The digital asset revolution is upon us, transforming the financial domain at aremarkable pace. From cryptocurrencies like Bitcoin to non-fungible tokens (NFTs), a new asset class has emerged, packed with potential for high returns. However, this exciting new venture comes with inherent risks that investors must carefully consider.

This blog post aims to help understand the risks and rewards of digital investments, providing a balanced perspective to help you steer the dynamic digital asset market. So, without further ado, let’s get into the details:

Why Consider Both Risks and Rewards?

Before diving headfirst into the digital asset pool, understanding the potential for both windfalls and pitfalls is crucial. Here is an example:

The hedge fund industry took a major hit in 2022, experiencing a record loss of $208 billion. This marked the worst performance since 2008, when losses reached a staggering $565 billion. However, in a surprising turn of events compared to the overall market slump of 2022, a recent report by Global Investment Research in 2023revealed that the top 50 hedge funds with a proven track record defied the odds and still managed to secure positive returns exceeding 5% last year.

But that’s not all.

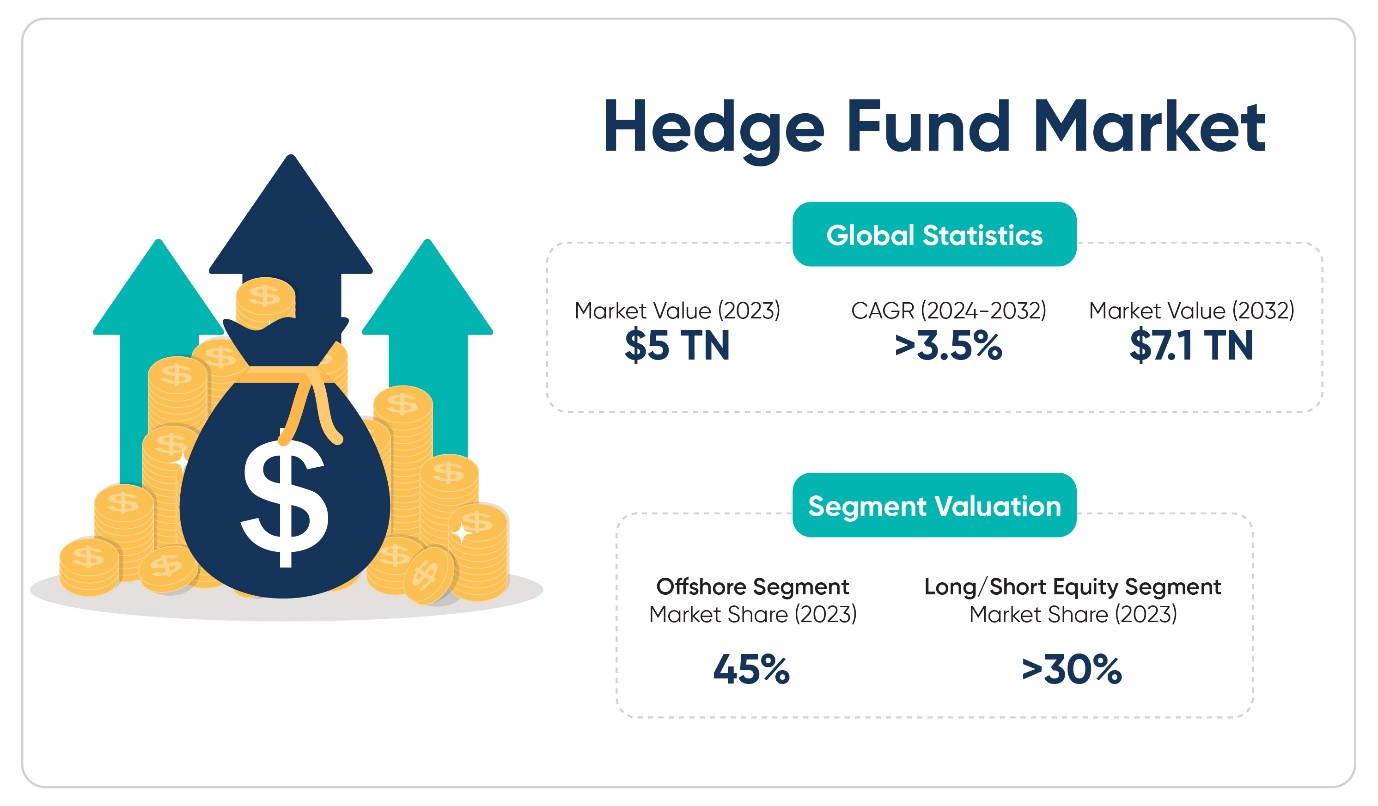

Most of these top-performing hedge funds delivered average annual returns of over 16% in the past decade. This impressive feat highlights the potential for skilled investment management and importance of selecting funds to steer clear in even volatile markets. According to Global Market Insights, the hedge fund market is predicted to grow at a CAGR of more than 3.5% between 2024-2032. While these figures are certainly enticing, it’s important to remember that hedge funds also carry significant risks.

Similarly, the cryptocurrency market has witnessed phenomenal growth. The price of Bitcoin, for instance, skyrocketed from a mere $10 in 2010 to over $60,000 in 2021. However, this meteoric rise has been punctuated by equally dramatic price drops, and raisesover the years highlighting the inherent volatility of digital assets. In a more recent positive development in the year 2024, Bitcoin regained its $1 trillion market cap milestone, surpassing the two-year mark since it last reached this valuation. This surge signifies a renewed confidence in the world’s leading cryptocurrency. Further bolstering this sentiment, Bitcoin also surpassed the $51,000 mark, a level last seen in December 2021. This upward trend represents a continuation of the rally that began in January 2023, with Bitcoin already experiencing a growth of over 21% so far this year.Additionally, improved liquidity conditions in the cryptocurrency market are contributing to this positive momentum. Increased trading activity and easier access to capital for investors are fueling the current bullish sentiment surrounding Bitcoin.

To learn more about how liquidity affects the world of crypto, read HERE. (Unlocking Digital Gold: Understanding Liquidity in the World of Crypto)

Exploring the World of Digital Assets

Kenson Investments specializes in a variety of digital assets, each offering unique opportunities and challenges. Let’s explore some of the most popular categories:

- Bitcoin:The undisputed king of cryptocurrencies, Bitcoin boasts a loyal following and the potential for significant returns. However, its price volatility and scalability limitations are well-documented concerns.

- Altcoins:A diverse universe of alternative cryptocurrencies exists beyond Bitcoin. These Altcoins, such as Metaverse tokens and Layer 1 tokens, offer exposure to emerging blockchain technologies but may carry even greater volatility risks than Bitcoin.

- Stablecoins:Designed to offer price stability, stablecoins are pegged to traditional assets like fiat currencies. This stability makes them ideal for investors seeking a hedge against the volatility of other cryptocurrencies. However, the regulatory landscape surrounding stablecoins is still evolving, posing potential challenges.

- NFTs:Representing ownership of unique digital assets, NFTs have exploded in popularity. While offering exciting investment opportunities in the creative and collectible space, the NFT market is nascent and lacks established valuation metrics.

- Derivatives and Futures Trading:These instruments allow investors to speculate on the future value of digital assets and manage risk. However, they are complex financial products that require a deep understanding of the market and carry significant risks of loss.

Managing Your Digital Investment Portfolio

With a diverse range of digital assets at your disposal, crafting an effective investment strategy is paramount. Here are some key tips:

- Diversification is Key:Don’t put all your eggs in one basket. Spread your investments across different digital asset classes to mitigate risk. Consider consulting a Cryptocurrency investment consultant or a Digital asset investment consultant for guidance.

- Start Small: The digital asset market is volatile. Begin with a small investment to gain experience and understand your risk tolerance before committing larger sums.

- Conduct Thorough Research: Don’t blindly follow the hype. Research each digital asset you consider investing in, understanding its underlying technology, development team, and market potential.

- Prioritize Security:Digital assets are susceptible to theft and hacking. Invest in secure storage solutions and employ robust cybersecurity practices.

- Stay Informed:The digital asset landscape is constantly evolving. Stay updated on industry news, regulatory developments, and technological advancements to make informed investment decisions.

Kenson Investments: Your Partner in the Digital Asset Journey

The digital asset revolution presents a compelling opportunity for investors seeking high returns. However, it’s crucial to approach this market with caution and a clear understanding of the associated risks. By carefully considering your risk tolerance, conducting thorough research, and employing sound investment strategies, you can navigate the digital asset landscape and potentially reap significant rewards.

Kenson Investments understands the complexities of the digital asset market. With a team of experienced professionals and a commitment to innovative investment solutions, we can guide you through this exciting new frontier. We offer transparent investment solutions tailored to your individual needs and risk tolerance. Whether you’re a seasoned investor or just starting out, Kenson Investments can be your trusted partner in navigating the world of digital assets.

Remember, Kenson Investments stands ready to be your partner on this journey, offering digital asset consulting services, and cryptocurrency investment advicefor short and long-term gains. With our expertise and guidance, you can confidently explore the exciting world of digital assets and build a prosperous future. For further details, feel free to get in touch with us today.

Disclaimer: The content provided on this blog is for informational purposes only and should not be construed as financial advice. The information presented herein is based on personal opinions and experiences, and it may not be suitable for your individual financial situation. We strongly recommend consulting with a qualified financial advisor or professional before making any financial decisions. Any actions you take based on the information from this blog are at your own risk.