Utility tokens have captured the spotlight in the blockchain industry with their diverse applications and growing market presence. Recent data from CoinMarketCap reveals that the total market capitalization of utility tokens surpassed $50 billion in early 2024, reflecting their growing significance in the digital economy.

Meanwhile, a recent report by Blockchain.com revealed utility tokens now represent over 40% of the total market capitalization of all digital assets. This impressive figure highlights the increasing reliance on these tokens for facilitating financial transactions as well as various other functionalities within decentralized platforms.

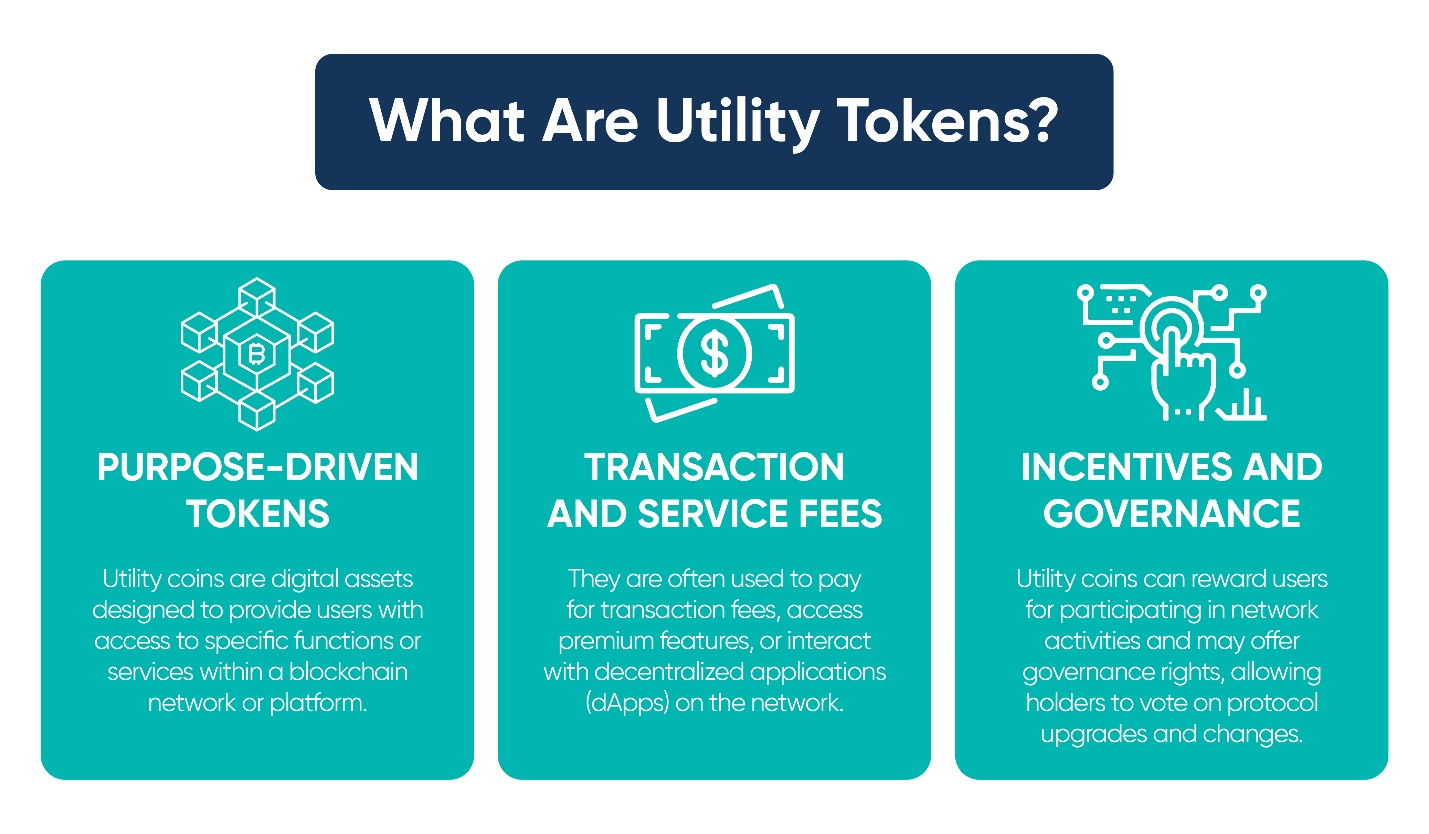

What Are Utility Tokens?

Utility tokens are digital assets that grant holders access to specific functions or services within a blockchain-based platform or application. These tokens are typically issued through an Initial Coin Offering (ICO) or a similar fundraising mechanism.

Unlike traditional cryptocurrencies, which can be used broadly as a form of payment or investment, utility tokens are purpose-built to facilitate particular actions or benefits within their respective ecosystems.

For instance, a utility token might be used to pay transaction fees, access premium features, participate in governance, or obtain rewards. These tokens are often integral to the functionality of decentralized applications (dApps) and blockchain platforms, providing a bridge between users and the services offered by the platform.

| How Utility Tokens Work The mechanics of utility tokens involve a straightforward concept:

Token Creation: A project team issues a predetermined number of utility tokens, representing ownership or access rights within the platform.

Token Distribution: Tokens are distributed through various methods, such as initial coin offerings (ICOs), airdrops, or rewards for platform contributions.

Token Utility: Token holders can use their tokens to access platform features, purchase goods or services, participate in governance decisions, or benefit from future revenue sharing.

Token Value: The token’s value is intrinsically linked to the platform’s success and utility. As the platform grows and attracts more users, the demand for tokens increases, potentially leading to an appreciation in value. |

How Utility Tokens Drive Value

Utility tokens drive value in several ways, including:

Access to Services and Features

Utility tokens often serve as a means of accessing the services or features offered by a platform. For example, in the decentralized finance (DeFi) space, utility tokens might be used to participate in lending and borrowing protocols or to gain access to exclusive investment opportunities.

Incentivizing Participation

Many blockchain projects use utility tokens to incentivize user participation. By rewarding users with tokens for engaging with the platform, providing liquidity, or completing certain tasks, these tokens help drive user engagement and growth.

Facilitating Transactions

Utility tokens can be used to pay for transaction fees within a blockchain network. This creates a demand for the token as users need it to execute transactions or interact with the platform.

Enabling Governance

Some utility tokens grant holders voting rights or governance privileges within a blockchain network. This allows users to have a say in the platform’s development and decision-making processes, aligning their interests with the success of the project.

Creating Network Effects

As more users and developers participate in a blockchain ecosystem, the value of its utility token can increase. This is due to the network effects where the token’s utility and demand grow with the platform’s adoption.

The Role of Utility Tokens in Innovation

Utility tokens are integral to the blockchain ecosystem, playing a crucial role in driving technological advancements and reshaping business models. Here’s an expanded look at how utility tokens contribute to innovation:

Funding and Crowdfunding

Utility tokens have revolutionized fundraising mechanisms for blockchain projects through Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs). These fundraising models enable startups to raise capital by issuing utility tokens to early supporters and investors.

Unlike traditional venture capital, which often involves lengthy negotiations and equity dilution, ICOs and IDOs provide a more accessible and democratized approach to securing funding.

ICOs (Initial Coin Offerings): ICOs emerged as a popular method for blockchain projects to raise funds by issuing new tokens to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. This model allows projects to bypass traditional funding routes and tap into a global investor base. The success of early ICOs, such as Ethereum’s 2014 ICO, demonstrated the potential of utility tokens to fund ambitious blockchain projects.

IDOs (Initial DEX Offerings): IDOs represent an evolution of the ICO model, conducted on decentralized exchanges (DEXs). IDOs offer greater liquidity and decentralized access, allowing projects to launch tokens and raise funds directly on blockchain-based platforms. This method has become increasingly popular due to its transparency and the ability to reach a broader audience.

Through these models, utility tokens not only facilitate funding but also promote innovation by enabling projects to develop and bring novel solutions to market. By providing a new avenue for raising capital, utility tokens help support and accelerate the growth of groundbreaking blockchain technologies.

Explore More: ICOs vs. IDOs: Demystifying Alternative Fundraising Mechanisms for Altcoin Projects

Decentralized Applications (dApps)

Decentralized Applications (dApps) rely on utility tokens for their operation and user engagement. Unlike traditional applications that run on centralized servers, dApps operate on blockchain networks and leverage utility tokens to enable various functionalities.

Access and Interaction: Utility tokens are often used to access services or features within dApps. For instance, a decentralized finance (DeFi) application might require users to hold or spend their native tokens to participate in lending, borrowing, or staking activities. This model ensures that users are directly engaged with the platform’s ecosystem and incentivizes their participation.

Incentivization: Many dApps use utility tokens to reward users for their contributions, such as providing liquidity or participating in governance. For example, decentralized exchanges (DEXs) often distribute their native tokens to users who provide liquidity, thereby fostering a more active and engaged user base.

Growth and Adoption: By integrating utility tokens into their operational models, dApps can drive adoption and innovation across various sectors, including finance, gaming, and social media. The success of dApps like Uniswap and Axie Infinity showcases how utility tokens can catalyze the development and scaling of decentralized solutions.

Smart Contracts

Smart contracts are self-executing contracts with the terms directly written into code, and utility tokens play a crucial role in their execution and management. These contracts automate processes, reducing the need for intermediaries and enhancing efficiency.

Gas Fees and Execution: On platforms like Ethereum, utility tokens (ETH) are used to pay for gas fees associated with executing smart contracts. Gas fees compensate miners for validating and processing transactions, ensuring that smart contracts can operate smoothly and efficiently.

Automation and Efficiency: Smart contracts enable automated, trustless transactions and processes across various industries. By leveraging utility tokens, businesses can create innovative solutions that streamline operations, reduce costs, and eliminate the need for manual intervention.

Smart contracts powered by utility tokens have found applications in diverse areas, such as supply chain management, insurance, and real estate. For instance, DeFi platforms use smart contracts to automate lending and borrowing processes, while insurance platforms utilize them to manage claims and payouts.

Tokenization of Assets

Tokenization refers to the process of representing real-world assets as digital tokens on the blockchain. Utility tokens are central to this process, enabling fractional ownership, increased liquidity, and broader accessibility.

Fractional Ownership: Tokenization allows assets such as real estate, art, or commodities to be divided into smaller, tradable units. This enables investors to acquire fractional ownership, making high-value assets more accessible to a wider audience.

Increased Liquidity: By converting physical assets into digital tokens, tokenization enhances liquidity and facilitates easier trading. Tokenized assets can be bought, sold, or traded on blockchain platforms, offering greater flexibility and market efficiency.

Broader Access: Tokenization democratizes access to investment opportunities that were previously limited to accredited or institutional investors. For example, the tokenization of real estate properties allows individual investors to participate in the real estate market without the need for substantial capital.

Recommended Read: Tokenization 101: Transforming Assets into Digital Tokens

Interoperability and Cross-Chain Solutions

Interoperability and cross-chain solutions are essential for creating a more integrated and innovative blockchain ecosystem. Utility tokens play a vital role in enabling seamless interaction and value transfer across different blockchain networks.

Cross-Chain Compatibility: Utility tokens facilitate cross-chain solutions that enable different blockchain networks to communicate and transact with each other. This interoperability is crucial for expanding the functionality and reach of blockchain applications.

Bridging Networks: Solutions such as atomic swaps and cross-chain bridges use utility tokens to facilitate exchanges between disparate blockchains. These mechanisms allow users to transfer value and assets between different networks without relying on centralized intermediaries.

Enhanced Ecosystem Integration: By supporting cross-chain interactions, utility tokens contribute to a more cohesive and innovative blockchain ecosystem. This integration promotes collaboration between different projects and enables the development of new, multi-chain applications.

| Prominent Examples of Utility Tokens Ethereum (ETH) Ethereum’s native token, ETH, is one of the most well-known utility tokens. It is used to pay for transaction fees (gas) on the Ethereum network and is integral to the operation of smart contracts and dApps. ETH also plays a crucial role in Ethereum 2.0’s Proof-of-Stake consensus mechanism, where it is staked to secure the network and validate transactions.

Binance Coin (BNB) BNB is the native utility token of the Binance Smart Chain (BSC) and Binance Exchange. BNB is used to pay for transaction fees on the Binance Exchange and within the BSC ecosystem. It also provides access to various services and features, including token sales and trading discounts.

Chainlink (LINK) Chainlink’s native token, LINK, is used to pay for services within the Chainlink decentralized oracle network. LINK tokens are used to incentivize data providers and ensure the accuracy and reliability of the data being supplied to smart contracts.

Uniswap (UNI) UNI is the token for governance for Uniswap, a decentralized exchange (DEX). Holders of UNI can vote on protocol upgrades, changes, and other important decisions affecting the Uniswap platform. UNI also serves as an incentive for users to participate in liquidity provision and other activities within the Uniswap ecosystem. |

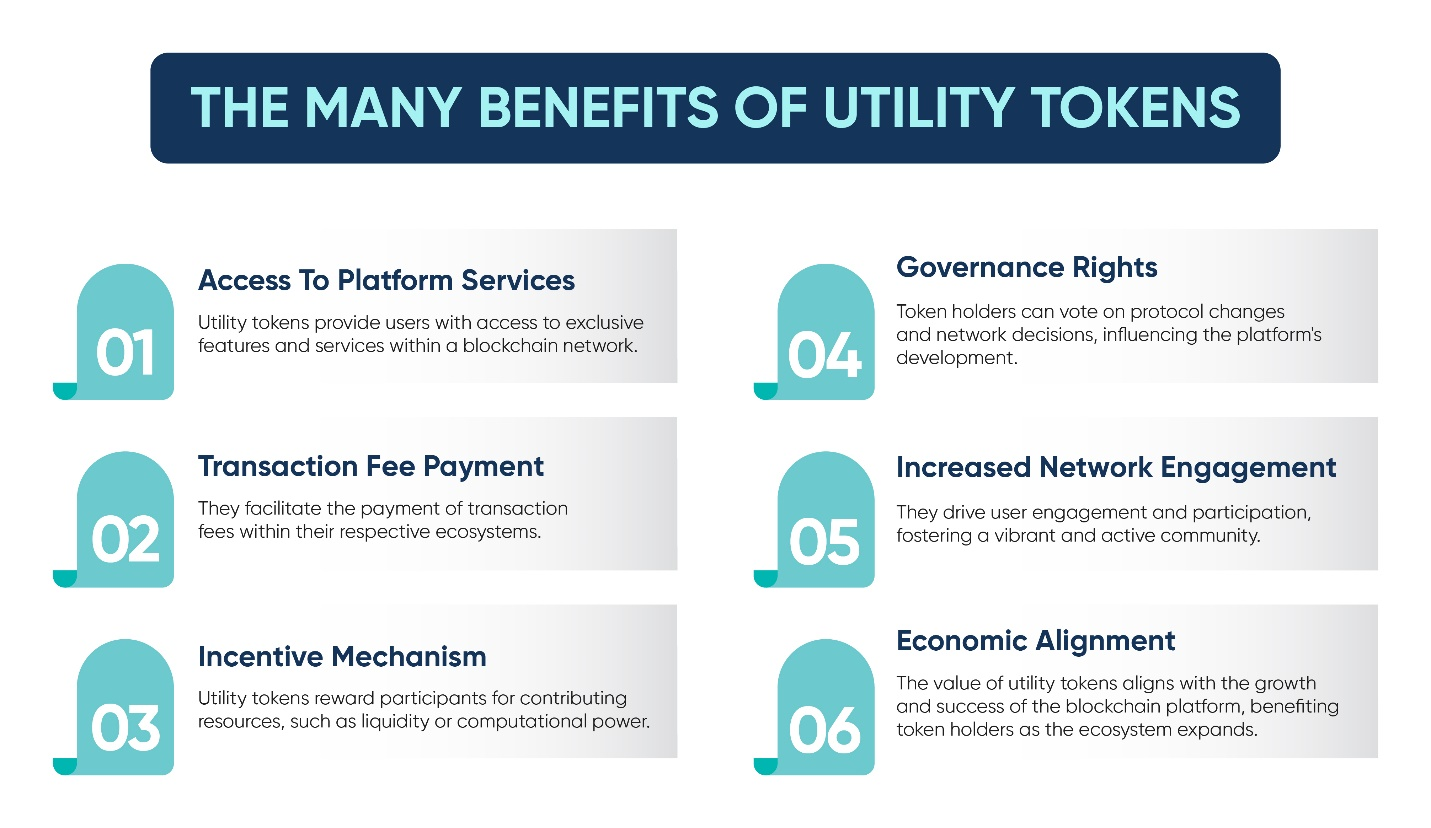

Benefits of Utility Tokens

Utility tokens offer a range of benefits that contribute to the functionality, growth, and success of blockchain networks. Here’s a detailed look at the advantages these digital assets bring to the table:

1. Enhanced User Engagement

Utility tokens create a compelling incentive for users to actively participate in a blockchain platform or application. By providing rewards, access to exclusive features, or other benefits, utility tokens encourage users to engage more deeply with the platform. This increased engagement often translates into higher user retention, more frequent interactions, and overall growth of the platform.

2. Increased Liquidity

Utility tokens contribute to the liquidity of a blockchain network by facilitating smooth transactions and interactions within the ecosystem. By allowing users to acquire, trade, and use tokens within the platform, they help enhance liquidity and market efficiency. This increased liquidity supports more dynamic and functional marketplaces and financial systems.

| For example, in decentralized exchanges (DEXs) like Uniswap and SushiSwap, utility tokens are used to facilitate trading pairs and liquidity pools. The availability of these tokens ensures that users can easily trade and interact with various assets.

|

3. Alignment of Interests

Utility tokens align the interests of users and developers, creating a mutual benefit structure. As the value of the token is often linked to the success and growth of the platform, both parties have a shared incentive to see the platform thrive. This alignment fosters collaboration and drives efforts towards improving the platform and achieving collective success.

4. Decentralized Governance

Utility tokens enable decentralized governance, allowing token holders to participate in decision-making processes and influence the direction of the platform. This democratic approach ensures that decisions reflect the collective interests of the community and promotes a more inclusive and transparent development process.

| For example, in Decentralized Autonomous Organizations (DAOs) like MakerDAO, MKR token holders have voting rights on proposals related to protocol changes, upgrades, and governance. This system ensures that the community has a say in the platform’s future.

|

5. Funding and Investment Opportunities

Utility tokens serve as a means of raising capital for new blockchain projects through Initial Coin Offerings (ICOs) or token sales. By selling tokens to early investors, projects can secure the funding needed for development and launch.

Investors, in turn, gain early access to the platform and potential financial rewards as the project succeeds. For instance, during an ICO, a project might issue utility tokens to raise funds for development. Investors who purchase these tokens may benefit from their appreciation in value if the project succeeds and gains traction.

6. Access to Exclusive Features and Services

Utility tokens often grant holders access to specific features or services within a blockchain network. This can include premium features, early access to new developments, or participation in special events. By providing these benefits, utility tokens enhance the overall user experience and add value to the platform.

| For example, in gaming platforms like Axie Infinity, players use AXS and SLP tokens to buy, breed, and battle virtual creatures. These tokens unlock various in-game functionalities and enhance the gaming experience.

|

7. Facilitation of Transactions

Utility tokens simplify and streamline transactions within a blockchain network. They can be used to pay for transaction fees, access services, or interact with various applications. This functionality makes it easier for users to engage with the platform and conduct transactions seamlessly.

8. Creation of New Economic Models

Utility tokens enable the creation of innovative economic models within blockchain ecosystems. They allow for the development of new types of incentives, rewards, and interactions that were not possible in traditional systems. This innovation drives the evolution of the blockchain space and introduces new opportunities for users and developers.

| The concept of yield farming in DeFi platforms involves earning utility tokens as rewards for providing liquidity or participating in specific activities. This new economic model creates opportunities for users to earn rewards and engage with the platform in novel ways.

|

9. Economic Efficiency

Utility tokens can enhance economic efficiency within a blockchain network by streamlining transactions and reducing intermediaries. They can lower transaction costs, speed up processes, and provide a more direct means of value transfer.

For instance, in supply chain management, utility tokens can facilitate transparent and efficient transactions between parties, reducing administrative costs and delays.

10. Transparency and Accountability

Utility tokens contribute to transparency and accountability in blockchain networks. All transactions involving tokens are recorded on a public ledger, providing a clear and immutable record of activities. This transparency helps build trust and ensures that the platform operates fairly. Platforms like VeChain use utility tokens to track and verify the authenticity of products, enhancing transparency in the supply chain and preventing fraud.

Challenges and Risks

While utility tokens offer numerous advantages, they also come with challenges and risks that need to be addressed.

Regulatory Uncertainty

The regulatory environment for utility tokens remains uncertain and varies across jurisdictions. Regulatory changes can impact the issuance, trading, and use of tokens, potentially affecting their value and utility. Projects must navigate these regulatory complexities to ensure compliance and mitigate risks.

Market Volatility

Utility tokens are subject to market volatility, which can affect their value and stability. Fluctuations in token prices can impact user confidence and the overall success of the platform. Projects must manage these risks and implement strategies to maintain token value and stability.

Security Concerns

Security is a critical concern in the blockchain space. Utility tokens and their associated smart contracts are vulnerable to attacks and vulnerabilities. Ensuring robust security measures and conducting thorough audits are essential to protect tokens and the platform from potential threats.

Adoption and Use Case Viability

The success of a utility token depends on the adoption and viability of the platform it supports. If the platform fails to attract users or deliver on its promises, the value of the token may decline. Projects must focus on creating compelling use cases and driving adoption to ensure the long-term success of their tokens.

The Future of Utility Tokens

The future of utility tokens is promising, with several trends and developments shaping their evolution.

1. Integration with DeFi and Web3

Utility tokens will continue to play a crucial role in the DeFi and Web3 ecosystems. As decentralized finance and Web3 technologies gain traction, utility tokens will be integral to accessing services, participating in governance, and driving innovation. The convergence of these technologies will create new opportunities and use cases for utility tokens.

2. Increased Interoperability

Interoperability between different blockchain networks is a key focus for the future of utility tokens. As blockchain ecosystems become more interconnected, utility tokens will need to operate seamlessly across various platforms. Cross-chain solutions and bridges will facilitate the transfer and utilization of tokens across different networks, enhancing their value and utility.

3. Regulatory Clarity

As the regulatory landscape evolves, clearer guidelines for utility tokens will emerge. Regulatory clarity will provide greater certainty for projects and investors, fostering innovation and adoption. Compliance with regulatory requirements will be essential for the continued growth and success of utility tokens.

4. Enhanced Security and Privacy

Advancements in security and privacy technologies will improve the protection of utility tokens and their associated smart contracts. Innovations such as zero-knowledge proofs and advanced encryption techniques will enhance the security and privacy of token transactions, addressing current concerns and vulnerabilities.

5. Innovation in Token Models

New token models and mechanisms will emerge, offering novel ways to leverage utility tokens for various applications, including governance, staking, and rewards.

Seize the Opportunity with Kenson Investments!

Utility tokens are transforming the blockchain landscape, and Kenson Investments is here to help you seize this opportunity. Our specialized knowledge and strategic approach, including digital asset management consultant services and cryptocurrency investment consultant expertise, will guide you in navigating the world of utility tokens effectively. Ready to explore how these digital assets can benefit your investment strategy with digital asset portfolio management, and insights into stablecoins for investment and altcoin investment? Contact Kenson Investments today to get started and stay ahead of the curve in this exciting market!

Disclaimer: “The cryptocurrency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and US Federal Government. None of the information provided by Kenson LLC should be considered financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC including, equities, registered securities, ETFs, stocks, bonds, or equivalents”