance-like mechanisms or adjusted fee structures to mitigate such losses, ensuring that liquidity providers have lesser risk exposure.

Integration with Other Financial Tools

Integration of trading strategies with other financial tools and services, such as lending protocols, can enhance the functionality of liquidity provisions. For instance, borrowed funds can be used to provide liquidity, thus leveraging existing assets to generate additional financial activities without necessitating further capital injection.

These strategies collectively contribute to a more liquid and stable market environment where transactions are executed efficiently and prices remain stable even under the stress of large trades. By continuously adapting these strategies to the evolving market conditions and regulatory landscapes, digital asset markets can strive towards higher levels of institutional adoption and broader mainstream acceptance.

The Emergence of Decentralized Finance (DeFi) and Its Impact

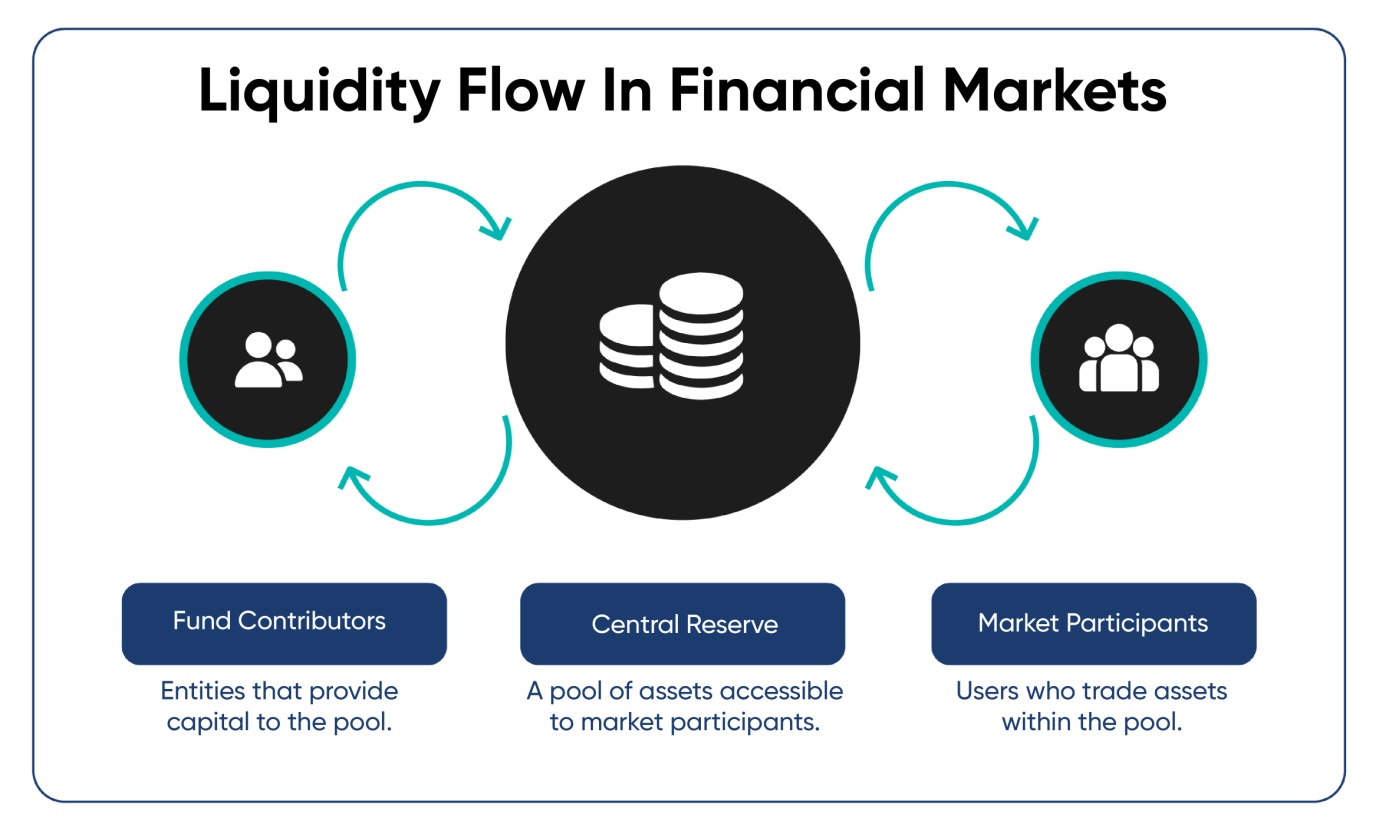

Decentralized finance (DeFi) liquidity pools have revolutionized liquidity provision by allowing users to contribute assets to a collective pool, earning fees and incentives. This model supports continuous liquidity flow and reduces price slippage, making trading processes smoother and more predictable. Liquidity mining further enhances this by rewarding users with tokens for their liquidity contributions, thus incentivizing sustained participation and support for DeFi platforms.

Regulatory Considerations and Compliance in Liquidity Management

Navigating regulatory landscapes is crucial for maintaining and enhancing liquidity. Ensuring compliance with relevant laws and regulations builds trust among participants and stabilizes the market. Regulatory bodies implement surveillance and oversight to detect and prevent fraudulent activities, ensuring fair and orderly market conditions. Additionally, innovative regulatory approaches are needed to adapt traditional frameworks to the unique aspects of digital assets, fostering a conducive environment for liquidity.

Investment consultants are pivotal in offering customized strategies to enhance digital asset liquidity. They utilize extensive market analysis to help clients understand liquidity profiles, optimal trading strategies, and regulatory compliance, ensuring legal and operational security in a complex market.

Enhance Your Digital Asset Strategy

At Kenson Investments, we excel in digital asset portfolio management, focusing on DeFi and blockchain assets. Our approach emphasizes transparency and strategic management to support your financial aspirations in the blockchain realm, including cryptocurrency investment solutions, stablecoins for investment, and altcoin investment. Connect with our dedicated digital asset specialists today and embark on a journey toward effective digital asset management!

Connect with our dedicated digital asset specialists today and embark on a journey toward effective digital asset management!